But that's starting to change, as servicers realize they must do more to improve borrower engagement and retention. For example, only a small share of mortgage borrowers plan on using their same servicer when originating or refinancing their next loan, according to a study by the Mortgage Bankers Association.

Innovating for the borrower was a consistent theme during the MBA's 2019 Mortgage Servicing Conference in Orlando, Fla., this week. Whether through greater investments in technology and talent, or streamlining back-end processes to improve the consistency and speed of the decision-making process, servicers are doing more to prioritize borrowers in their businesses.

Here's a look at seven ways borrower-focused initiatives are reshaping mortgage servicing, according to conference speakers and industry professionals attending the MBA Servicing Conference.

OK servicers, now let's get in formation

Of particular concern is Federal Housing Administration requirements, which differ greatly from those of Fannie Mae and Freddie Mac. A more consistent approach to tasks like loan modifications and foreclosures will make it easier for servicers to help distressed borrowers, he added.

"Adopting a unified foreclosure timeline would make FHA servicing far more efficient and effective, while still holding servicers accountable for minimizing taxpayer exposure," Broeksmit said. "And while a direct conveyance model may be far in the future, we can still make the process better for consumers and lenders along the way."

FHA Commissioner Brian Montgomery has previously said improvements like servicing alignment are coming as part of the Trump administration's overall deregulation efforts, adding late last year that the

Broeksmit, who

"We need you with us, connecting with and educating a new Congress, working with regulators in reshaping policies, reminding them of our shared goal and our shared responsibility of helping borrowers," he said.

All about the borrower

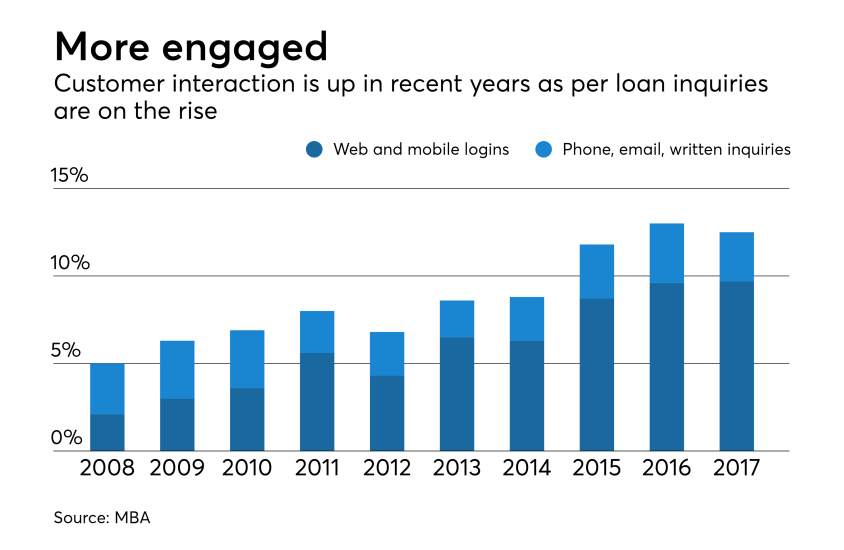

While customer retention for servicers may be down, consumer interaction is growing. Web and mobile logins, as well as calls and other forms of outreach per loan are on the rise in recent years, providing more opportunities for servicers to get in front of borrowers.

Servicers can leverage growth in consumer touch points to offer assistance, education and even cross-sell products, which will hopefully help grow the mere 17% share of consumers who return to their same servicer for another loan, according to the MBA.

Setting the table

What's more, as regulators continue to scrutinize the effect of loan sales and servicing transfers on borrowers, concerns about privacy and data control continue to present challenges for servicers when trying to get borrowers to sign up for automatic payments — particularly when a loan changes hands.

During a

Any vendor migration requires significant due diligence and cost, the panel acknowledged, but inaction can often be just as risky, the speakers said.

Picky about payments

While auto-pay is the most widely-used payment method for mortgage borrowers, only 28% of them choose that route, followed by paying via a servicer's website in close second. The myriad options that consumers use to pay their mortgages present both a challenge for servicers to offer a variety of choices, but also an opportunity for them to expand and enhance their offerings.

Storm warning

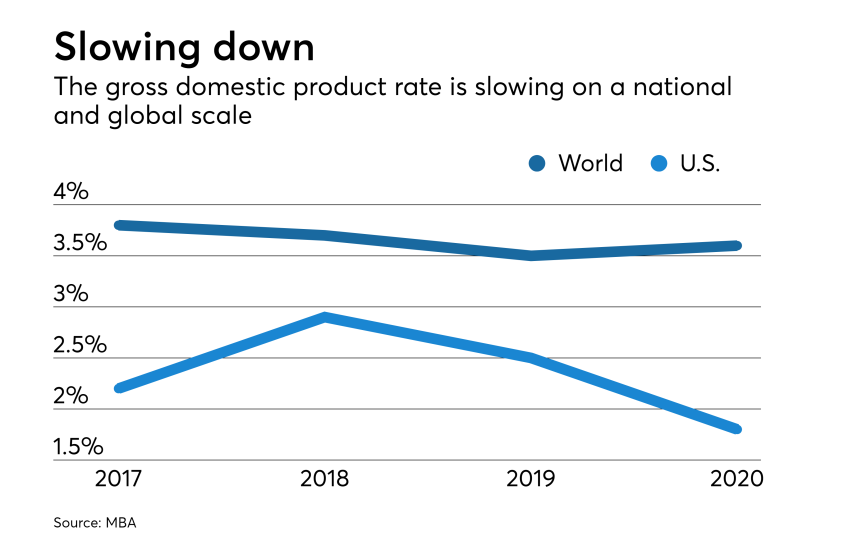

Since the last recession over 10 years ago, many households have paid down their debt and are in better positions financially as both income and home equity have increased.

A slowdown in housing will contribute to a greater potential for a recession, but only affects a small part of the economy compared to consumer spending patterns. The government shutdown also rocked the boat, having caused some stock market volatility, according to Joel Kan, the MBA's associate vice president of economic and industry forecasting.

Freddie set to "reimagine servicing"

The GSE has targeted more than a dozen servicing pain points it plans to address over the next three years, Yvette Gilmore, Freddie Mac vice president of servicer relationship and performance management, told NMN.

For example, Freddie Mac is re-evaluating its data workstream capabilities to assess how it currently obtains data from servicers and how those processes and systems can be improved.

As delinquency and default rates remain incredibly low, now is the time to invest in upgrading loss mitigation and foreclosure processes so the industry is better prepared to handle the next inevitable cyclical downturn, Gilmore said.

Staff support

Just like in originations, where digital mortgage tools are helping loan officers and underwriters spend more time advising borrowers, servicers can leverage technology to make their workers more effective at solving problems, particularly when it comes to loss mitigation.

That means investments in top talent are more crucial than ever. However, the confinement of servicers to mostly the Southwest and California poses numerous hurdles.

The structure of servicing staff to specific geographic hubs is pushing up salaries across the sector, as institutions compete to retain talent. Full-time employment tenure is also on the decline, as workers bounce around in search of better employment opportunities, a recent MBA study found.