With new single-family home inventory a bright spot in the consumer real estate market, lending against the construction of new homes offers one of the few ways to expand.

It's an area nonbanks have traditionally ceded to depositories because of the latter's advantages in risk management and capital access. Now, that situation is starting to change.

For nonbank lenders to gain traction in this part of the market, they will need more than just a real estate development tailwind to make it happen. Factors that will come into play range from those that any mortgage lender would be familiar with (think scale and liquidity here) to those with which many have little experience (think specialized underwriting, risk management and even marketing here).

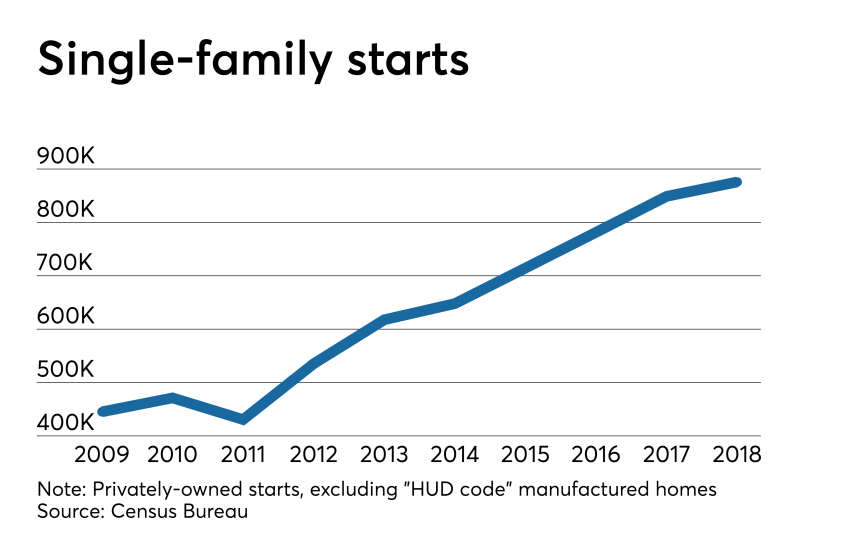

To be sure, there is a strong tailwind. At 1.25 million in 2018, production of total, privately owned housing starts have more than doubled since hitting a post-crisis low in 2009, according to the Census Bureau. Single-family housing starts account for more than half of that total and also have grown.

And at a time when the supply of existing homes for sale remains tight (despite a one-month pop in February, the trend has consistently weak) an estimated 200,000-300,000 entry-level housing units would be needed annually to keep up with demand, according to Fannie Mae Chief Economist Doug Duncan.

"It's the entry-level where there's a real supply issue," Duncan said. "From a purchase perspective, whatever the builders can build that's affordable, will sell."

Forays by some nonbanks show that it is possible for these lenders to compete, and initiatives by a handful of government agencies may soon provide more ways for would-be participants to overcome capital and liquidity challenges.

Key to how this all plays out, industry participants say, will be whether and how actively buyers of mortgages snap up loans that combine the traditional bridge- and mortgage-loan into a single transaction known as a one-time close, single-close or construction-to-perm loan.

Here are 5 reasons that nonbank mortgage lenders are working to make these loans.

To fill a void new homebuyers are facing

"In many of the markets that we're serving right now, there is limited inventory. Also a lot of the inventory in the market is dated, and we have a new generation of homebuyers that is just not interested in rehabbing a property, or can't get themselves to a place where they can rehab a property," he said. "So we started bolting on the single-close construction product."

While inventory was the main driver of GSF's decision to provide financing for consumers' home construction, the availability of single-close loans and higher loan-to-value ratio limits that allow consumers to make low down payments were as well. LTVs can be far above what borrowers expect. In the case of U.S. Department of Agriculture loans, for example, it's 100%. It can go into the 90s for some of the other loans nonbanks sell to major investors, Jampedro said.

"While, with typical construction lending, you have a bridge loan that rolls into a permanent loan, a one-time close is a more efficient transaction where the borrower is not carrying two house payments. That's important because typically a first-time buyer in particular may have a difficult time managing cash-flow," Jampedro said.

In addition to helping borrowers' manage their cash-flow, the single-close loan also helps lenders offer what can be an attractive alternative to other types of lenders' construction loan products.

