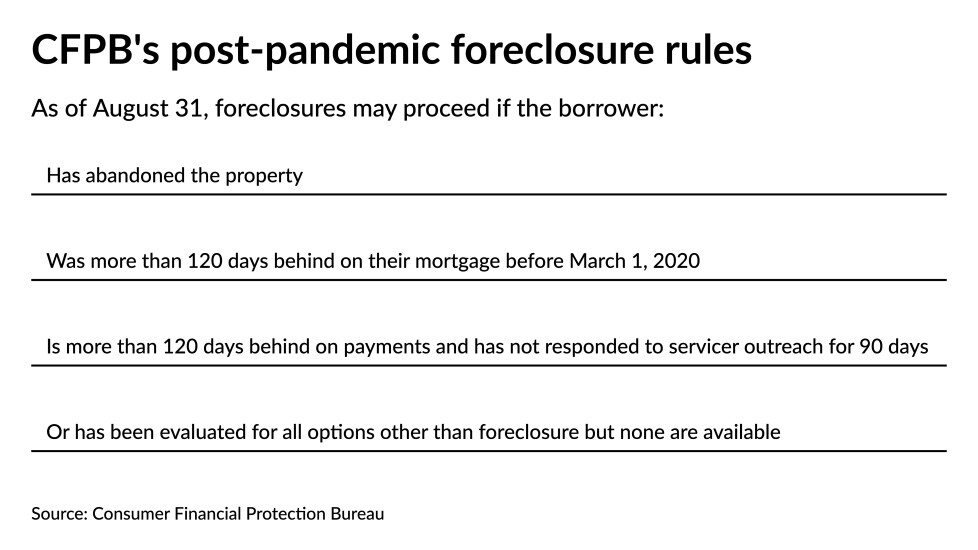

CFPB lets foreclosures resume — but with caveats

The CFPB issued a temporary final rule Monday that provides added borrower protections such as required outreach and loss mitigation reviews by servicers. But the agency essentially abandoned a proposal

"Let me be clear: Our final rule does not impose a foreclosure moratorium," acting CFPB Director Dave Uejio said on a conference call with reporters.

Read the

Forbearance re-entries rise as borrowers struggle with underemployment

The total forbearance rate slipped 2 basis points to 3.91% and re-entries rose to 6.2% of all suspended payments, from 5.9%

Read the

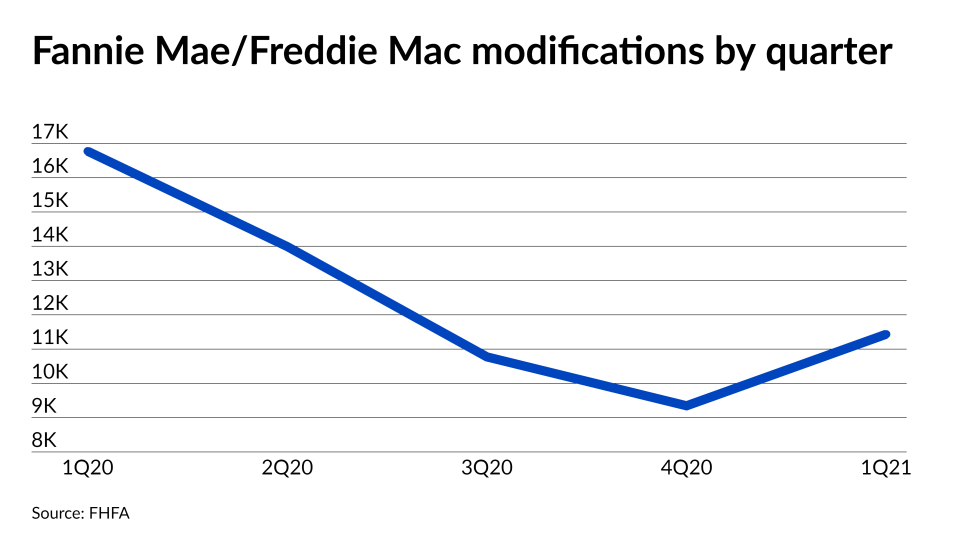

FHFA lowers bar for distressed borrowers seeking loan modifications

The new terms for Fannie Mae and Freddie Mac’s standard Flex Modifications are in line with broader efforts to make it easier for borrowers to maximize home retention options as temporary payment suspensions and

