Not only has advancing increased, but housing-finance businesses have faced additional liquidity strains elsewhere. In particular, with MSR and nonagency loan values dropping, housing-finance businesses' access to additional liquidity has declined. Also, in some cases, mortgage companies have been subject to margin calls.

Some companies may be getting sufficient liquidity from traditional sources, but others aren't, and in either case they may want to prepare for the possibility of additional loan performance stress down the road by supplementing existing sources of cash.

"Nonbank mortgage companies want to put in place not only what they need today but what they think they may need in a stressed scenario over the next 6-12 months in case forbearance options and delinquency levels rise even further," said Warren Kornfeld, a senior vice president in Moody's Investors Service's financial institutions group, and the author of a recent quarterly report on the sector.

From strategies accessible to players of all sizes to a new innovation in advance financing that may appeal to larger companies, here's the rundown on five ways mortgage servicers may be able to maintain liquidity, and some of the pros and cons of each.

Ginnie Mae's PTAP program

It's an important backstop and an option for smaller players in the government market that otherwise might have nowhere else to turn.

But as it's description as a "last resort" suggests, Ginnie's program is not the most attractive from a cost perspective and sets some restrictions on users, such as limits on executive compensation. It also could affect other counterparties' willingness to lend.

While issuers aren't formally required to use PTAP financing only when all other options are exhausted, it may be best to consider it in that context.

"If you are in a position to somehow finance these advances either through cash, other operations or otherwise, you should do that instead," said Michael McElroy, a partner in Mayer Brown's banking and finance practice.

MSR financing

"Only a handful of lenders that lend in the MSR financing market are active right now," Kornfeld said.

MSR sales

"The deals that we do see where lenders want to trade or sell their assets, these typically are lenders who have a liquidity event or issue that they need to solve for and in that case, selling assets even at a 'depressed price' is something that they've figured out they've got to do," said Allen Price, senior vice president at servicer BSI Financial Services.

Like the PTAP program, MSR sales may be a "last resort" option for liquidity.

"If you don't need to sell mortgage servicing rights, you don't need the liquidity and you can afford to hold onto your assets, then that's what you'll do," he said.

While overall market conditions are challenging for servicing, there are some fluctuations that may be worth noting in decisions about whether or when to sell.

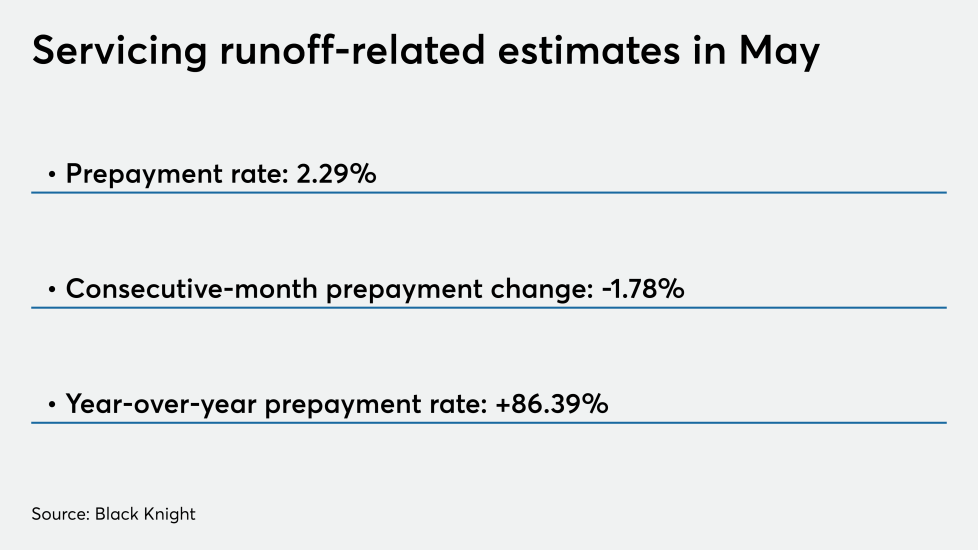

For example, May estimates from Black Knight suggest that prepayments have slowed slightly month-over-month even though they are still historically high.

Breaks from the FHFA and GSEs

From coronavirus-related relief applied to mortgage companies'

"This is the agencies saying, 'We recognize that there's disruption. We get it and while we're not trying to cover your entire expense, here’s something that will help,'" said Price.

MSR securitizations

"I wouldn't overstate this, but there certainly has been a little more interest in this kind of transaction because of the environment today," said Jack Kahan, head of Kroll Bond Rating Agency's residential mortgage-backed securities group.

In the universe KBRA rates using its methodology, these rated transactions seem to be most economically beneficial for larger nonbank mortgage companies with low-end investment-grade or high-end speculative-grade ratings, Kahan said.

An increased willingness by Fannie Mae and Freddie Mac in recent years to tweak the acknowledgement agreement defining the extent of the servicer and the servicer's lenders' rights to the MSRs has helped pave the way for these transactions, said Lenny Giltman, a senior managing director at KBRA.

Advancing financing

Now that advance rates are higher, companies are giving a lot of thought to using private facilities to specifically fund advances again, particularly in the Ginnie Mae market.

"What some companies are looking for is the ability to finance the Ginnie Mae MSRs themselves and the advances separately," said Eric Edwardson, a partner in Mayer Brown's consumer financial group.

For example, PennyMac in April announced that it was recently able to establish an offshoot of an existing MSR securitization facility for this purpose. As a company that primarily originates and services Ginnie Mae loans, which have higher than average delinquencies, it was pursuing advance-financing even before the coronavirus spread. The innovation proved to be timely and opened the door to a contractual adjustment at Ginnie that the government agency said could potentially be used to facilitate similar arrangements by others.

With the extent and duration of loan performance issues still uncertain, it's difficult to gauge how interested market participants will be in developing these facilities; but if problems with distressed loans increase, these types of facilities could, too.

While such facilities are beyond the reach of smaller players and represent a cost that may only look attractive once traditional warehouse and MSR financing is maxed out, they are an option for larger companies.

"What you'd like to see a company do is max out as much as they can on their [traditional warehouse line] repo facilities then, after that, max out as much on their servicer advance facilities," Kornfeld said.