Homebridge merging with blockchain fintech Figure Technologies

Figure uses its

"We are bringing together the most robust, powerful and efficient technology ever seen in lending and pairing that with a $25-billion-a-year loan originator with 150,000 customers we can introduce to new payment and lending products," said Figure founder Mike Cagney in a press release. "We're going to deliver to this all-star loan origination team at Homebridge a tech platform on Provenance Blockchain that is going to double their capacity for fulfilling loans."

Read the

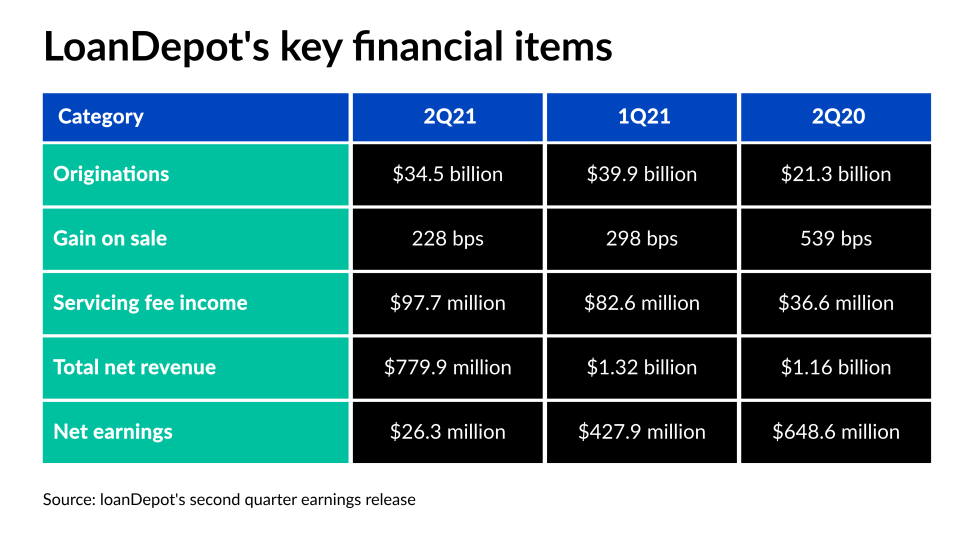

LoanDepot earnings down significantly on lower margins, revenues

The company’s earnings dropped by more than 93% quarter to quarter, falling to $27.3 million, compared with $427.9 million in the first part of 2021.

This is the first full quarter for loanDepot as a public company, following its

Second quarter total revenue of $779.9 million was down from $1.3 billion from

Read the

Biden issues new eviction ban for COVID-19 hot spots

The Centers for Disease Control and Prevention’s order on Tuesday, following several days of legal wrangling within the administration, aims to keep tenants who are in arrears from losing their homes until Oct. 3. White House officials hope that’s enough time to stand up a long-delayed $47 billion rental assistance program.

(

CFPB clarifies Juneteenth’s impact on mortgages

For compliance periods starting on or before June 17, 2021, when the holiday was signed into law, it was a business day. Thereafter, it’s considered a federal holiday.

