Nonbank lenders balk at Ginnie Mae capital plan

Ginnie issued a

State and federal regulators have sought for years to impose prudential regulation and stress-testing on nonbank lenders but the new Ginnie plan is the first to include a risk-based capital standard.

Read the

Flagstar's 2Q mortgage earnings slip on margin compression

The Troy, Mich.-based bank, which is in the process of

But the parent company, which also has community bank branches along with

Read the

New Residential 2Q earnings released

The New York-based REIT announced $121.3 million in net income for the second-quarter in its earnings call Thursday, compared to a net loss of $8.9 million in the same COVID-impacted quarter last year. In this year’s

With the portfolio of recently acquired Caliber Home Loans largely complementing New Residential’s NewRez lending business, company executives were optimistic about future prospects, particularly in originations, after the deal closes in the third quarter.

Read the

Jay Z, Will Smith-related funds invest in homeownership fintech Landis

The round is led by Sequoia Capital. Other investors include Arrive (part of Shawn "Jay-Z" Carter's Roc Nation); Dreamers VC (associated with Smith) and existing investor Signia Venture Partners.

"Landis is an innovative company that also has a social mission we are aligned with," Smith said in the press release. "We are excited to be part of a journey that helps Americans achieve homeownership through financial education."

Read the

Doma CEO Max Simkoff on speeding up the timeline to go public

If the deal is completed, Doma will join the

Although Doma’s underwriting business, North American Title, has been growing, it still only had

Read the

State regulator group issues standards for nonbank mortgage servicers

The CSBS’s board of directors on Tuesday

The standards resemble the capital and liquidity requirements

“The standards provide states with uniform financial condition and corporate governance requirements for nonbank mortgage servicer regulation while preserving local accountability to consumers,” John Ryan, the bank supervisor group's president and CEO, said in a press release.

Read the

New 2022 data standards could head off foreclosure errors in transfers

Protocols aimed at ensuring nothing is lost in translation when information about billing, late payments and related processing moves to a new system are set for comment and subsequent release in 2022, according to the Mortgage Industry Standards Maintenance Organization.

“These transactions sometimes cause confusion among borrowers about when their next payment is due and things of that nature. Standards would help clear that up,” said Seth Appleton, president of MISMO, in an interview.

Read the

As FHFA sets eviction rules, MBA redoubles push to get aid to tenants

With the two large government-sponsored enterprises adding a notification period for tenants in properties securing their loans, and the Consumer Financial Protection Bureau releasing an online tool to assist tenants and landlords in securing aid from the Emergency Rental Assistance programs, the MBA urged members to get more involved too.

“With the CDC nationwide eviction moratorium set to expire on July 31st, we are working closely with our multifamily loan servicing members to communicate to their borrowers that billions of dollars [are] available to help tenants and landlords in need,” MBA President and CEO Bob Broeksmit said in an emailed statement on Wednesday. “We will continue to partner with policymakers and industry stakeholders to build awareness and push for

Read the

Purchase applications drop to lowest level in over a year

The MBA’s Market Composite Index, which tracks mortgage applications through a survey of MBA members, increased 5.7% on a seasonally adjusted basis from the previous week for the period ending June 23. The unadjusted index came in 6% higher

The Purchase Index fell a seasonally adjusted 2% — or 1% on an unadjusted basis — hitting its lowest point since May 2020. Purchases have declined on an annual basis for the past three months.

Read the

Fannie, Freddie, FHA offer some tenants relief as eviction ban ends

The FHA, the Department of Veterans Affairs and the Federal Housing Finance Agency announced separately on Friday that they’re extending moratoria on evictions from single-family real-estate owned properties through Sept. 30, following a recommendation by the Biden administration.

Mortgage servicers can proceed with certain foreclosures after a ban on these ends on July 31, but no evictions of the renters on the properties involved can take place until the end of September, according to the FHA.

Mr. Cooper 2Q earnings released

The company’s earnings were down slightly from

At $654 billion, Mr. Cooper’s servicing portfolio size was up 4% from the previous quarter and 16% annually. Acquisitions of mortgage servicing rights accounted for $16 billion of the growth in the unpaid principal balance of loans, followed by mortgages acquired from other companies through the correspondent channel ($12 billion), subservicing and other sources ($10 billion), and direct-to-consumer originations ($9 billion). Runoff of MSRs reduced the net increase in the portfolio by $22 billion.

