All six MI companies combined did $148.7 billion in new insurance written, down 6% from $158 billion

"We see continued [price to earnings] multiple expansion for the mortgage insurance space as a whole given that the regulatory front remains constructive as the macro backdrop has supported cures of delinquencies," Cullen Johnson, an analyst with B. Riley Securities, said in his report on MGIC.

Total origination volume for the third quarter is expected to be down 13% from the second quarter and 15% from the year prior.

Only Radian reported a quarter-to-quarter increase in NIW; no company had a year-over-year rise. However, MGIC retained its market share lead.

Additionally, the delinquency and forbearance outlook for the MIs is favorable. "Cures continue to outpace new delinquencies," Johnson said. "Further, many new delinquencies are still eligible for forbearance, and many of the borrowers that are phasing out of forbearance are able to take advantage of various loss mitigation plans upon the end of those forbearance plans that can avert a foreclosure and thus avert a potential claim for the MIs."

MGIC is still the top underwriter

Its new insurance written of $28.7 billion was down from $33.6 billion during the second quarter and $32.8 billion in the third quarter of 2020, which the company attributed to a decrease in the refinance market.

"NIW was stronger than expected in the quarter, showing the quarterly volatility that is normal in this line item across the MIs," Johnson pointed out.

Still, MGIC could remain tops in market share as BTIG models a 5% increase in NIW in 2021 and a 12% drop in 2022, while insurance in force grows 10% for this year and 12% in 2022. This is a result of "stronger persistency offsetting declining NIW, albeit at a lower level than anticipated in the second quarter," said Eric Hagen in a report.

Radian adds business in 3Q but income slips

Its NIW was $26.6 billion in the third quarter, compared with $21.7 billion in the second quarter, and $33.3 billion in the third quarter of 2020. The share of refi loans needing MI fell significantly, to 10.2% of NIW in the third quarter, versus 22.9% in the second quarter and 29.5% for the third quarter of 2020.

For the full year, Gilbert expects a 14% decline in NIW in 2021 and 4% in 2022.

Its non-MI business, the homegenius segment that includes title, valuation, asset management, software-as-a-service and other real estate services, had an adjusted pretax operating loss of $5.6 million, an improvement over the second quarter loss of $9.2 million but slightly higher than the $5 million loss for the third quarter of 2020.

Segment revenues for the third quarter totalled $45.1 million, compared with $33.5 million for the second quarter and $29.8 million for the third quarter of 2020 because of increases in net title premiums earned and services revenue attributable to the title and asset management businesses.

"Should this segment continue to track towards management's revenue guidance, we think it serves as another avenue for multiple expansion for Radian shares," Johnson said in his report.

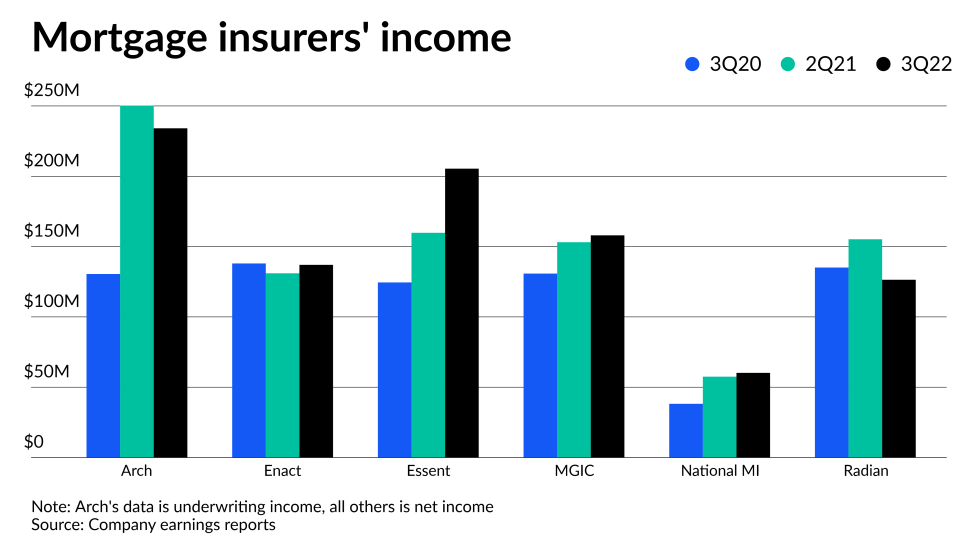

Arch MI's underwriting income up 79%

Gross premiums in the fourth quarter rose by 4.2% compared with the prior year to $360.9 million, reflecting growth in Australian single-premium MI activity from its acquisition of Westpac Lenders Mortgage Insurance Limited.

NIW for its U.S. business was $27.8 billion in the third quarter, down from $28.4 billion in the second quarter and $32.8 billion in the third quarter of 2020.

Enact's first report as a public company a good one

"We are very proud to begin our journey as a public company with one of our strongest quarters of financial and operational performance since the beginning of the pandemic," Rohit Gupta, president and CEO of Enact, said in a press release. "Our results reflect the high credit quality of our insurance portfolio and continued execution of our growth strategy against the backdrop of a resilient housing market."

Enact's third quarter net income was $137 million, compared with $131 million for the second quarter and $138 million for the third quarter of 2020. The year-over-year decrease was primarily driven by lower earned premiums and a full quarter of interest expense from Enact's 2020 debt offering, partially offset by lower incurred losses.

NIW was $24 billion, down 10% compared with $26.7 billion in the second quarter and $26.6 billion in the third quarter of 2020.

"All in, a solid debut quarter from Enact," Gilbert said in his report on the results.

Essent posts higher net income even as NIW shrinks

Third quarter NIW of $23.6 billion was 6% down from $25 billion in the second quarter; that was in line with the industry's overall decline, Keefe, Bruyette & Woods analyst Bose George pointed out. George had expected Essent to come in at $24.7 billion. Essent's NIW was also down from $36.7 billion in the third quarter of 2020.

Market share gains expected to continue for National MI

"Our credit performance continued to trend in a favorable direction, and we remain optimistic about the broad strength of the economy and resiliency of the housing market," said CEO Claudia Merkle in a press release.

National MI ended the quarter with $18.1 billion of NIW, down from $22.6 billion in the prior three month period and from $18.5 billion one year prior.

"We believe market share gains will resume in 2021 as NMIH deploys the capital raised in 2020, maximizes the benefit of new accounts opened in 2020, and further expands customer relationships in 2021," BTIG's Gilbert said in a report. "This is critical because the stock is much more closely correlated to NIW growth than other PMIs."