GSE exemption to stay in place until underwriting rule finished

The bureau's decision announced Tuesday is intended to provide breathing room for the mortgage market that had feared a quick end for the exemption before the CFPB makes key changes sought by the industry to the underwriting rule. (Read full story

Mortgage applications dip, but low rates keep buyer demand strong

Google gets into the mortgage game with Roostify

Bidding wars boom as homes spend as little as 4 days on the market

Guild's IPO downsized, prices under expected range

Fannie Mae extends purchasing loans in forbearance

Senate Democrats' bill would ban discrimination in financial services

The landmark 1964 law bans discrimination on the basis of race, color, religion, or national origin at places of "public accommodation" — including hotels and restaurants — but it did not include financial institutions.

A bill introduced by Sens. Sherrod Brown of Ohio, Tina Smith of Minnesota, Cory Booker of New Jersey, Elizabeth Warren of Massachusetts and Chris Van Hollen of Maryland would change that, prohibiting financial institutions from discriminating on the basis of race, religion, national origin, sex, gender identity or sexual orientation. (Read full story

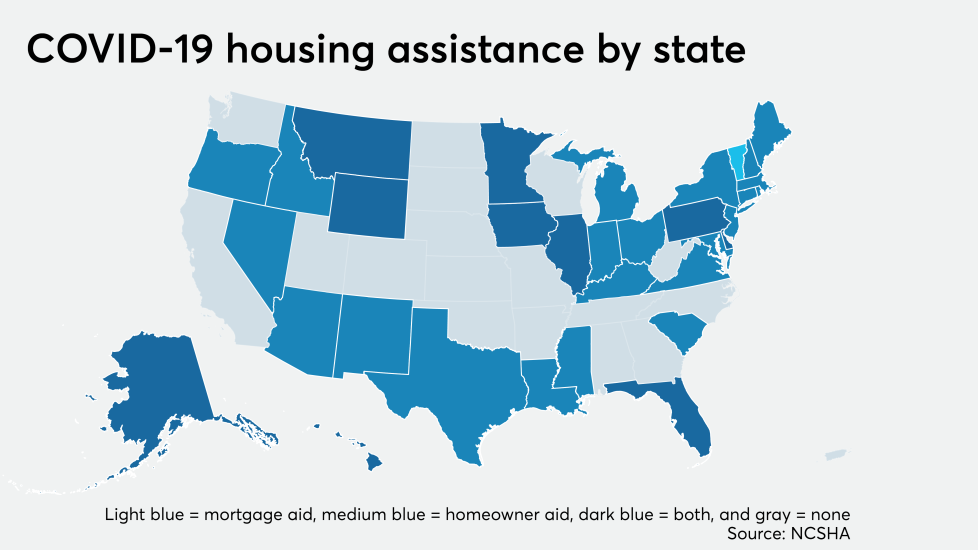

States scramble to issue mortgage, rent aid before year's end

“That puts a lot of pressure on these programs,” said Stockton Williams, executive director of the National Council of State Housing Agencies. “The demand in most states is far in excess of what is available and going to be available.” (Read full story

CoreLogic posts record revenue for 3Q, makes case against hostile bid

"CoreLogic is firing on all cylinders," Frank Martell, president and CEO, said during the company's earnings call. "We are exiting 2020 with accelerating momentum and believe that we're well positioned to capitalize on the many value creation opportunities to drive continuing organic growth and margin gains." (Read full story

James A. Johnson, former Fannie Mae CEO, dies at 76

In addition to leading Fannie Mae, Johnson worked for financial firms Perseus LLC and Shearson Lehman. After departing from Fannie Mae in 1998, he started his own firm, Johnson Capital Partners, in 2001. (Read full story