The bureau’s

Read the

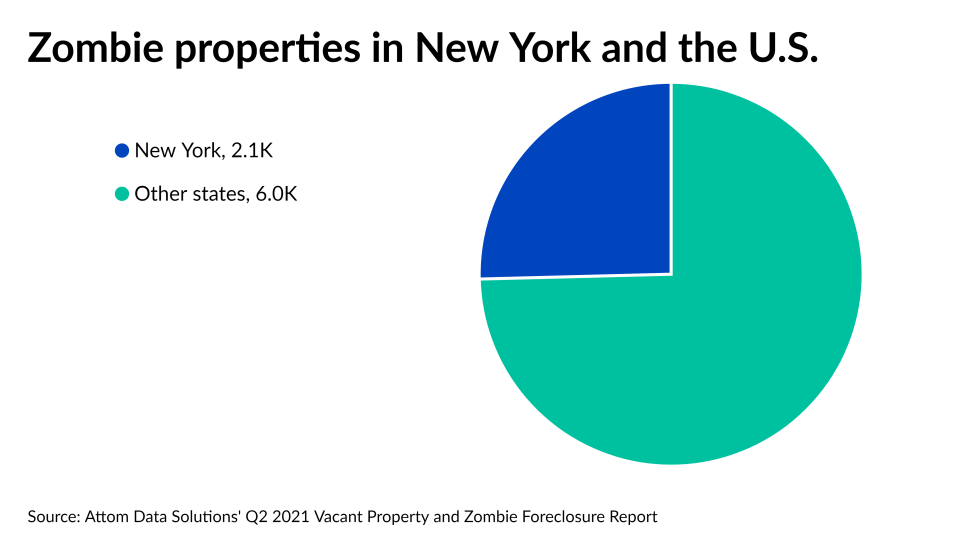

Ocwen, PHH review alleged abandoned property violations in 3 cities

Albany, Schenectady and Troy have coordinated legal actions against Ocwen and PHH under

While

Read the

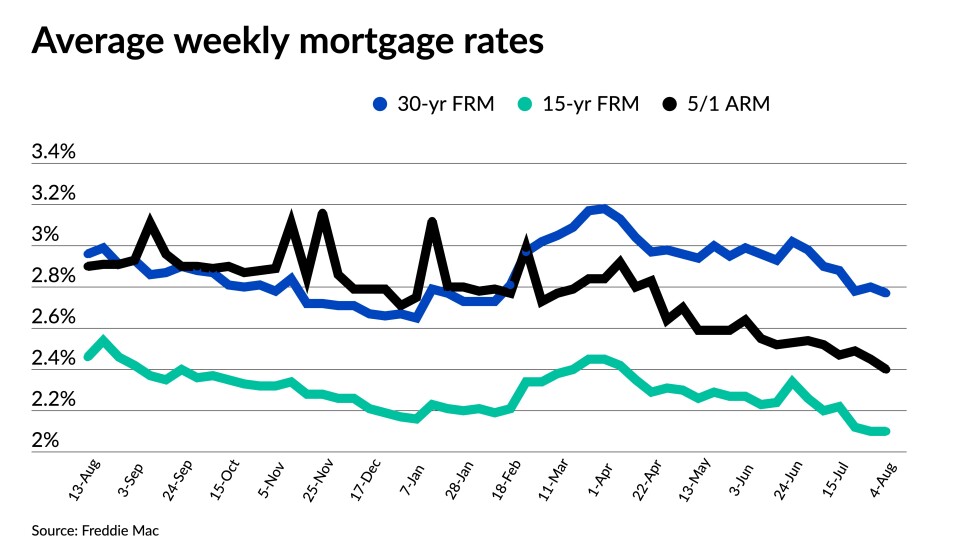

Mortgage rate drops to 2.77%

The average 30-year fixed-rate mortgage dropped to 2.77% — the lowest since mid February — for the weekly period ending August 4, according to Freddie Mac’s Primary Mortgage Market Survey. The rate averaged 2.8% one week earlier and stood at 2.88% during the same week a year ago.

