Sink or swim

For all the progress, whether in terms of the elimination of paper at various steps or the ability to accelerate certain aspects of the process, the mortgage industry has barely made a dent in terms of reducing closing times. One reason for that, many mortgage professionals say, is due to a logjam that exists specifically at the point of the appraisal.

"You look at other aspects of the loan process, or any other industry in the world pretty much, and technology has had a big impact. You

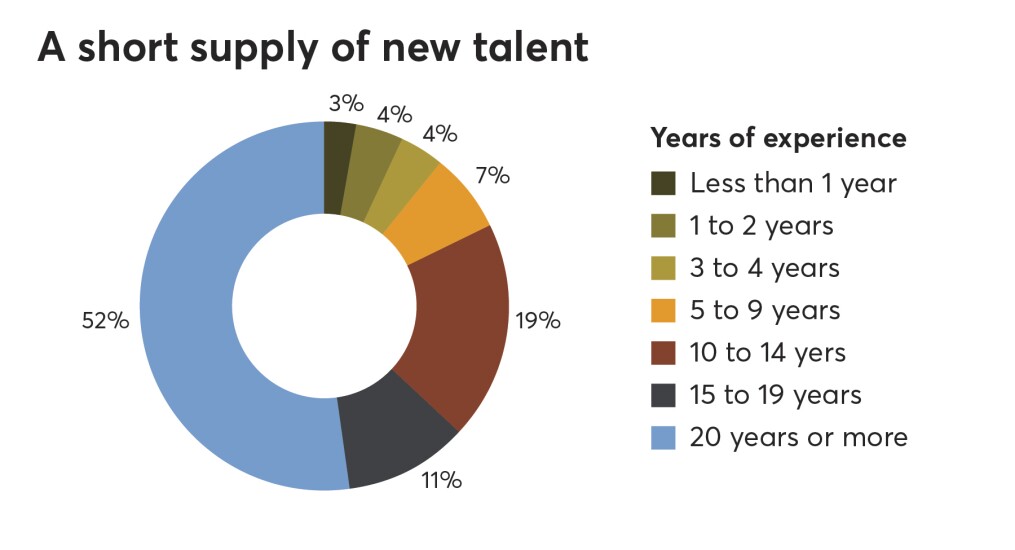

Now, with advances in data and analytics altering the landscape, the stage may be set for that to change in a way that sets man against machine in a manner that tilts inexorably toward the latter. Of course, predictions of the demise of the appraisal industry are not new. The number of people employed as appraisers has been declining for years and the role is attracting few new entrants in the workforce, a trend that some see as self-reinforcing.

"I hate to say it but it's almost worse than trying to hire a teller at a bank; it's not the first career choice for most people," said Teresa Blake, managing director of business optimization at KPMG.

"Part of me feels bad that they're not able to bring in the next generation of talent. But the other part of me says what this signals is a generational shift — when all of a sudden people are going to wake up and realize, 'you know what, my profession is dying.' And that's maybe a horrible thing to say. But I think we're going to get to a point where very few properties require an appraisal," she said.

The decline in appraiser ranks only exacerbates the view of the appraisal as a closing-time pain point — with fewer people available to deliver appraisals, delays become more likely.

End of an era

In that second model, what's in store for the market isn't so much an elimination of an industry, but a more hybrid approach, marrying human and technology. This theory suggests the future appraiser looks a little less like a robot, and more like a person sitting at a desk behind a screen.

Regardless of which (if either) path emerges as the dominant one, many agree that something has to give for reasons that have as much to do with demographics as they have to do with efficiency. As noted, generational shifts have put pressure on the business.

In the 10-year period between 2007 and 2017, the volume of licensed appraisals plunged 32.5%, with figures expected to climb down further, according to Valligent data. On average, over half of those appraisers have been in the business for more than 20 years.

This is happening at a time when lenders feel intense pressure to streamline their processes in part — and somewhat ironically — due to a lack of volume. Mortgage lenders want to capture as much volume as possible and to complete that business faster. Customer retention and acquisition remain top of mind, as well as keeping down costs to protect razor-thin margins.