Read the

American Express partners with Rocket and Better.com on mortgage offer

The financial services behemoth now offers its existing card member base statement credits totaling $2,000 for conforming and $6,000 for jumbo loans if they originate or refinance through either partner company. The credits will be paid out by the lenders and the deal was created to deliver value during a hot market based on a similar limited-time pilot offer conducted in 2019, an Amex spokesperson told NMN.

Amex

Read the

FHFA addresses regulatory gap as servicers prep for foreclosure return

While industry groups had not vetted the entirety of the CFPB’s 200-plus page temporary final rule at deadline, they were relieved that the directive allows them restart of a broader range of foreclosures after the federal ban ends.

The FHFA’s announcement that it will immediately align its policies with the CFPB’s after the

Read the

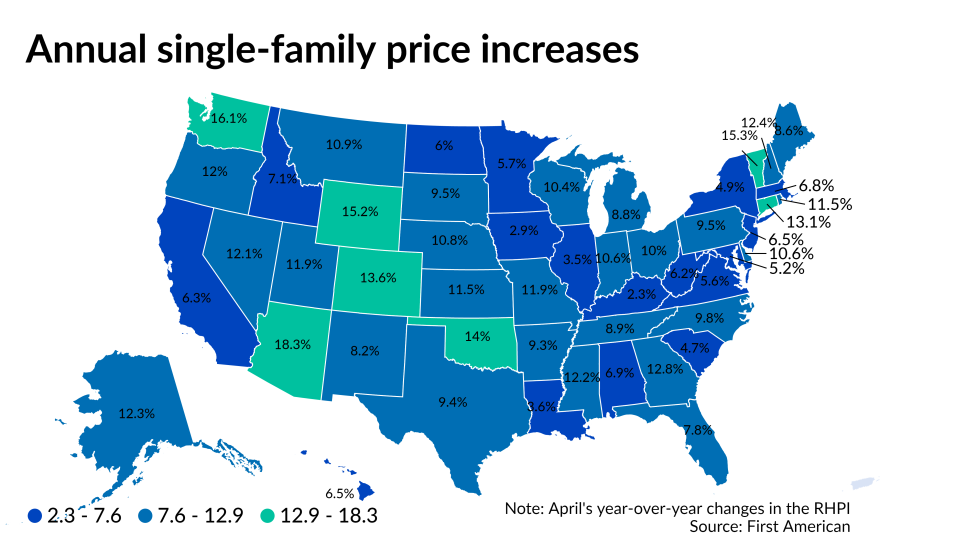

Housing affordability takes biggest plunge since 2018

The Real House Price Index — a metric that adjusts residential property prices for income and interest rate fluctuations — grew 0.7% from March and 7% year-over-year. When RHPI rises, home buyer affordability falls. Median household income increased to $74,249 from $73,455 monthly and $70,542 annually while house-buying power jumped to $505,904 from $499,060 the month before and $465,906 in April 2020.

Read the

Reverse lender can foreclose on non-borrowing spouse: Fla.'s top court

The case, WMVF v. Palmero, centered on discrepancies between the promissory note and the mortgage document. Prior Florida Supreme Court rulings for forward mortgages dating back nearly 100 years stated that in those cases, the note takes priority over the mortgage. This decision extends that to reverse mortgage legal proceedings.

The ruling sends the case back to the trial court, which is expected to approve the foreclosure motion, said William McCaughan, the lead counsel for WMVF, who argued the case before the Florida Supreme Court.