(

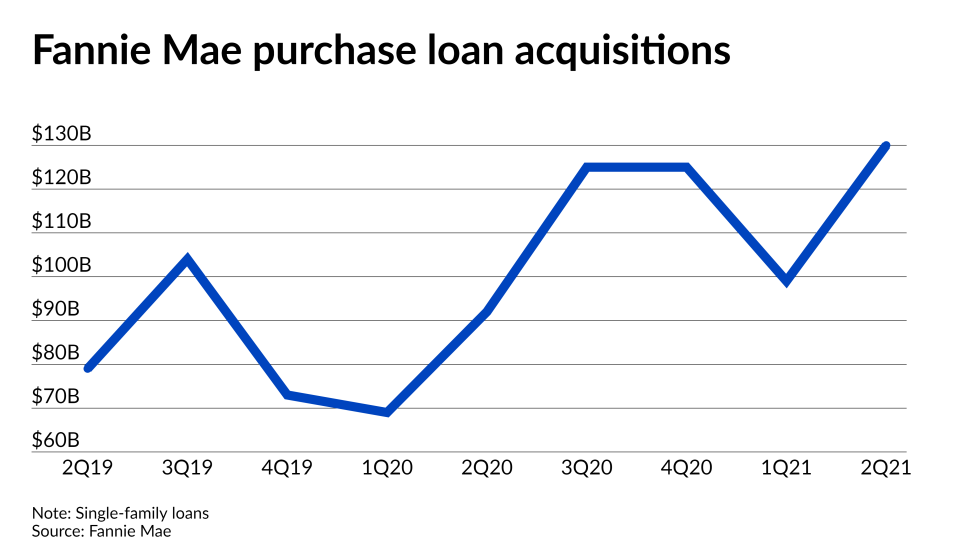

Fannie Mae sets purchase mortgage acquisition record

The government-sponsored enterprise’s net income was up from $2.55 billion

Fannie’s net worth rose to $37.3 billion from $16.5 billion during the same period a year earlier, and from $30.2 billion in 1Q20. Net revenues rose to $8.4 billion from nearly $5.9 billion a year ago and $6.8 billion the previous fiscal period. Second-quarter purchase loan acquisitions increased from $92 billion a year ago and $99 billion the previous quarter.

Read the

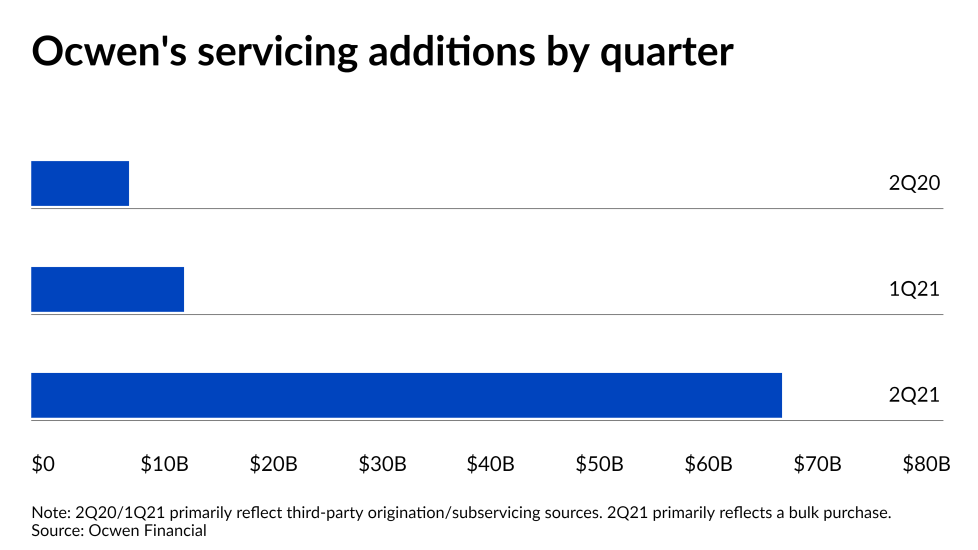

Ocwen takes $10M loss in Q2 2021

The company’s $10 million net loss followed a

However, when Ocwen’s earnings are adjusted for non-recurring charges, quarterly numbers look more consistent, and its recent investments position the company for growth in the second half, executives said in an earnings call.

“We accomplished a lot in the quarter: record servicing additions and seller growth, improved scale in ... originations, cost reduction, strong operating execution growth in higher margin channels, services, and products; all of which have given us strong momentum,” President and CEO Glen Messina said.