"With a more modernized offering, a credit union today, for example, might modify or convert the permanent loan for a small fee such as $500. But with a single-close loan, there is no conversion from the bridge loan to the perm loan one time. It's one-time only. If something happens during the course of a build, it can be a challenge to get into the permanent loan. If you're closing one time, you're saying, 'I don't have to revisit this again.' It eliminates the potential that the loan will not be converted to a permanent one."

But risks that something will go awry with construction, and lenders will be on the hook for it, do exist. GSF addresses these by monitoring its builder counterparties closely with regular reviews and communication.

"As a company we go through builder eligibility. They must have a history of being a builder, paying their bills, and so on and so forth. They need to have agency eligibility, which requires, for example, that the borrower can do none of the work on the property, which makes sense to me."

After initially working with various builders and other lenders as partners to introduce consumer construction lending, GSF eventually found it was a risk best controlled and addressed in-house, with some use of a third-party technology system to process builder draws on the construction portion of the loan, and recruitment of experienced construction lending professionals, Jampedro said.

Because product evolution looks promising

The USDA has tested and Fannie Mae has contemplated offering a single-close loan that can be sold into a securitization immediately during the construction period. But to date it's generally the lender that must hold the construction loan until it converts into a permanent loan.

"In the VA's program, the FHA's program and Fannie's program, there is a construction phase with one particular payment due during construction, and then you have a permanent phase where the house is completed, and the note is modified into the permanent loan. Because you can't collect full principal and interest payments during the construction phase on those programs, they can't be pooled and securitized until the house is completed and the note is modified to the permanent terms," said Rudy Marquez, a managing director in the construction lending at GSF Mortgage.

"That's where USDA's program was unique and really interesting," he said. "There has been some discussion from Fannie of taking that concept and seeing if they could develop a similar program which would make the loan salable immediately."

With this kind of momentum behind them, construction-to-perm loans have become the largest growing segment of GSF's offerings in recent years. And with additional wholesale channel distribution the company is test marketing as well as expansion in the correspondent channel, the company is expecting as much as 50% year-over-year growth in 2019, according to Jampedro.

To respond to mortgage broker requests

"We've got a tremendous amount of people who have contacted us and are interested in originating the product," said Leinan.

Plaza introduced the Fannie Mae product to its brokers in April, and is considering expanding into loans offered by other government agencies down the road. Its correspondent unit also will buy construction-to-perm loans after their conversion to permanent financing.

Construction-to-perm loans remain one of the relatively few product segments with growth prospects, he said. Wholesalers are under increasing pressure to offer construction loans, but not every wholesaler wants to, he added. "There is demand there, but many wholesale lenders are established today to build a scalable business and handle more of a generic product set," said Leinan.

Plaza was able to enter the business because it had been active in lending used for rehabilitation or remodeling, and found that expertise was helpful in gearing up to manage loans through the construction process, said Tom Tough, a vice president in Plaza's national renovation lending division.

"There are definitely risks and different types of management associated with both renovation loans and new construction. It does take a certain amount of experience to understand what those additional risks are and manage them," he said.

"A lot of wholesale lenders want to be able to originate a product they can immediately sell on the secondary market, and with these loans, you can't necessarily do that right away. You have to manage through the construction project, and then sell."

That's why the notion of a construction-to-perm loan loans that could be immediately securitized could be a game-changer, were it ever to become more of a reality.

In order to meet a regional need

A densely populated area with older housing stock more likely to need repair might have less demand for construction lending than areas with more available land and new housing.

