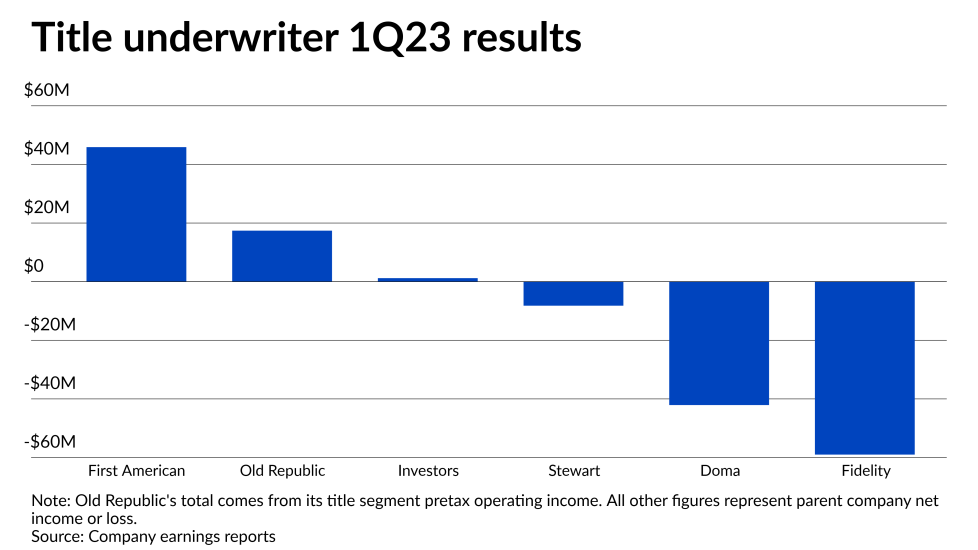

Only Doma — even as it took yet another loss — had a better financial performance compared with the first quarter of 2022. By comparison, Fidelity National Financial's title results, while in positive territory, were lower than the year before. Its net loss was attributable to the F&G Annuities & Life business of which it is the majority shareholder.

Title insurance activity is

The following are the results for the four national underwriters, as well as the two smaller publicly traded companies in the field.

Fidelity's life unit drags results into the red

The title business, however, was profitable in the first quarter, with net income of $128 million, down from $191 million on a year-over-year basis.

"FNF's industry leading position and strong balance sheet puts us in an advantageous position to not only withstand periods of dislocation, as we have experienced through the first quarter, but also to take advantage of opportunities to strategically build and expand our title business for the long term," said William Foley, its chairman, in a press release. "A prime example is our acquisition of TitlePoint for $224 million in cash which closed in January."

FNF

FNF's other segment, the life insurance business, F&G, lost $164 million in the first quarter on unfavorable mark-to-market adjustments on investments.

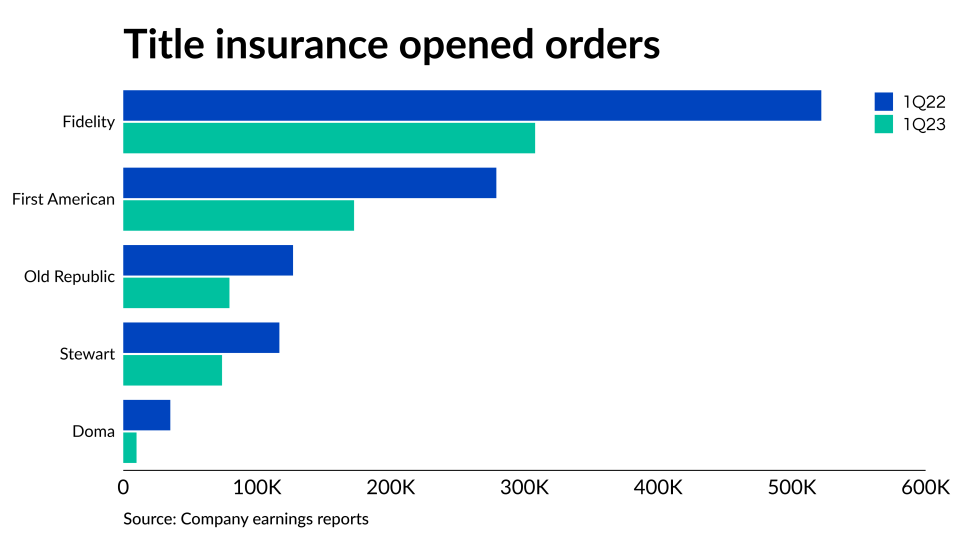

Open orders fell to 308,000 compared with 522,000 in the first quarter of 2022, while closed orders slumped to 188,000 from 380,000.

"Looking forward, we remain cautiously optimistic as we are seeing encouraging indications of a seasonal pattern in the residential purchase market, albeit at lower volume levels resulting from soft existing home sale activity and low refinance activity," Mike Nolan, Fidelity's CEO, commented. "That said, the underlying fundamentals of the residential housing market remain strong given pent-up demand and a growing working age population that are expected to support a rebound once rates stabilize and buyers and sellers more fully return to the market."