Read the

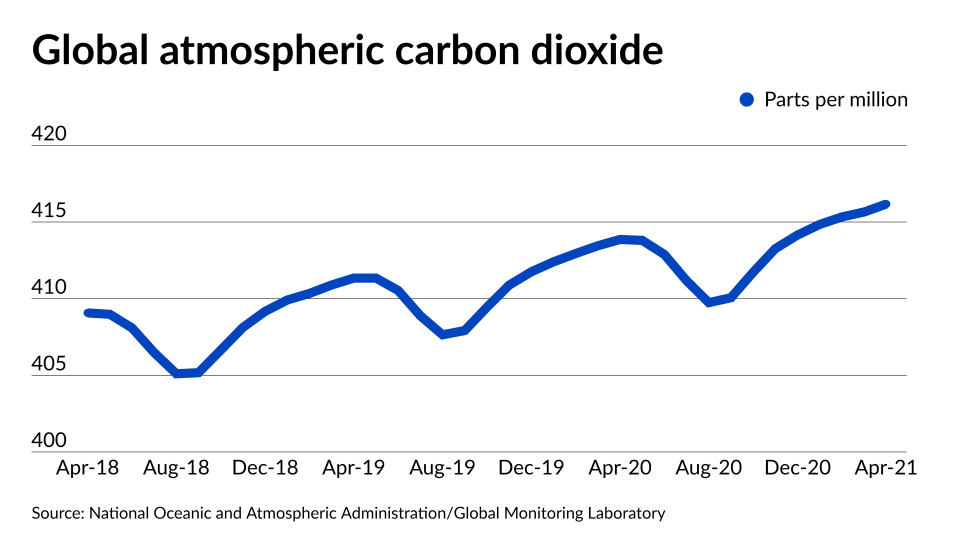

Redfin adds predictive data on climate change to its local statistics

In April, nearly eight in 10 respondents to a Redfin survey said the frequency and intensity of extreme weather events

"A home is a huge financial investment, and these days consumers are seeing all too many examples of climate-related risks like

ClimateCheck, a company that measures risk for climate disasters by location, provides the information to Redfin. It calculates a score from 0 to 100 for the county, city, neighborhood and zip code where each property is located.

Those ratings are based on both an area's future risk and how such risk is expected to change over the length of a 30-year mortgage. The model forecasts a higher risk for areas expected to experience more dramatic changes — compared with ones already experiencing such hazards — as this reflects the challenges and cost of adjusting to climate change and the increased stress on local infrastructure.

Read the

Bitcoin mortgage payment legislation proposed in Spain

If the bill is passed into law, Spanish banks and companies engaging in blockchain technologies would receive major breaks on taxes and patent costs. The legislation also calls for establishing a council for public blockchain advisory. It’s part of Spain’s larger effort to regulate the crypto market and fight tax fraud.

Across the Atlantic, El Salvador made history on June 9 by becoming the first country in the world to adopt Bitcoin as legal tender. On the same day, the U.S.