Read the

CoreLogic to acquire settlement services platform ClosingCorp

The deal will combine CoreLogic’s analytics with ClosingCorp’s platform, which offers streamlined settlement services during the closing process.

“The combination of ClosingCorp and CoreLogic digital solutions, platforms and domain expertise is clearly additive for our clients and the broader housing ecosystem,” said Frank Martell, CoreLogic’s president and CEO.

Read the

Lumber prices tumble, dropping to five-month low in June

Lumber futures ended June with a closing price of $737.40 per thousand board feet after starting the month at $1,267.50 and spiking to an all-time high of $1,670.50 on May 7, according to data from Nasdaq. While still above the year-ago rate of $431.60, it reached the lowest point since $700 on Jan. 20. The recent fall represents drops of 55.9% from May’s peak and 41.8% throughout the month — the largest monthly decrease on record dating back to 1978, according to CNBC.

Read the

Former Zillow execs raise $70 million to launch mortgage fintech Tomo

Zillow’s former Vice President of its Premier Agent business, Carey Armstrong, and former President of media and marketplace, Greg Schwartz, co-founded Tomo in October 2020 with the aim of improving the buying experience — a

Read

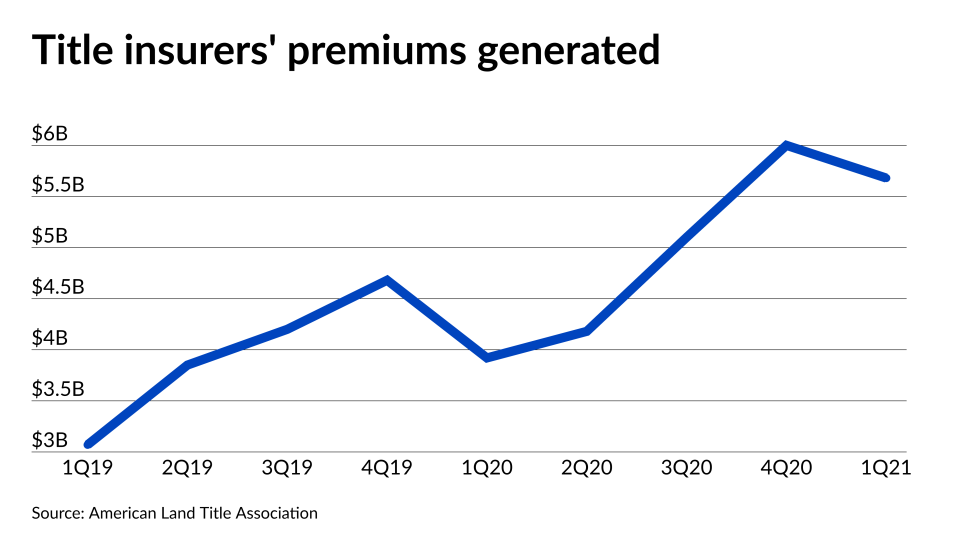

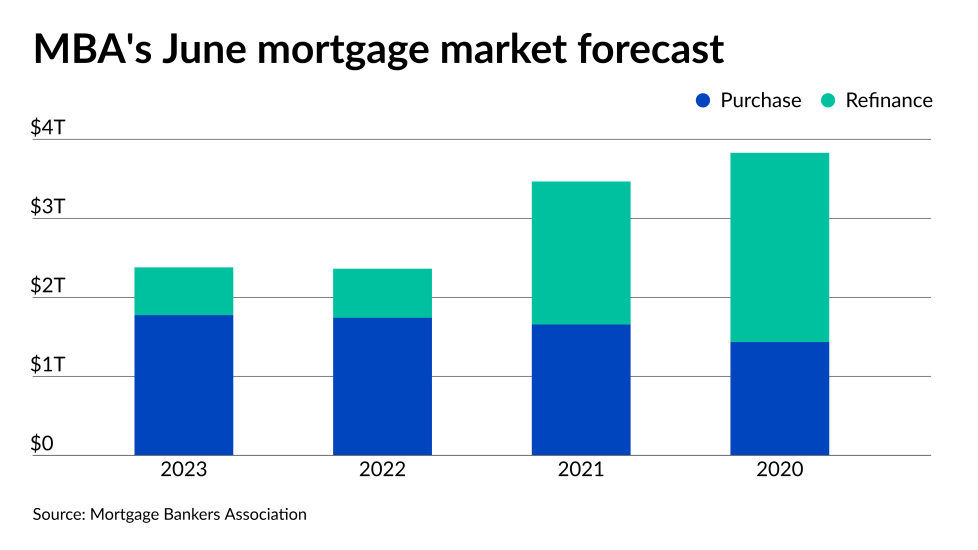

Refinancings lead title insurers to their best first quarter ever

Mortgage originations topped $1 trillion in the first quarter — Fannie Mae

That led to $5.68 billion of title insurance premiums written during the period, down from approximately $6 billion in

Read the

Fannie, Freddie keep MIs dividend restrictions, haircut in place

The dividend restriction was extended instead of expiring on June 30 as scheduled, the latest update to secondary market capital requirements said. Allowing the restriction to lapse created concerns that the FHFA and the government-sponsored enterprises decision permitting the MIs to hold less capital against delinquent loans would be ended as well, said Bose George, a Keefe, Bruyette & Woods analyst, in a note on the announcement.

Read the

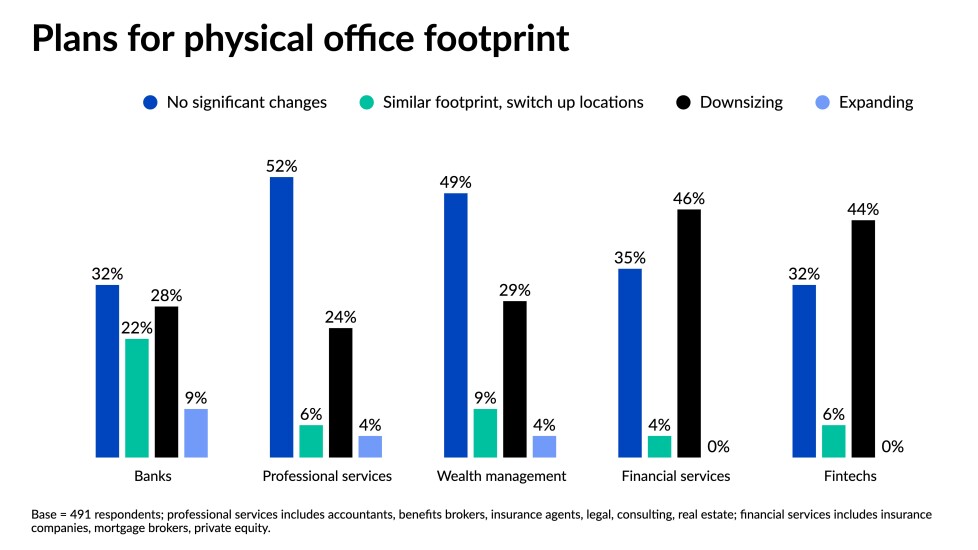

What use of office space in U.S. could look like by 2022

Over half of American companies expect to maintain a similar physical footprint or even expand in the post-pandemic environment, according to a recent

