"The

His counterpart at the No. 2 company, First American Financial, was also optimistic about the prospects for the housing market.

"We are encouraged by April's open order trend, with purchase orders down 2% and refinance up 29% compared with last year, which is an improvement over the past three quarters," said CEO Dennis Gilmore in a press release. "In addition, we expect continued strong performance in our commercial business."

Here are the earnings reports for the four national title insurance underwriters along with two other businesses heavily dependent on mortgage volume.

Building momentum

Pretax earnings from its title business grew to $292 million from $163 million in the first quarter of 2018, while total revenue increased slightly, to $1.7 billion from $1.6 billion.

Direct orders opened totaled 438,000 for the period (65% for home purchases), down from 478,000 (66% for home purchases) one year prior.

"The 11.3% adjusted pretax title margin was only a 40-basis-point, or 3%, decline from the first quarter of 2018, despite a 16% decrease in direct orders closed, comprised of a 9% decline in purchase orders closed, a 21% decline in refinance orders closed and a 5% decline in total commercial orders closed," said Foley.

"We remain optimistic that the strong economy, stable or declining mortgage rates, slower home price appreciation and the possibility of increased residential supply will also provide the backdrop for a restart of the strength in the residential purchase market as we move into the seasonally stronger spring and summer months."

Fidelity is still pursuing its pending acquisition of Stewart Information Services, filing a new application with the New York Department of Financial Services. The NYDFS

Stuck in limbo

Revenue in the title business was down 11% year-over-year to $376.1 million from $422.4 million. There was a pretax loss of $400,000 for the period compared with pretax income of $5.1 million.

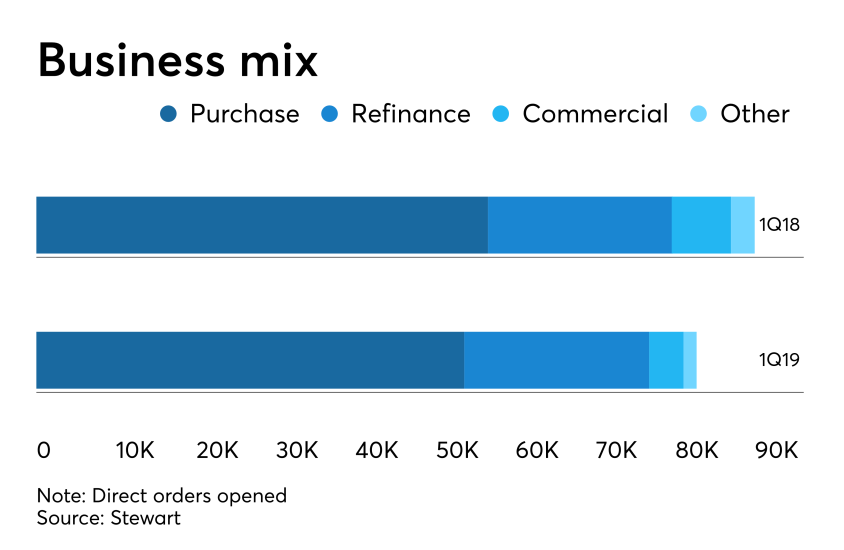

There were 82,820 total orders opened compared with 90,075 for the first quarter of 2018. Purchase business was 53,547 down from 56,491, while refinance was 23,184, a slight gain from the 23,132 opened in the first quarter of 2017.

"In addition to preparing for the spring selling season, we continue to work through the ongoing regulatory approval process for our merger with Fidelity National," said CEO Matthew Morris in a press release. "I remain thankful for the support and professionalism of our associates during the transaction process."

Managing expenses

Total revenue was $1.3 billion for the first quarter in both 2019 and 2018; the title insurance business had $1.2 billion in revenue for both periods.

"The company performed well in the first quarter despite ongoing challenges in the housing market that began in the second half of last year," Gilmore said. "Our strong performance was driven by effective expense management and growth in our investment income that helped us achieve a 12.1% pretax title margin, or 10% excluding net realized investment gains."

Open orders for the first quarter were 227,800, down from 253,500 one year prior. Pretax income for the title insurance segment was $142 million, up from $102.4 million one year ago.

Claims costs rise

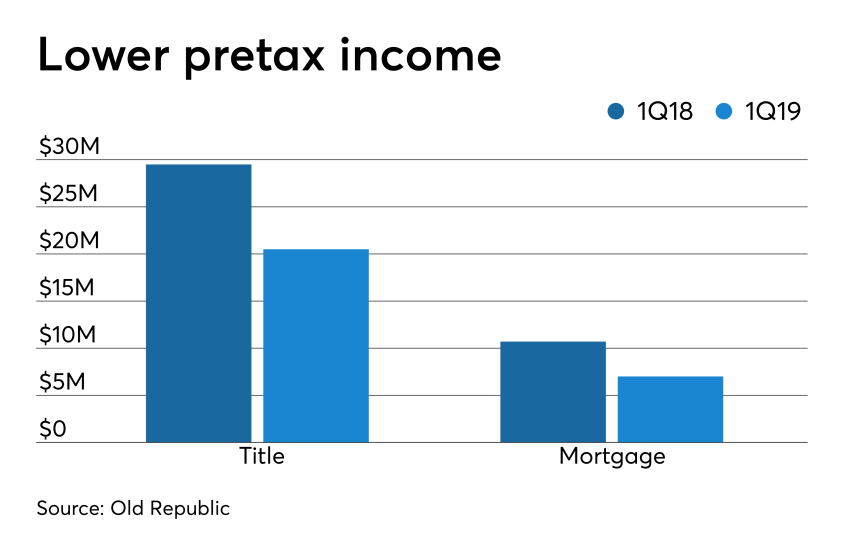

But its claims costs rose 11.9% to $14.4 million from $12.9 million, "as favorable development of prior years' claim reserve estimates edged down," the company's earnings release said.

Meanwhile, its mortgage insurance business, which remains in run-off status, had pretax operating income of $7 million, down from $10.7 million one year prior. This was attributed to the decline in risk-in-force as loans exit the book of business.

Unlike the other title underwriters, Old Republic also has a general insurance segment, which contributed $108.3 million of pretax income in the first quarter, up 30% year-over-year.

Old Republic had net income of $412.2 million in the first quarter, up from $4 million one year ago.

Transformation hurts bottom line

"CoreLogic is off to a strong start in 2019. We delivered solid financial results highlighted by adjusted EBITDA above our expected range, despite significant mortgage market headwinds," Frank Martell, president and CEO of CoreLogic, said in a press release. "We also reduced our run-rate costs significantly and drove productivity. In addition, we pressed forward with our AMC transformation and the exit of noncore mortgage and default technology units."

First-quarter revenue totaled $418 million, down 6% from 2018, with the drop due to U.S. mortgage market activity, appraisal management company volumes and the wind-down of noncore mortgage and default technology related platforms. This was partially offset by acquisitions made last year.

By segment, property intelligence and risk management solutions revenue rose 1% compared with the first quarter of 2018 to $176 million. Underwriting and workflow solutions revenue totaled $245 million, down 11% from 2018 levels.

Streamlined organization

The company

"I'm pleased with our solid first-quarter performance," said CEO William Shapiro in a press release. "Operationally, we have streamlined our organization, are focusing on our larger opportunities, and seeing the results through our financial performance. First-quarter 2019 adjusted operating income was 10% higher than the first quarter of 2018 and marks the third straight quarter of adjusted operating income growth compared to the same quarter in the prior year."