Read the

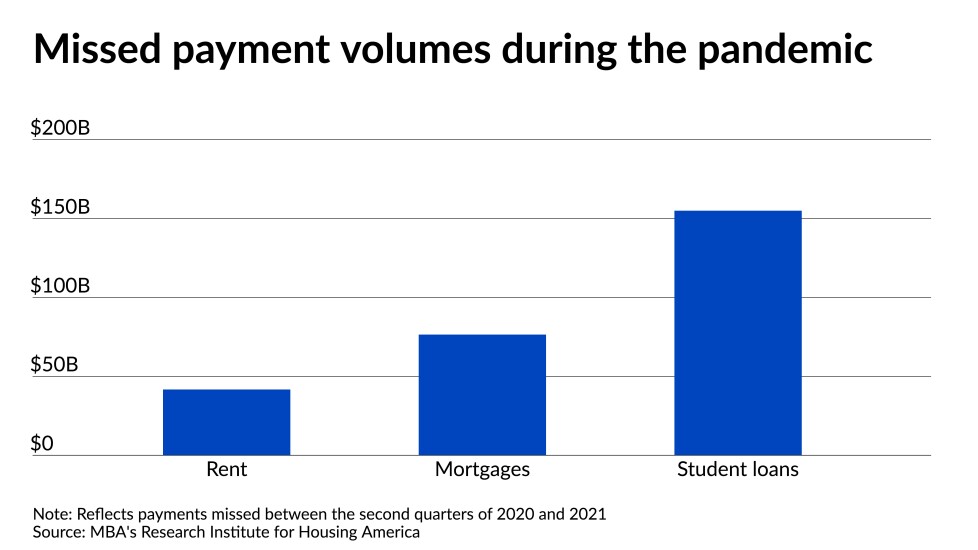

Improvement in performance slows for rent, mortgages, student loans

Missing payments for mortgage borrowers had fallen to 2.19 million in June from 2.33 million in March, according to the Research Institute for Housing America. During the same time period, missing payments for renters rose to 2.86 million from 2.56 million. Arrears for student loan borrowers increased to 28 million from 26 million. However, those statistics include payments suspended through

The numbers reinforce other

Read the

Freddie Mac names Dionne Wallace Oakley chief HR, diversity officer

A veteran of the insurance industry, Wallace Oakley will hold the title of senior vice president, chief human resources officer and chief diversity officer for the McLean, Virginia-based government-sponsored enterprise. She most recently held the role of executive vice president, human resources and strategy, at Erie Insurance. Prior to joining Erie in 2011, she held a variety of roles at State Farm Insurance for over two decades, including serving as its corporate human resources director.

Wallace Oakley is the third major corporate leadership hire at Freddie Mac in the past few months.

Read the

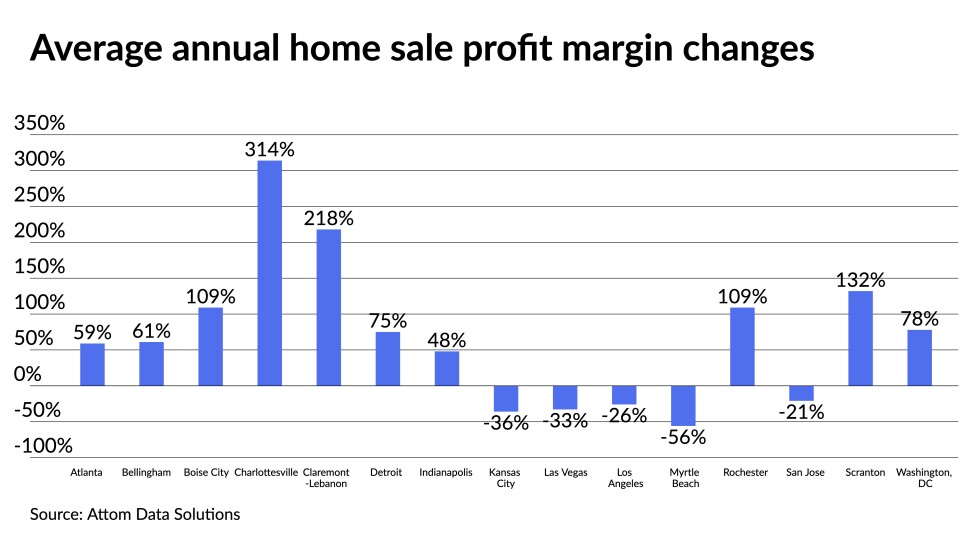

Home sale profits take rare dip in second quarter

Typical single-family home and condo sales across the United States during the second quarter of 2021 generated a profit of $94,500, up from $90,000 in the first quarter of 2021 and from $60,572 in the second quarter of 2020, according to a report

