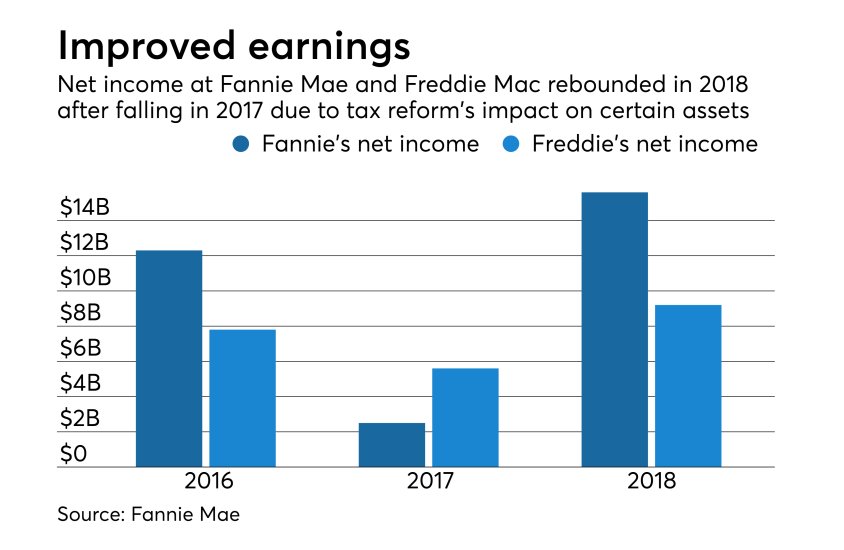

Fannie reported net income of $3.2 billion and net revenue of $5.1 billion for the fourth quarter of 2018, compared with

Freddie, in comparison, had fourth-quarter net income of $1.1 billion, compared with

Here's a look at five questions facing Fannie Mae and Freddie Mac that could change those numbers.

Could the FHFA's proposed capital rule change how its financials look?

While each GSE currently is allowed to hold a $3 billion capital buffer, the rule proposed to prepare for the day when the two companies could be released from conservatorship would target their combined capital at well over $100 billion.

Freddie Mac's conservatorship capital, for example, averaged $56.6 billion in 2018, down 16% from $67.6 billion the year prior, a 16% decrease. This decrease was due to "ongoing appreciation in home prices, our innovative legacy asset dispositions and our leadership in credit risk transfer across both the single-family and multifamily business segments," Freddie Mac CEO Donald Layton said during a media conference call. "I believe that a 16% reduction, which represents significantly less risk to the taxpayer, along with increased profits, is very good performance."

Credit risk transfers reduced the conservatorship capital needed in the single-family business for loans purchased during 2017 by approximately 60%, and the multifamily business by approximately 90%. Freddie Mac calculates that based on loan purchases from the prior year.

The lower risk to the taxpayers is seen in its FHFA stress test results, which measure how much Freddie Mac would need to draw from Treasury in a severely adverse scenario. It is currently $35 billion, down from $93 billion for 2013, when the first stress test was done.

Fannie's calculation for the proposed capital requirement was $89 billion at the end of 2018, down $5 billion from year-end 2017, according to Fannie Mae CFO Celeste Brown. Excluding the deferred tax asset adjustment included in the 2017 number, but not the 2018 number, Fannie's proposed capital requirement would have been down $11 billion.

Under the proposed FHFA rule, the GSEs' capital would be "very sensitive to home prices" in particular, Brown said during a press briefing on the company's earnings.

Home price appreciation could decline to 4% this year from 5.6% last year, according to Fannie. That would put upward pressure on the GSEs' capital requirements, if the rule were to go into effect.

If credit scores were to fall due to the increasingly competitive lending landscape, capital requirements also hypothetically could increase. Adding to the questions in this area are the GSEs' explorations of alternatives to the traditional FICO score within

Can Fannie and Freddie help close the affordable housing gap?

Fannie Mae's plans to "address the significant shortage of affordable housing" and "the supply of homes that are affordable to working and low-income families," will include cautious involvement in areas like manufactured housing, interim CEO Hugh Frater said during the agency's press briefing. Both GSEs are facing mandates to do more in this sector.

Efforts to build, maintain and finance homes "that are fundamentally less costly to the end user" also introduce the possibility that the GSEs will be contending with some new counterparty risks.

The inventory shortage is "not something that Fannie Mae alone can overcome. It will require collaboration," Frater said.

"We are committed to participate, and, where appropriate, lead efforts," he said.

In 2018, Freddie Mac provided $396 billion of liquidity to the housing market. That included funding for over 1.3 million single-family properties, with first-time homebuyers representing 46% of purchase loans.

It also funded nearly 866,000 multifamily rental units, with more than 90% affordable to low- and moderate-income families earning at or below 120% of the area median income, Layton said.