First American expects increased activity for the second half of the year

"Challenging market conditions continued into the first quarter," said Ken DeGiorgio, First American's CEO in a press release. "Existing home sales have fallen to levels not seen since the 2008 financial crisis and the commercial real estate market has significantly declined."

Income before taxes from the title and services segment fell to $88.2 million from $219.5 million year-over-year.

First quarter open orders were 172,600 from 279,000 in the same period last year, while closed orders were 106,600 from 205,100.

But the company is upbeat about market conditions for the rest of the year.

"Moving forward, the purchase market, which appears to have stabilized, is showing improvement in the first three weeks of April, with open orders up over 5% compared with March," DeGiorgio said. "While there is a high degree of uncertainty concerning the commercial market outlook, we remain optimistic that transaction activity will improve in the second half of the year."

But First American's financials going forward could be hurt by

Title income down almost 80% at Old Republic

Old Republic Title reported 79,415 opened orders in the first quarter, down from 126,976 for the same period in 2022. Closed orders reached 64,042, versus 106,801.

Company executives have a more subdued view of the market than some of its competition.

"I just don't feel like we're going to see a lot of improvement in the second quarter like we had hoped," Carolyn Monroe, president of Old Republic's title business, said on its earnings call. "Just so much of it is just we've got tight inventory in a lot of markets and people right now don't have a sense of why should they move."

Meanwhile, Old Republic's run-off mortgage insurance business had pretax operating income of $6.9 million, down from the first quarter of 2022, when it was $9.7 million.

"Given the volatility inherent with a lack of scale, this segment is expected to produce highly variable operating results throughout the remainder of the run-off," the earnings press release said. In its current status, the business does not have any new insurance written to replace the insurance in force policies that cancel.

Parent company Old Republic International, which also has a general insurance segment, earned $199.8 million in the first quarter, down from $306.3 million for the same period in 2022.

Stewart slides to first quarterly net loss since 2019

"Our first quarter results were impacted by historically low transaction volumes, driven by an elevated interest rate environment, as well as a seasonally slower first quarter," CEO Fred Eppinger said in a press release. "We remain focused on our long-term strategies of transforming Stewart into a stronger and more resilient company."

In the fourth quarter, Stewart reported net income of $13.3 million, while in the first quarter last year, it earned $57.9 million.

This was the company's worst quarter since

For its title business only, Stewart recorded a pretax loss of approximately $0.7 million for the quarter compared with pretax income of $82.8 million one year prior. Its real estate solutions segment posted pretax income of $1.4 million, down from $6.8 million in the first quarter of 2022.

Opened orders totaled 73,861 in the first quarter, compared with 116,755 one year prior, while for the same periods for closed orders, Stewart did 47,899 this year and 87,885 in 2022.

Doma's results improve, but it's still losing money

Adjusted EBITDA, the non-GAAP metric Doma is looking to achieve profitability in this year, didn't break that hurdle yet, with a loss of $21.6 million, versus $44.9 million in the first quarter of 2022.

Addressing consumers' affordability concerns are front and center in Doma's path forward, said CEO Max Simkoff, in a press release.

"When nearly 73% of U.S. households cannot afford the average U.S. home, there is clearly work to be done across the industry," Simkoff said. "Via our new go-forward strategy, we will not only ensure that Doma is positioned for long term success, but secure our role in making homeownership both more affordable and more attainable."

He added that Doma, the 10th largest title company by brand based on American Land Title Association first quarter data, would be providing additional details on these plans in the future.

The company recorded a significant decline in opened and closed orders on a year-over-year basis. It reported 9,940 opened orders and 6,280 closed orders for the most recent period, versus 35,192 and 27,347 during the first quarter of 2022.

"Looking ahead, we expect our retained premiums & fees to benefit from the tailwinds from the opened order momentum we've been experiencing due to both seasonality and rates that have declined since peaking in February and March," said Mike Smith, chief financial officer. "Additionally, we anticipate similar tailwinds to benefit our adjusted EBITDA performance as we continue to realize the benefits of the cost cutting actions that we took in the second half of 2022."

Investors Title’s investment income moderates lower revenues

"While mortgage rates declined slightly from the prior quarter, the overall higher level continued to negatively impact home sales and commercial real estate activity," J. Allen Fine, chairman of the Chapel Hill, North Carolina-based company, said in a press release. "Higher interest rates in the financial markets did help partially offset the decline in real estate activity by providing the ability to increase our investment income."

Title segment revenue was down 38.3% from the first quarter of 2022, but for the entire company, revenue was only 25.6% lower.

Like most of the other executives, Fine painted a positive picture for the company's prospects.

"Regardless of the recent softness in the real estate market, we are still finding opportunities to enhance our operational capabilities and expand our presence in new and existing markets," Fine said. "We possess a very strong balance sheet which affords us the strength to continue to make investments in the future, even in market downturns."