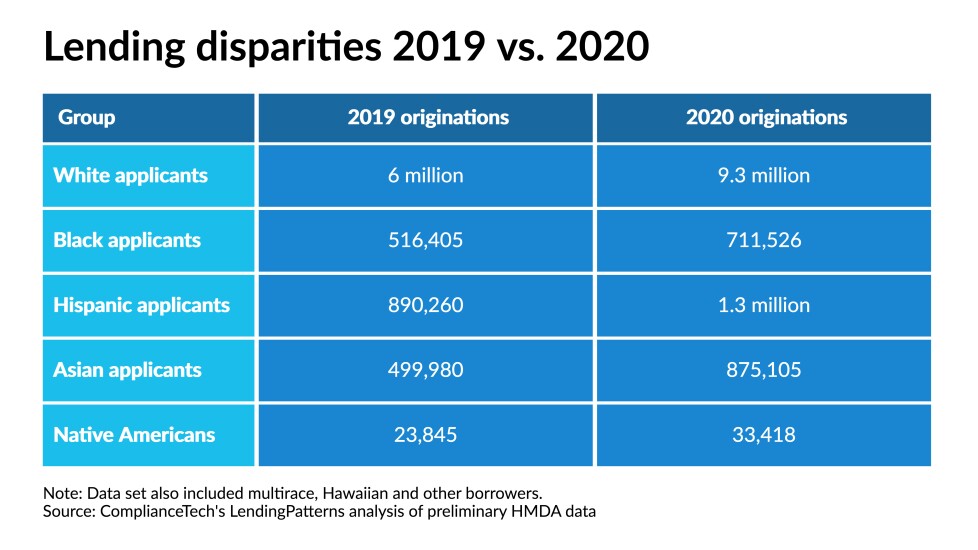

Overall, 2020 was a record year for the housing finance industry, but not everyone reaped the same gains from it, early analyses of Home Mortgage Disclosure Act data show.

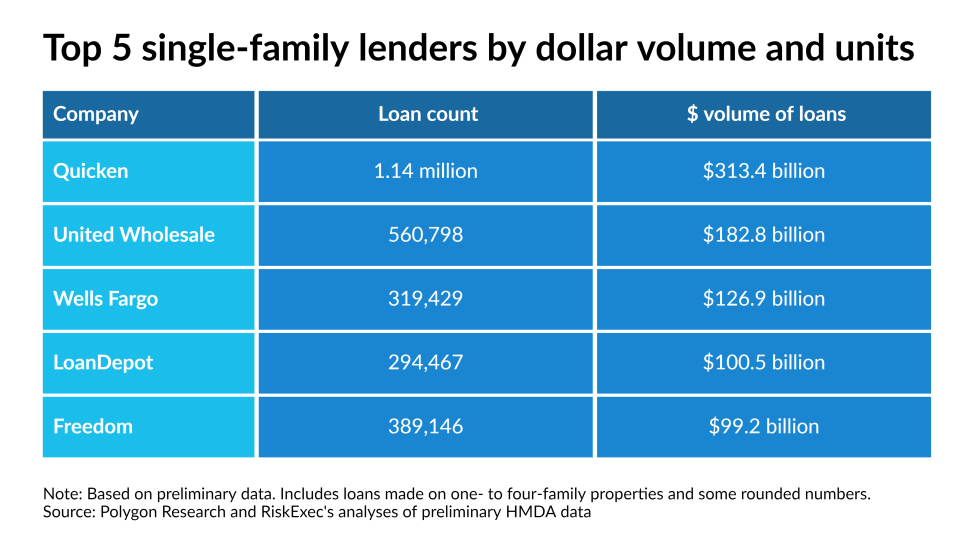

Nonbanks claimed more market share, and annual origination gains for Hispanic, Black and Native American borrowers were weaker than for other groups, according to first-takes on HMDA data by ComplianceTech, Polygon Research and RiskExec.

Given that

newly public nonbanks were eager to show shareholders growth as banks became more conservative with credit amid the pandemic, nondepositories took four out of the top five slots for single-family lenders last year, as compared to just three in 2019.

That development could redouble calls for more safety-and-soundness measures for nonbanks from the banking industry, which

is concerned about how the growing presence of less-regulated nondepositories could affect the broader financial system.

“Nonbanks are growing, and that is cause for concern by banking trade associations,” said Anurag Agarwal, founder, president and chief architect of RiskExec.

And with early HMDA data also suggesting inequities persist, there could be more policy making toward this end as well.

The proposal to

extend a version of the Community Reinvestment Act to nonbanks may address both issues, Agarwal said.

The CRA requires banks to lend equitably in communities where they take deposits. Since nonbanks don’t take deposits, there have been questions about how it could be adapted to their business models, but that may be something policymakers could explore further, he added.

To be sure, the HMDA data available to date is preliminary and has its limitations given that some smaller companies are exempt from the reporting, but generally it’s broadly considered to be a reliable industry benchmark.

What follows are more specific data points and other first-takes on 2020’s HMDA numbers from experts currently analyzing them.