A better operating environment for 2019 could further boost these companies. Purchase volume, where the private mortgage insurers generate most of their new insurance written, was underwhelming in 2018 even though this year's home sales prospects are somewhat better. There were 6.12 million home sales in 2017, which fell to 5.98 million last year, according to Freddie Mac. It

But there are some headwinds. At the end of the first quarter, new, tougher, capital standards to do business with Fannie Mae and Freddie Mac go in effect, with the legacy companies feeling the greatest impact.

And government-sponsored enterprise reform, which the future of the MI industry is dependent on, still, as it has for many years, remains a series of concepts and ideas, with no concrete plans in place and none on the horizon.

Here's a look at why the private mortgage insurance industry has a positive outlook for 2019.

PMI will continue to gain share of the home purchase market

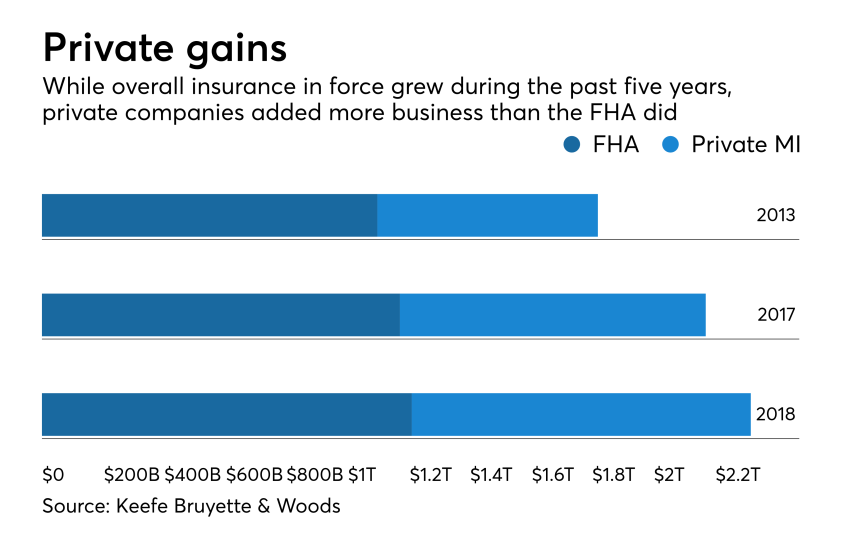

At the end of 2018, total insurance-in-force — from all six private MIs as well as the Federal Housing Administration — was $2.3 trillion, up 1.7% from

On the other hand, mortgage debt outstanding grew by approximately 3% year-over-year as of the end of the third quarter (the most recent available data).

Meanwhile, the FHA's share relative to PMI of the total low down payment credit enhancement continued to shrink. At the end of the year, 52% of the total insurance in force was held by the FHA, with the six active and three run-off private companies holding the remaining 48%, according to KBW. This is a change from five years ago when the FHA dominated, with a 60% share to private MI's 40%.

"We believe that private MI growth will continue to remain strong in the near to medium term driven by sustained high penetration in the purchase market led by a growing demographic of first-time home buyers using GSE loans," the KBW report written by analysts Bose George, Thomas McJoynt-Griffith and Eric Hagen said. "Despite a decline in interest rates late in 4Q18, persistency remained elevated in the period and we do not expect much of a decline unless rates drop further. The decrease in premiums by the MIs (effective in June) should result in some market share shift from the FHA. According to the FHA Annual Report from November, nearly 15% of FHA borrowers in 2018 fiscal year had a FICO score of over 720. We believe that with the reduced MI pricing, this cohort should have lower premiums with private mortgage insurance."

KBW estimated that the private MI's insurance-in-force increased by $112 billion last year, while the FHA's rose by just $43 billion.

