Want unlimited access to top ideas and insights?

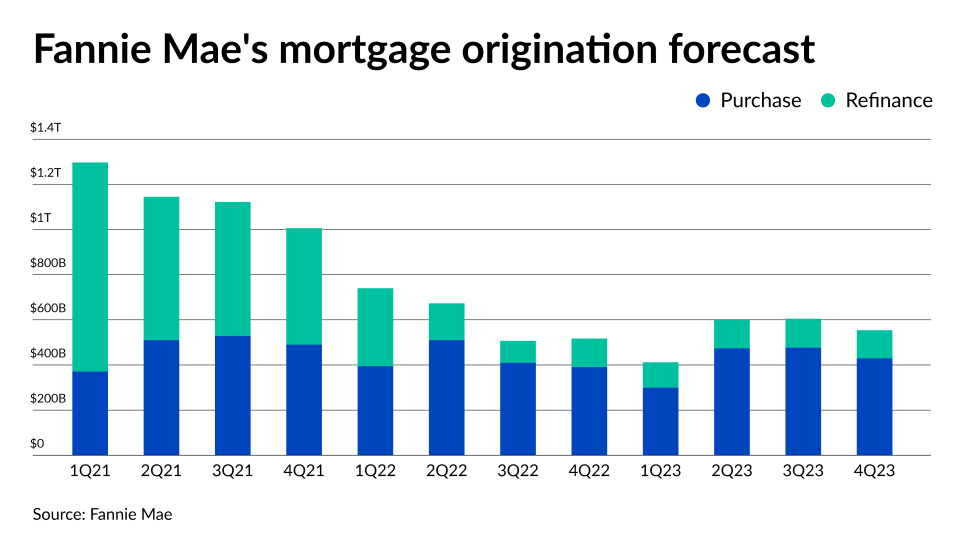

The housing market of 2023 looks very different to the one seen not that long ago, when interest rates hit stunning lows. As buyer and seller behavior shifts in reaction to higher interest rates and sour macroeconomic predictions, mortgage originators are wise to observe carefully and reshuffle their strategies to keep winning business. Below we round up a number of findings that could inform those plans.