First Guaranty files for bankruptcy

FHFA implements fee but may revisit capital framework that includes it

Freddie Mac automating rent-based underwriting for single-family loans

House prices are rising faster in disaster-prone areas

Five ways the CFPB could rein in Facebook

U.S. home-price growth decelerates for first time since 2021

States can play hardball with credit reporting bureaus, CFPB says

Lower housing costs — not jobs — are driving intercity moves

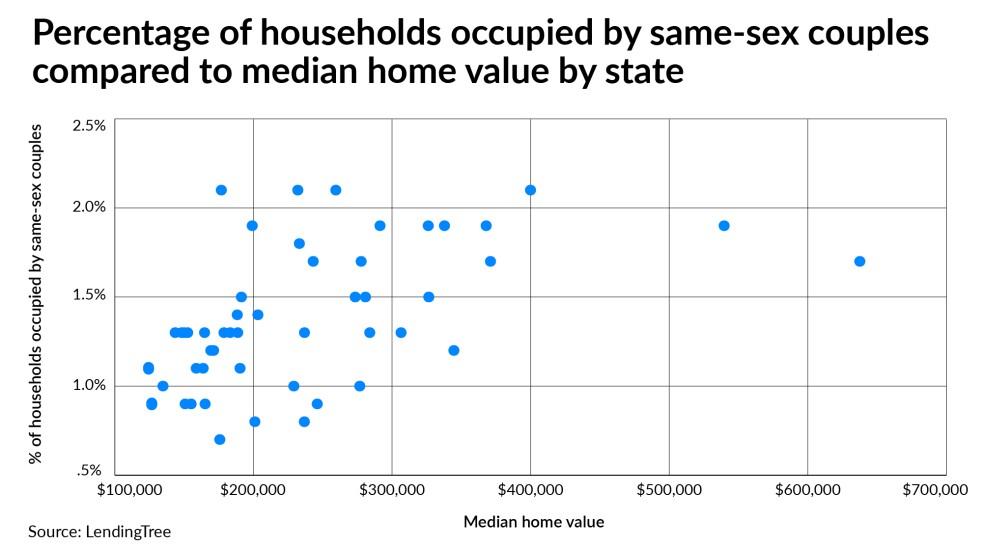

Same-sex couples pay a premium to live in more liberal states

Black entrepreneurs aim to narrow the racial wealth gap with mortgage fintech

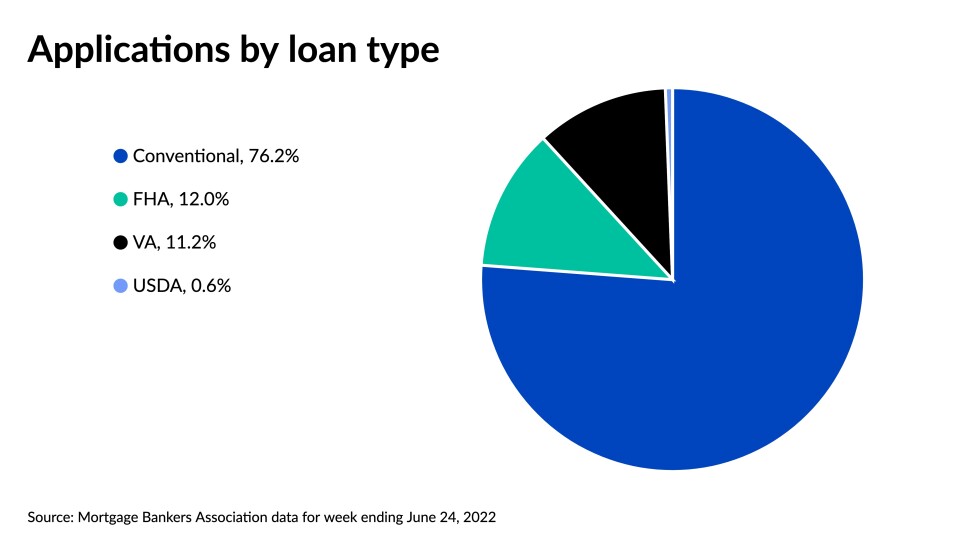

Refinance apps are 80% below their 2021 level

Mortgage servicer says prior data breach hit 100,000 more users

Roostify, Indecomm team up to streamline income verification

Flagstar Bank sued over its latest massive data breach