Read the

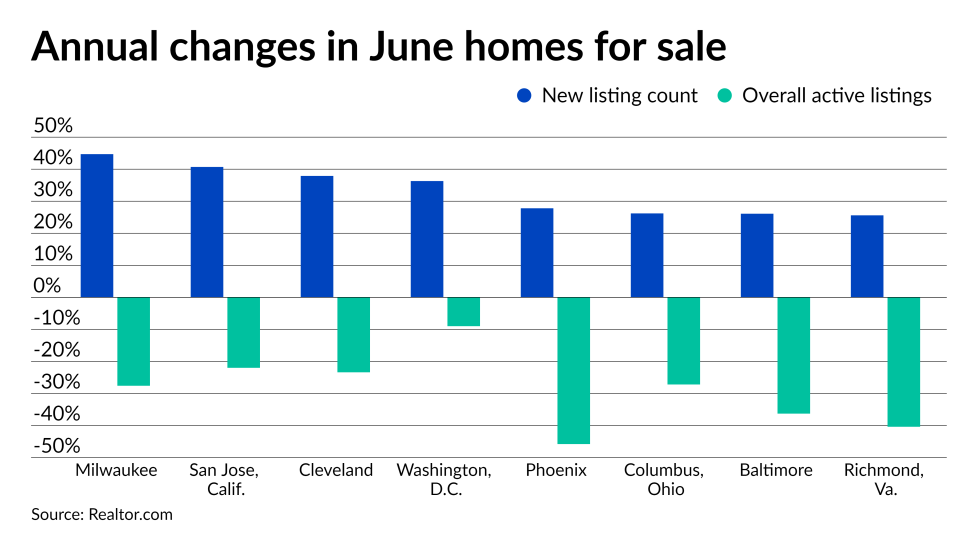

June sees slight improvement in housing inventory

New listings jumped 10.9% month-over-month and 5.5% year-over-year. While the overall supply of homes for sale stood 43.1% lower than June 2020, it rose from May’s inventory, which was 50.9% lower from the year before. In spite of the still significant lack of homes for sale, June’s data bodes well for home buyers, according to

Read

What housing bubble? Price growth driven by fundamentals, analysts say

"To me a bubble would be prices moving really apart and adrift from fundamentals and everything I've talked about here really is a fundamental story — that we have strong demand from an improving economy, very favorable demographics as

Backing that up, he said, was data from Moody's regarding short-term home purchasers, also known as flippers. Back in 2005, 20% of buyers owned the property for one year or less.

Currently, the number is down to about 7%.

Read the

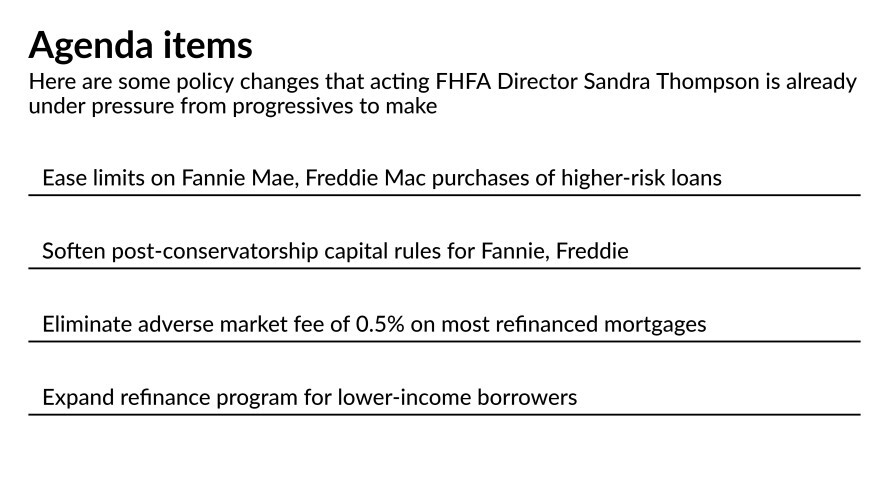

What is FHFA's next move?

Acting FHFA Director Sandra Thompson — who was appointed by the Biden administration to run the agency last Wednesday after

“I do hope there's a chance for course correction with new leadership,” said Doug Ryan, a senior fellow at Prosperity Now, a nonprofit consumer advocacy group. “I think there's an opportunity for this to support the larger housing goals of the Biden administration.”

Read the