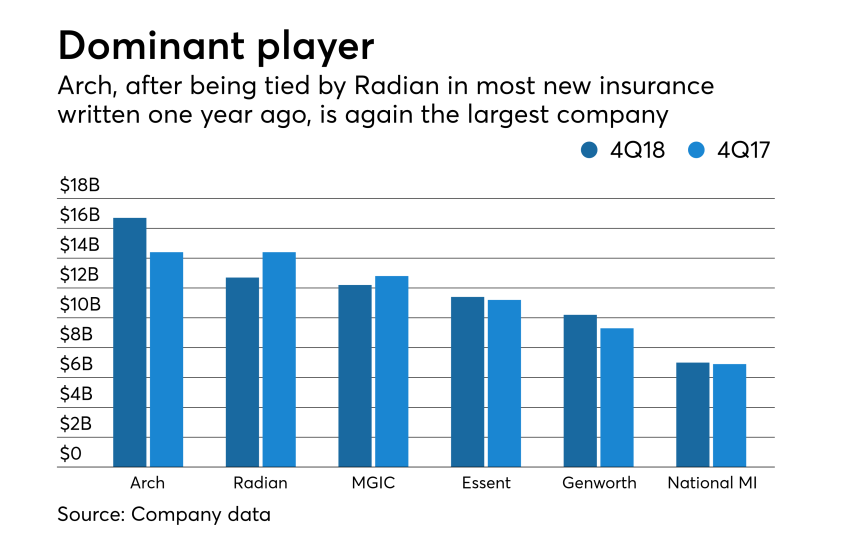

Arch reestablishes itself as the clear No. 1

And for the first time, National MI broke the 10% market share level.

We don't manage our business to share, but we feel really good about our performance," National MI CEO Claudia Merkle said during the company's fourth-quarter conference call. "At the end of the day we sell our differentiated terms of coverage, our service, we've got very strong sales relationships with our lenders. But our performance in the fourth quarter was all organic. It was not in activating with any other customers besides new customers and doing business with our existing customers to grow share." Arch's strength was seen in the year-over-year NIW numbers, as it was the only company to show significant growth, while the three other legacy firms did less business.

Arch generated $16.7 billion of NIW in the fourth quarter, up from $14.4 billion one year prior.

But Radian, while writing a record amount of new flow business for the full year, saw its fourth-quarter NIW drop to $12.7 billion from $14.4 billion one year prior. MGIC fell to $12.8 billion from $12.2 billion. Genworth slipped to $9.3 billion from $10.2 billion; however, Genworth's share has trended down since its parent company agreed to be

Essent had a slight gain in NIW to $11.4 billion from $11.2 billion. National MI also had a small increase to $7 billion from $6.9 billion.

Arch not the only company using granular pricing

MGIC

National MI

"So it was a very smooth process and I think that was another reason why we're seeing such adoption and continued success. But really at the core of it, this is activating new customers and building share within each of those customers, selling our value proposition and our service and our certainty of coverage it's resonating with our lenders."

Even in a not-so-great purchase market, the MIs will do well

"GSE reform will be in the headlines with the new FHFA commissioner, Mark Calabria, confirmed in 2019. While his past rhetoric has been anti-GSE, we expect a status quo approach, given market volatility and the 2020 election cycle. At the same time, the recent FHA audit implies that this market will seed share to private MIs in 2019-2020."

PMIERs 2.0 will be a non-event for the MIs

Essent's cushion was $362 million at the end of the quarter. It didn't provide a PMIERs 2.0 number, but it's likely the cushion would be little changed if not higher, for the same reason as National MI, it does not have any boom era loans in its portfolio.

As of December 2018, Arch MI's PMIERs sufficiency ratio was 141% of the GSE capital requirements. Other than saying the unit's sufficiency ratio also exceeded the PMIERs 2.0 revisions, Arch did not provide any other data or give a dollar amount.

Genworth had a cushion of over $750 million under the existing PMIERs, and if the PMIERs 2.0 calculation were used, the cushion was over $550 million.

MGIC's cushion under the new PMIERs would be $1 billion, approximately $400 million lower than the cushion under the existing standard.

Radian's cushion was approximately $567 million, or 19%, over its minimum required assets of approximately $2.9 billion. That would slip to approximately $340 million, or 12%, over its minimum required assets in the pro forma calculation.

Could there be significant M&A activity

Meanwhile, slowly but surely, Genworth Financial's acquisition by China Oceanwide is nearing the finish line, although the deadline keeps getting extended.

Now Radian Group

Radian itself