While some go so far as saying the mortgage process has the potential to see closing times fall to just

"Just getting a time scheduled where the appraiser can get out to the property is a pain. And candidly, it's a pain in the ass. The borrowers get frustrated and then the lenders get frustrated," said Blake.

"It's this vicious cycle — and then the appraisal comes back and the appraiser missed a third-floor bedroom or there's a mistake on the report, it has to go back for correction. Nobody likes that. It's this horribly painful practice only to find out the home isn't worth what you thought it was."

Man vs. machine

"[Fannie Mae] will tell you, if a house sells, they get the data like seven or eight different times. So they know the accurate data of all these homes," said Claudia Mobilia, senior vice president of operations at Embrace Home Loans.

"Somebody's going to come out with an automated model that's going to have required property inspection, or maybe the appraisal is going to be done at a desk. I don't think we're going to see appraisers traveling around the marketplace. There's not enough people in the industry to support it anymore."

Appraisers counter that their value lies in their understanding of the market and expertise on components specific to a particular property that data, drone footage and

"When you start to get into more unique types of properties, or properties with lots of different features, rural properties, and so forth, then some of these other real estate products are going to be, maybe not even possible in some cases, so you're absolutely going to need an appraiser," said Appraisal Institute President Steven Wagner.

Others with ties to the appraisal industry acknowledge a lag in the adoption of innovation, but see a path forward where innovation empowers human assessment capabilities.

Anow is an appraisal management software company that helps facilitate scheduling by pinging appraisers within a certain radius of a property to conduct a valuation, not unlike how a ride-sharing application might work. It allows users to capture and upload photos and navigate each step of an appraisal through its mobile application. This lends itself to the theory that technology won't so much eliminate appraisers, but evolve and streamline their workflow.

"It's about putting tools in appraisers' hands and making them hyper-efficient. We have an Uber-like experience now where you can order an inspection, you can have someone right away and watch them drive to your door. They use our data collection tools to fill all that out and send it off before they even leave the property," said Anow's CEO, Marty Haldane.

"The difference of that to what exists today is you order an appraisal, wait for an appraisal company to accept it and call the homeowner to schedule it. Show up with pen and paper, go back, write the report, send it off. That's why in many areas we're talking about 10-plus business days to get an appraisal done, and I think that's where we really need to augment appraisers," he continued.

Room for error

According to data from Quicken Loans, for example, the gap in April between the home value estimates from appraisers and homeowners took its

One of the very premises of technologies like machine learning is to solve for such equations. These types of tools learn and develop by dissecting individual scenarios and use that knowledge down the line to solve for trickier circumstances. Technological advances could also solve what Mobilia says is a problem under the current system. Unusual properties in atypical circumstances are more costly to appraise, making them less attractive from a business perspective.

"I think that we're facing this reality that our appraiser pool is a little bit shrinking and people don't really like to appraise non-cookie-cutter houses," said Mobilia. "One of the things we're seeing is when you have a unique property, or you have a

"I actually think that artificial intelligence around these unique properties will provide a better appraisal to the consumer than one appraiser's opinion, because I actually feel like those particular customers, when you're not cookie cutter, there's such a wide variation of how the appraiser interprets that home," said Mobilia. "The customer could end up on the bad side of how an appraiser views their unique scenario."

So which model emerges? It's not yet completely clear. It may be true that someone will still need to physically visit a home. Or it may be that real estate agents, property inspectors, and the parties to the transaction can supply all the information needed to process an appraisal. Few argue that the current system will last much longer — but then again, it has proven remarkably resistant to change.

"Appraisals are being done pretty much like I was doing them 30 years ago. It hasn't changed much except for digital cameras and laser measuring devices. But the process is exactly the same," said McCarty.

"We see a lot of appraisals, and some of the appraisals are done by appraisers that have been in the business for a while that were trained very well when they started. Others came along in the last 10 to 15 years that were not trained very well and they just don't know what they don't know. And some of them just don't care that much, others are not aware of what they're doing. And so the resulting quality is a good percentage of appraisals are just not well supported at all," he said.