Read the

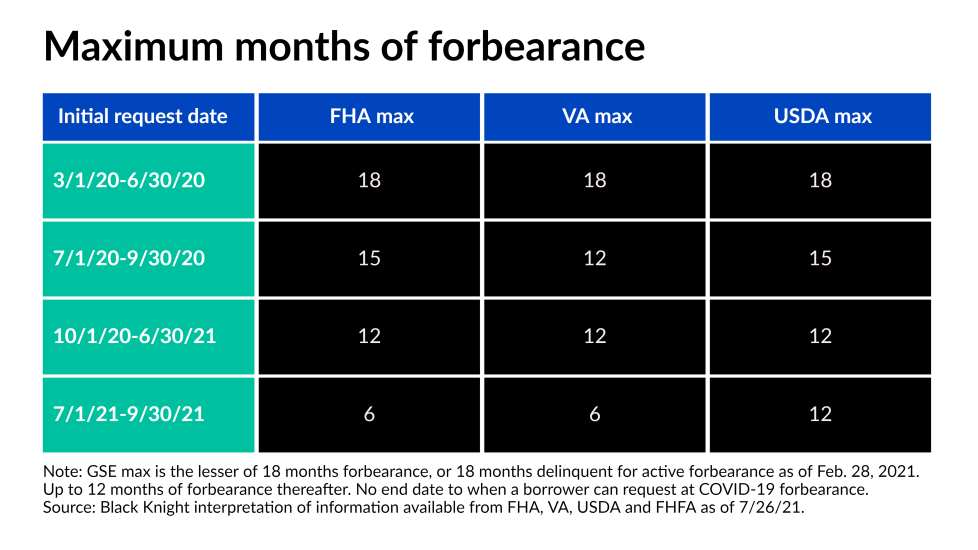

Foreclosure risk expected to spike in September

To be sure, government-related agencies

Read the

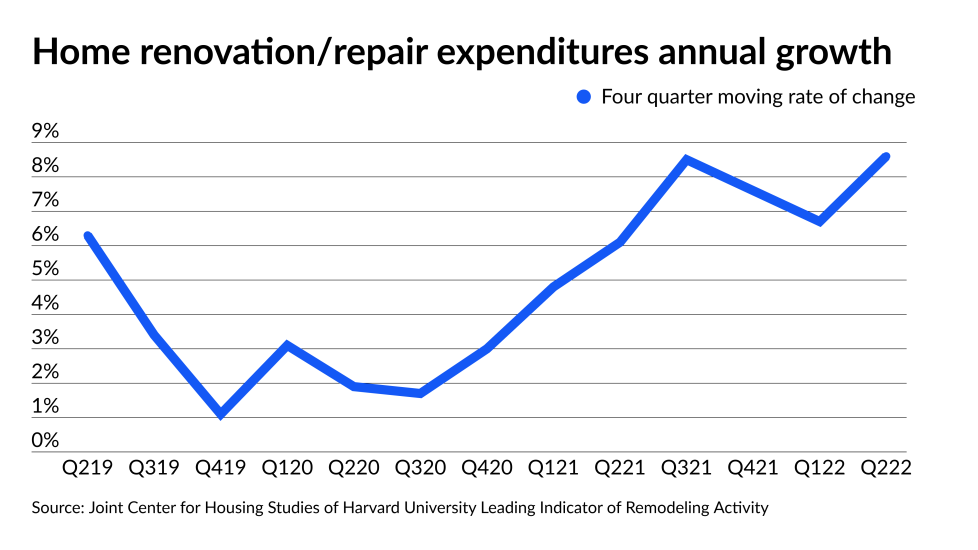

Heartland Financial offers home improvement loan to low-income clients

This fixed-rate installment loan is secured by the borrower's primary residence. It has a 60-month term, with dollar amounts between $5,001 and $14,999.

"This is another way we can help serve the communities that we're in," said Brian Jensen, senior vice president, segment marketing director at HTLF. "We know that a lot of larger national banks have announced they're

