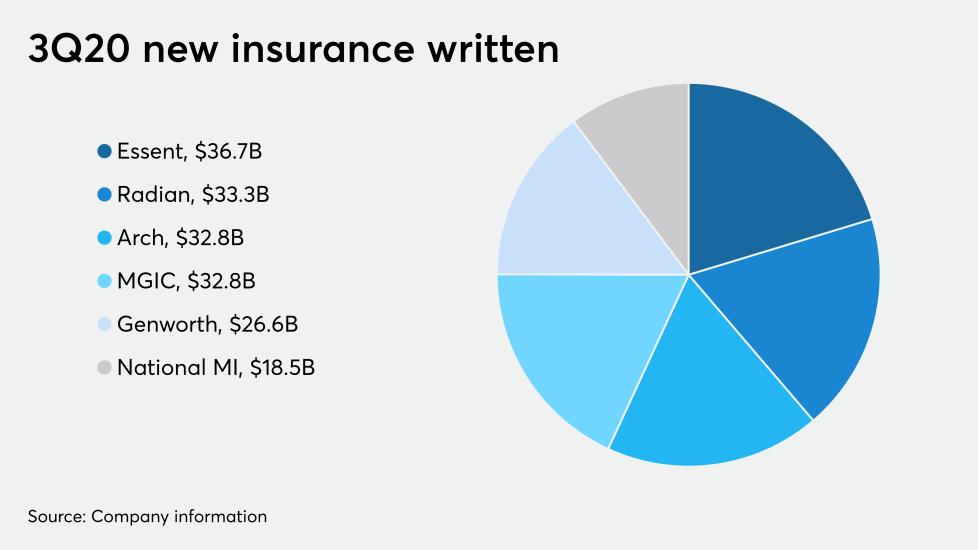

Even as private mortgage insurers had their best quarter ever, with four of the six active underwriters recording over $30 billion in new insurance written, they are facing a couple of roadblocks ahead.

Since these businesses are heavily dependent on providing credit enhancement for conforming mortgages, they are struggling with the lack of clarity on the election results, which would determine future of government-sponsored enterprise reform.

Overall though, the housing market will be a priority no matter which candidate ends up in the White House, B. Riley Securities analyst Randy Binner wrote in his reports on MGIC, Radian and National MI.

"A Biden victory would likely imply status quo on

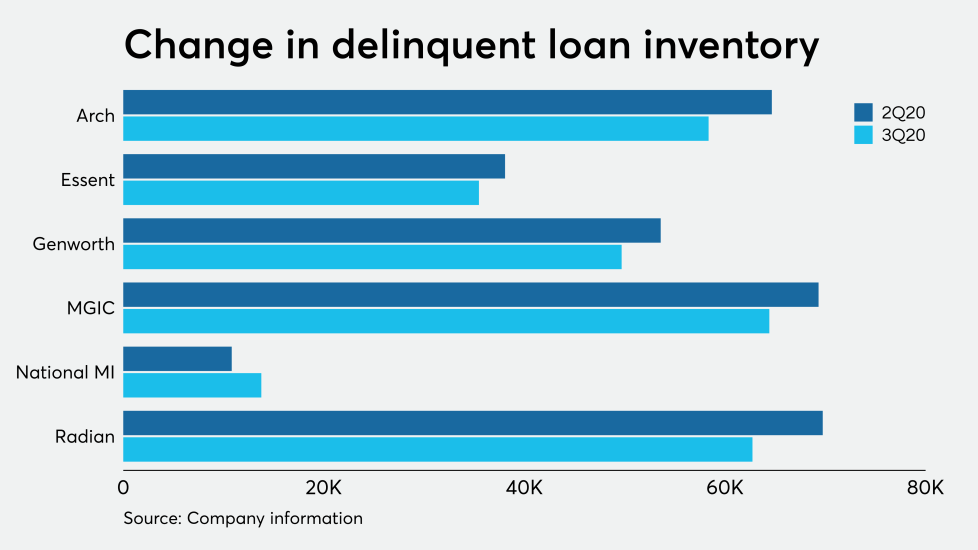

The other overhang on private mortgage insurers are the borrowers that were affected by the coronavirus who missed payments. Even if a mortgage is in forbearance, loans with missed payments are still reported by servicers to the mortgage insurers for inclusion in their delinquent loan inventory.

While those inventories remain elevated compared with post-housing crisis levels, there have been more loans curing than new notices of default being received.

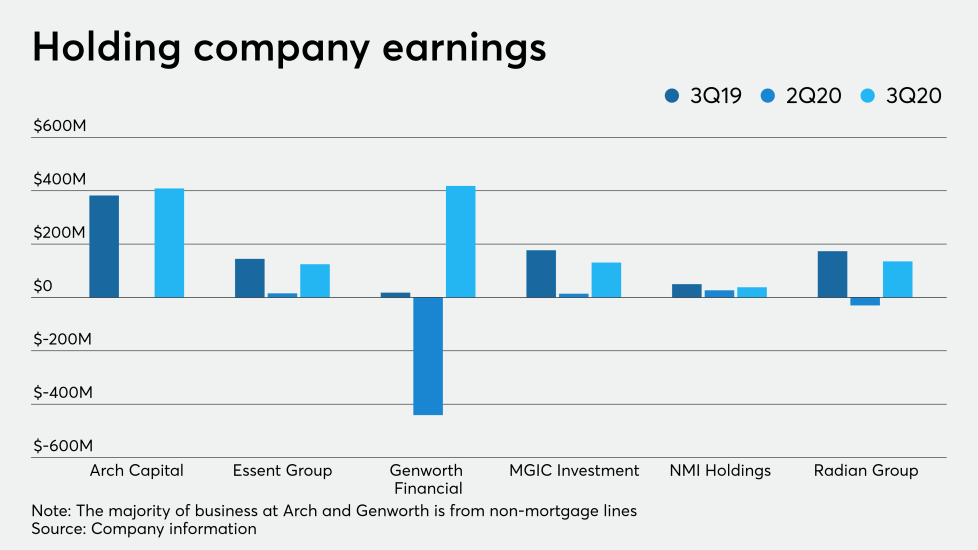

The main concern for the sector as a result remains capital adequacy under the Private Mortgage Insurer Eligibility Requirements, Binner said. All three companies he follows screened well in B. Riley Securities' analysis on capital adequacy. "Also, flattening forbearance and delinquency trends and increased clarity with respect to the FEMA forbearance haircut combine to leave the MIs in a strong capital position," he added.

Below, NMN reviews the third quarter earnings of mortgage insurers in the field.