Are dwindling distressed sales likely to reduce GSE profits?

But that could change, Brown warned during the company's press briefing on its earnings.

"While the sale of reperforming and nonperforming loans, and the associated redesignation of these loans from held for investment to held for sale has been an significant driver of income in recent periods, we may see less benefit in 2019 to the extent the population of loans we are considering for sale declines," she said.

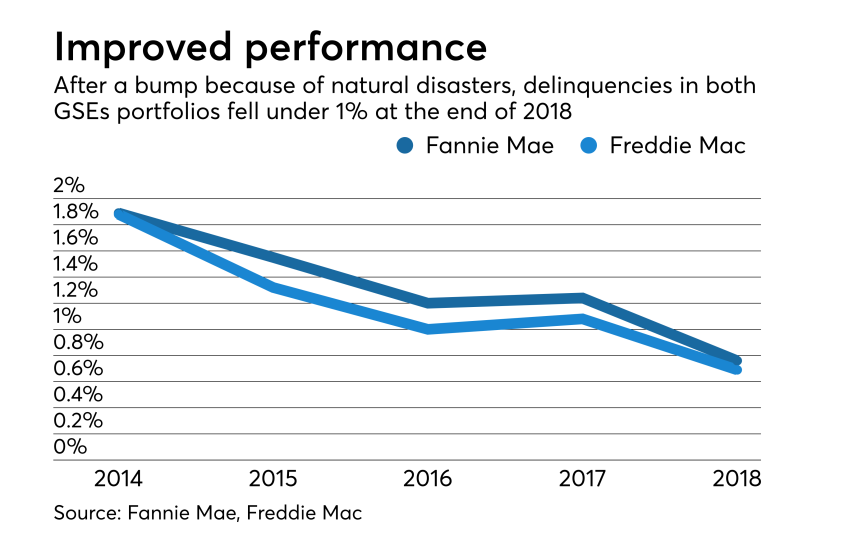

Both GSEs' delinquency rates are shrinking. Fannie's single-family delinquency rate was 76 basis points in its latest earnings, down from 1.24% during the same quarter the previous year, when a particular strong hurricane season inflated the number.

Freddie's single-family portfolio delinquency rate was 69 basis points. Take out relief refinance loans and mortgages originated before 2009, and Freddie's falls to 22 basis points. In 2017, it was 109 basis points. Its multifamily portfolio had just a 1 basis point delinquency rate.

"And these numbers do not give effect to CRT transferring to private markets unexpected and, more recently, expected, losses that would result from these delinquencies," Layton said during the company's press briefing on its results.

Freddie Mae now uses the retained portfolio to support the guarantee business to purchase defaulted loans out of securitizations to facilitate modifications for homeowners and to make good on its guarantee to investors, he said.

How will shifts in the accounting landscape reconfigure results?

The impact of tax reform on their deferred tax assets, for example, put big dents in their fourth quarter earnings last year, and in the future, the

Freddie Mac, for example, been working on models and systems to implement CECL, Layton said in an interview, but it can only do so much until detailed guidance comes out from the Financial Accounting Standards Board along with the accounting industry, which "has mechanisms to turn the accounting principle into specifics and that is not fully complete." When those come out, it will finish all the modeling.

"There will be an increase in reserves probably and then each quarter you'll have more instability of credit risk and loan loss provisions given that it's a full valuation," Layton said. "But both of these would be ameliorated by credit risk transfer to a degree."

Those credit risk transfers would largely offset the need for reserves for multifamily loans, but just modestly offset for single family because of the increase in that business. But over the years he expects the offset for single family loans to grow.

Another change that could lead to change in this area is the use of hedge accounting. Freddie currently employs it, but Fannie has not adopted it yet. This accounting method can smooth out swings in earnings results related to the effect of interest rates on the fair value of assets.

Freddie Mac's "quarterly volatility of income in 2018 was significantly reduced by having hedge accounting in place," Layton said. Still, in the fourth quarter, Freddie took $600 million of market related losses, split nearly equally between interest rate risk and spread risk.

"Fair value gains and losses are dependent on a number of factors including changes in interest rates which are difficult to predict," Brown noted in Fannie's fourth-quarter earnings media call.

For example, although rates generally were higher last year, a surprise drop in the fourth quarter that negatively impacted fair value contributed to lower net income at Fannie during the period than there might otherwise have been.

What will the new Uniform Mortgage-Backed Security mean for the GSEs?

"While there is still testing underway, we expect to begin issuing in June," Frater said.

The change could be for the better. The UMBS was created to resolve differences in Fannie Mae's and Freddie Mac's cash flows and market shares in ways that would improve the performance of the GSEs' MBS. But some