Read the

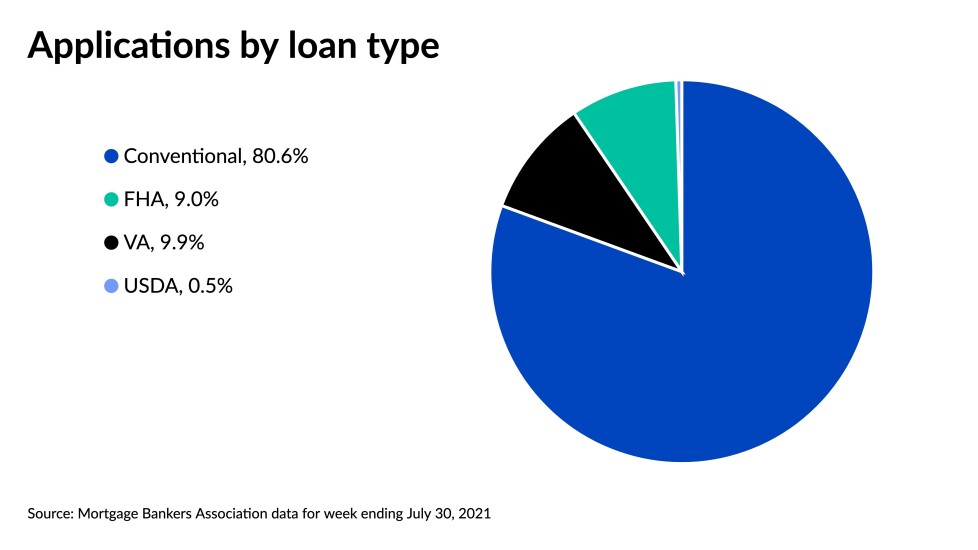

Mortgage applications drop in late July

The Mortgage Bankers Association’s Market Composite Index, which tracks applications through a weekly survey of MBA members, declined a seasonally adjusted 1.7% for the period ending July 30. On an unadjusted basis, the decrease equaled 2%. Compared to volumes for the same week in 2020, the seasonally adjusted index was 8.1% lower.

Although low interest rates have frequently led to surges in refinancing activity in 2021, the Refinance Index decreased 2% on a week-over-week basis and came in 3% lower than the same week a year ago.

After dipping to its lowest level since May 2020 the previous week, the Purchase Index slid a further 2%, seasonally adjusted. On an unadjusted basis, purchases were down 2% compared to a week earlier and 18% lower year-over-year.

Read the

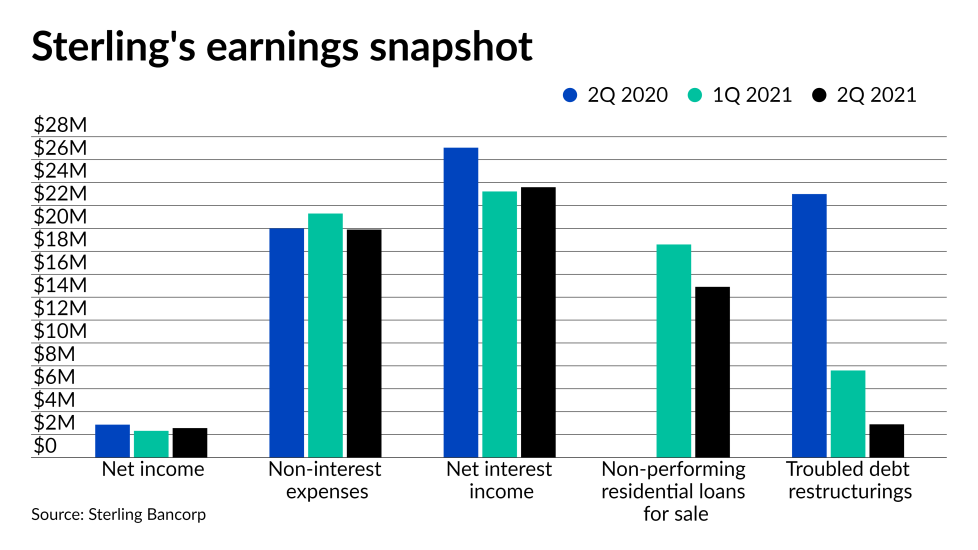

Sterling Bancorp’s mortgage-related legal expenses hamper Q2 earnings

After losing $13 million over the course of 2020, Southfield, Mich.-based bank drew profit for the opening two quarters of 2021, reporting a second quarter net income of $2.57 million, or $0.05 per diluted share. This rose

Last year, Sterling faced a

Read the