Headwinds that have sent residential lending volumes plunging in 2022 are leaving a mark on the investor real estate market but the economic environment still provides strategic opportunities for investors in both fix-and-flip properties and single-family rentals in addition to challenges.

"I think the super-prolific, seasoned, experienced folks are saying this is not necessarily a bad thing for me. It's back to the fundamentals and the basics of the math on buying right," said Stephanie Casper, chief revenue officer at

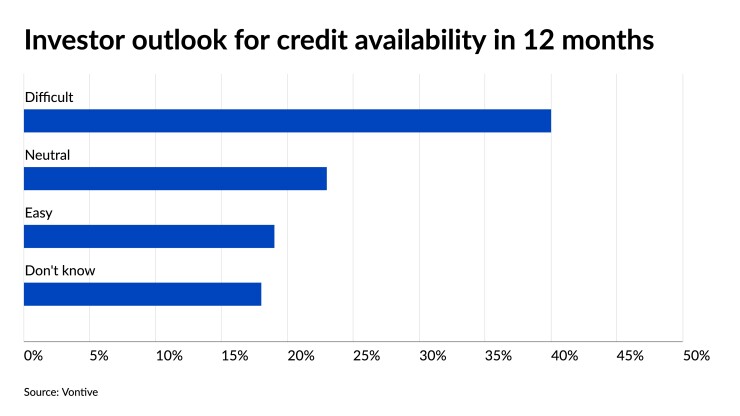

Signs of pessimism have emerged among some buyers, though, especially when compared to the average consumer's views. In a recent survey conducted by

Far more questions than answers hang over the heads of everyone involved in the mortgage industry, and businesses that provide loans to investors say the current trends will lead to more cautious and measured choices compared to recent history. While volume falloffs might not be as steep as what the