During the first quarter, the title insurers had unusually high activity due to the refinance boom. However, most home purchases, whose title orders have higher margins, typically take place in the spring, which helps to explain the increased earnings in the second quarter.

The Mortgage Bankers Association's forecast issued on Wednesday estimated the second quarter's total volume at $1.05 trillion, slightly down from the first quarter's $1.09 trillion. But purchase originations rose on a quarter-to-quarter basis to $460 billion from $320 billion. During the second quarter of 2020, mortgage originators had purchase volume of $348 billion

The trade group is still calling for record annual purchase volume through 2023, with $1.6 trillion this year, $1.74 trillion in 2022 and $1.78 trillion the following year.

Record pretax margins at First American

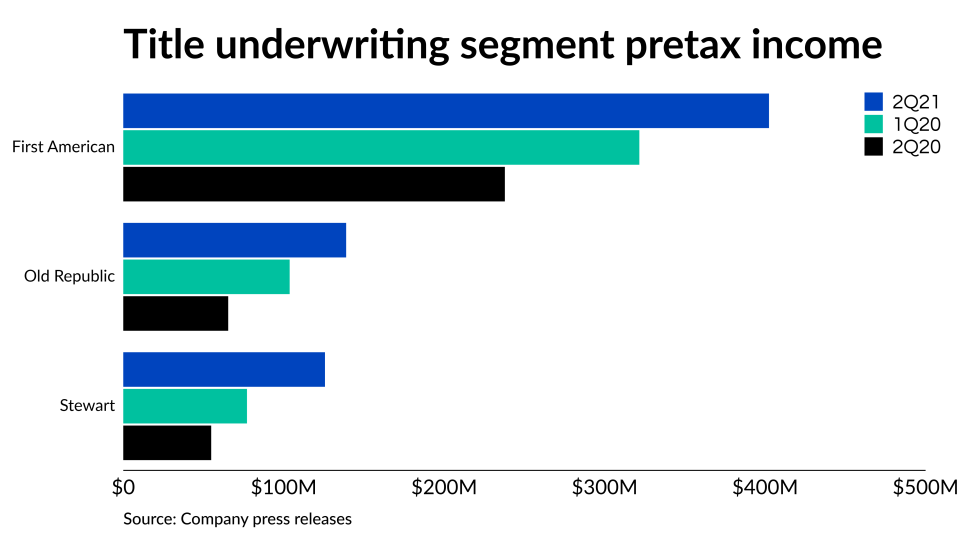

Segment pretax income rose to $402.4 million, up from $321.6 million last quarter and $237.8 million one year prior. Net income at the holding company level was $302.3 million, compared with $233.6 million and $170.7 million.

The company's results were the product of the strong purchase market as well as a commercial real estate rebound.

"We also benefited from high productivity bolstered by our ongoing data and title automation initiatives," First American CEO Dennis Gilmore said in a press release. "In addition, we recognized a $44 million gain this quarter related to our venture investments program, which continues to provide strategic and financial benefit."

However, open order counts are down from the prior quarter and the previous year. In the second quarter, First American opened 329,500 new orders, compared with 363,000 one quarter earlier and 351,300 one year prior.

Meanwhile, First American had closed orders of 271,100, versus 287,600 in the first quarter and 254,400 during last year's second quarter.

New high for title pretax income at Old Republic

The previous record was set in the fourth quarter of 2020 at $132.1 million.

Compared with the first quarter, Old Republic's open order count went to 154,508 from 161,851; one year ago, it had 150,197 open orders.

Meanwhile, Old Republic's mortgage insurance business, which hasn't written any new policies

"Claim costs for the current quarter and year-to-date periods continue to be driven by fewer newly reported delinquencies in combination with improving trends in cure rates and claim severity influenced by the ongoing economic recovery and continued strength in the real estate market," Old Republic's press release said.

The holding company, which also has a general insurance line, earned $316.4 million in the second quarter, down from $502.1 million in the prior period and $397.7 million one year ago.

Stewart's acquisitions add to company's results

During the quarter, Stewart

Operating revenue for the ancillary services segment was $58.2 million in the second quarter, up from $11.2 million one year prior. The segment had pretax income of $3.8 million, up from a year prior pretax loss of $5.8 million.

But title insurance income supports net income growth

The pretax margin grew to 16.7% in the second quarter, up from 12.2% in the first quarter and 10.9% for the same period last year.

As a result, net income rose to $94.8 million in the most recent quarter, compared with $54.2 million the prior quarter and $32.5 million the previous year.

Open orders rose to 143,301 in the second quarter, down from 157,918 the prior period. A year ago, it received 133,147 open orders.