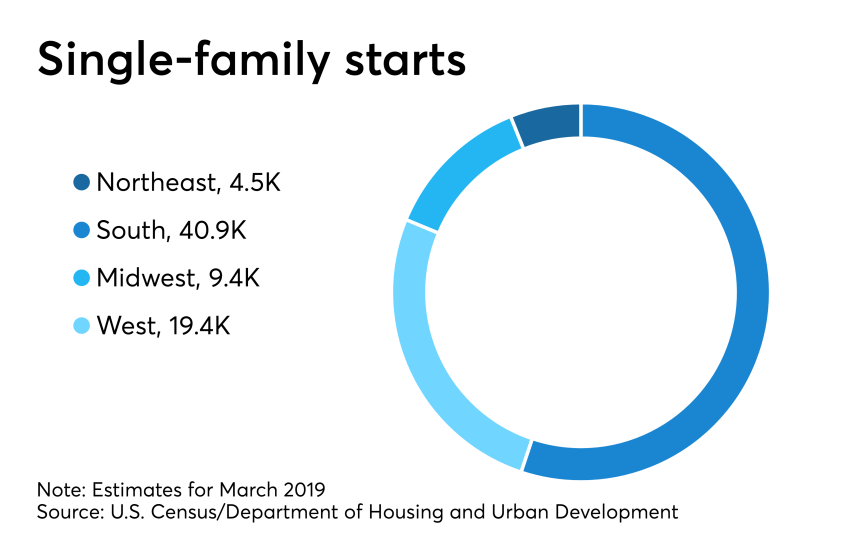

"Areas that are growing like Florida, the West and more rural markets are where we see the demand for the construction-to-permanent loan," said Leinan. "As it is real estate, demand is very specific to each local market."

To lay the groundwork for factory-built homes

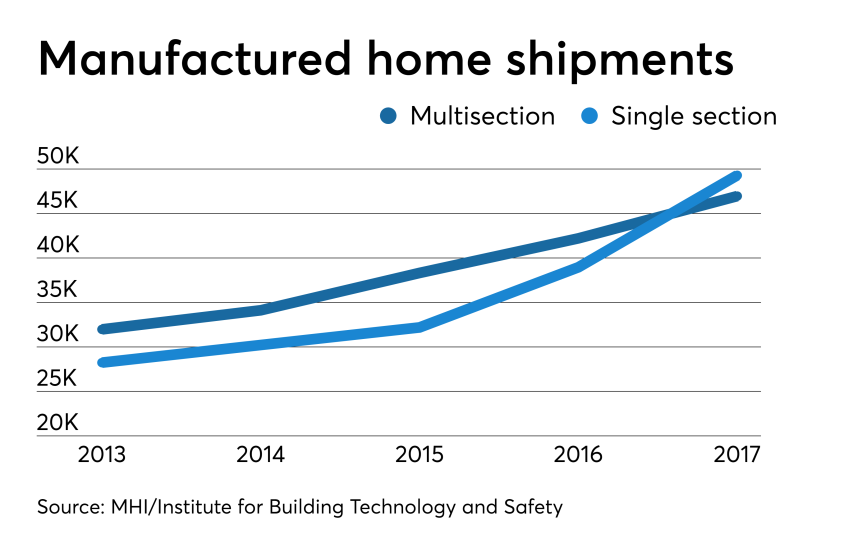

To address this challenge, some lenders are financing construction loans in the manufactured housing or modular home markets, where a confluence of improved structural quality, lower mortgage rates and the inventory speed are fueling growth.

A testament to construction lending's importance in this context is a recent round of debt and equity financing private equity firm LL Funds recently provided to Tammac Holdings, a modular housing and manufactured housing lender in Pennsylvania.

Tammac is using the financing from its new majority owner to fund construction loans, and expects it will go a long way toward helping it expand its loan volume.

"We haven't had the liquidity to offer construction financing and that's very important in our business," Tammac President Jeff Poth said.

Because some borrowers tend to view construction financing as suggesting a higher price point, they may overlook the possibility of getting an affordable factory-built home installed on land titled as real property with construction financing.

It's incumbent on the industry to help buyers understand that there are affordable options in this category of new home, said Laura Brandao, president of American Financial Resources.

Speaking on a recent web seminar hosted by National Mortgage News, Brandao said: "People always think, 'Wow, I'm going to have to put down 30% or I'm going to have to actually have to write a check to a builder with a very large down payment in order for me to even hold that spot.' There's a lot of education that needs to happen."

While construction lending in the factory-built market is specialized, traditional lenders willing to dedicate themselves to long-term can use it to build more small-loan volume, Jed Lowman, new construction division manager at mortgage brokerage ManufacturedHome.Loan, said during the same webinar.

"The process flow for both the LO, the loan originator, and the builder, is very, very similar," Lowman said. "There are just a couple extra requirements for manufactured homes that you don't have for site-built. You need a structural engineer to sign off on it, just those kinds of little things, but it's not apples and oranges. The process is very similar."

For others who want to get involved on a more experimental basis, a partnership approach is best, he said.

"There are really no half measures with these products. You're either an expert or you aren't and you're either doing a lot of them, or it's going to go very poorly," Lowman said.