Read the

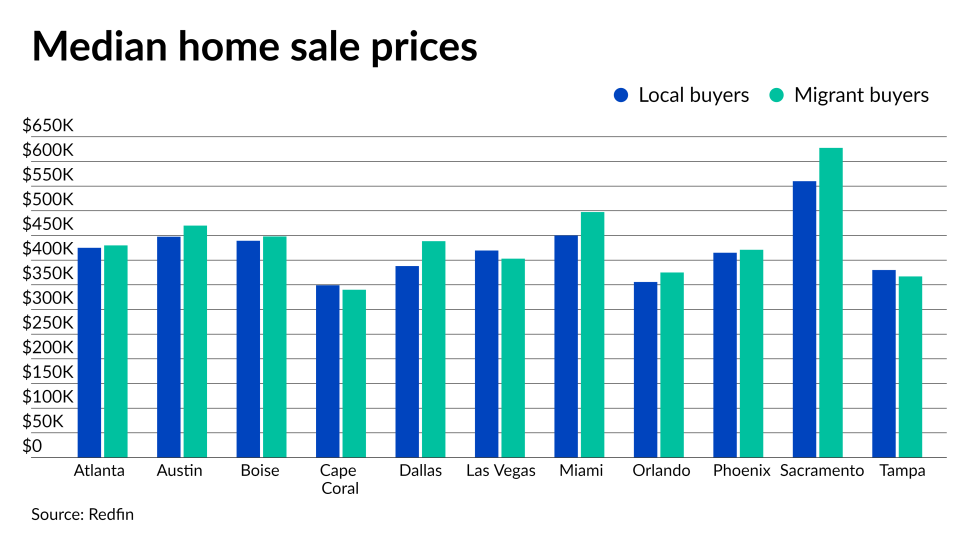

Out-of-town home buyers pay $17k more than locals

Consumers moving from one place to another pay an average of $17,123 more than local property purchasers, according to a study of the top 11 migratory housing markets between July 1, 2020 and June 30, 2021 by Redfin.

By dollar amount, the widest discrepancies came in Sacramento, Calif., with out-of-towners paying $67,500 more, $50,450 more in Dallas and an additional $47,500 in Miami. Out-of-towners actually paid $16,500 less in Las Vegas, $13,000 less in Tampa, Fla., and $9,000 less in Cape Coral, Fla.

When broken down by the percentage paid over asking

Read the

Benefit Street buying Capstead, forming 4th largest commercial REIT

Capstead’s common stockholders will receive a cash payment equal to a 15.75% premium to its diluted book value per share. In addition, they will receive shares of BSPRT common stock calculated on an adjusted book-for-book basis on a yet-to-be determined date proof to the deal’s closing. (Companies’ book values reflect their assets minus certain liabilities.) The move initially gave a slight lift to Capstead’s publicly-traded stock, which was up at $6.53 per share Monday afternoon, as compared from $6.41 when the market opened.

The proposed acquisition points to an interesting strategy, in which a player from the commercial sector that remained active throughout

Read the

Blend launches financial equality program

The technology provider, which has long touted its

"Blend's mission is to expand access to the world's financial resources, and we are committed to creating a more inclusive financial services ecosystem for everyone," Nima Ghamsari, co-founder and head of Blend, said in a press release.

Read the

Freddie Mac, Mr. Cooper, Cenlar, LendingHome name new leaders

In its

Read the

Newrez markets new ARM products

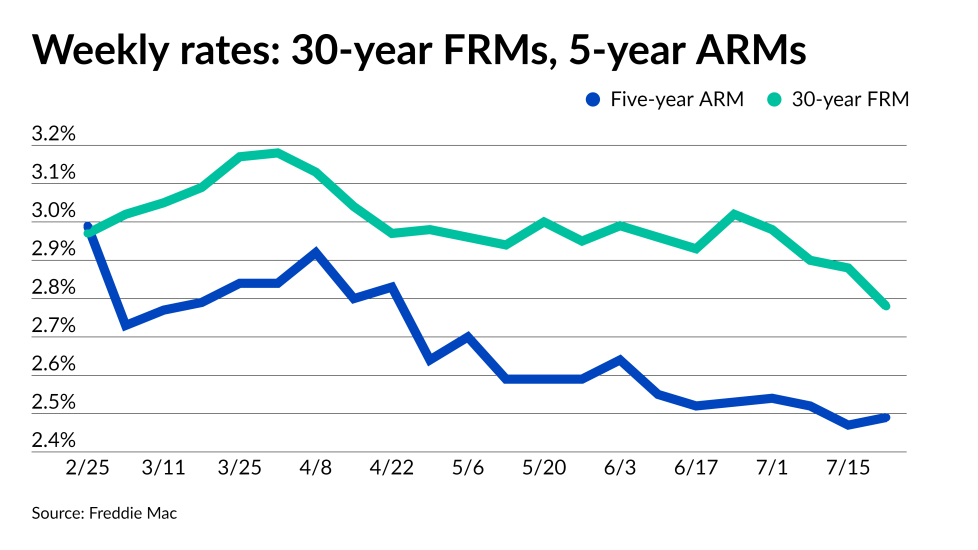

Newrez is selling ARMs that are fixed for five, seven or 10 years before adjusting in niches that include

A change in the relationship between short- and long-term rates has made ARMs more attractive, Jeff Gravelle, chief production officer at Newrez, noted. Although the current market typically has favored fixed rate loans, the relative discount for five-year products has increased.

Read the