Want unlimited access to top ideas and insights?

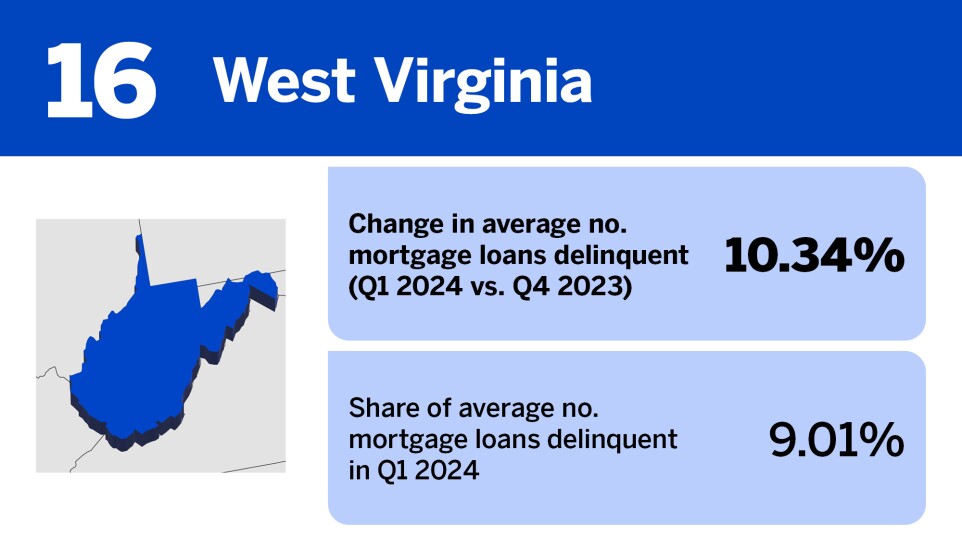

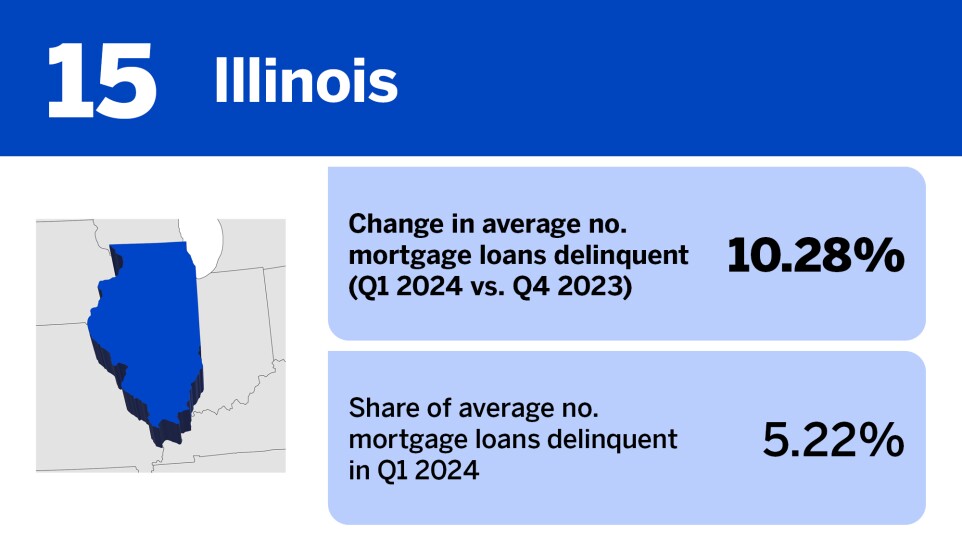

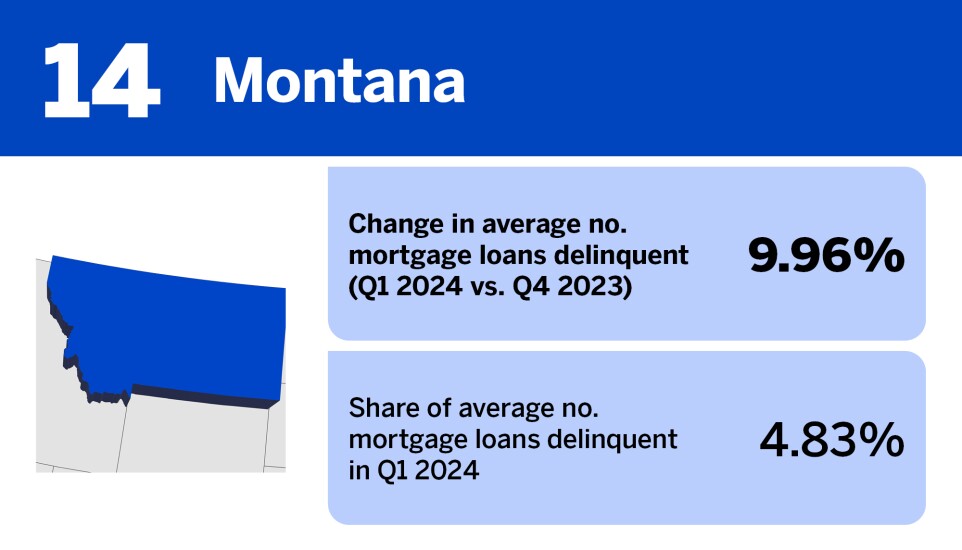

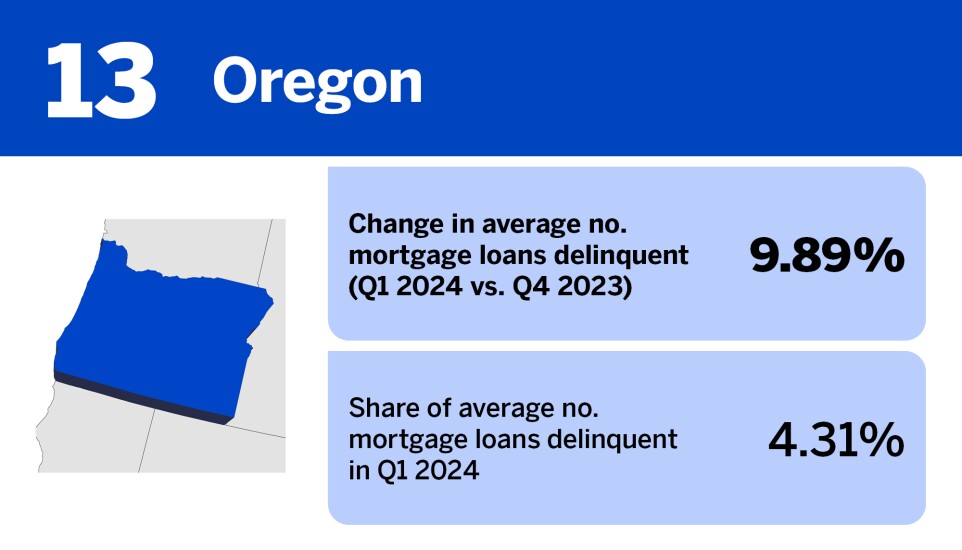

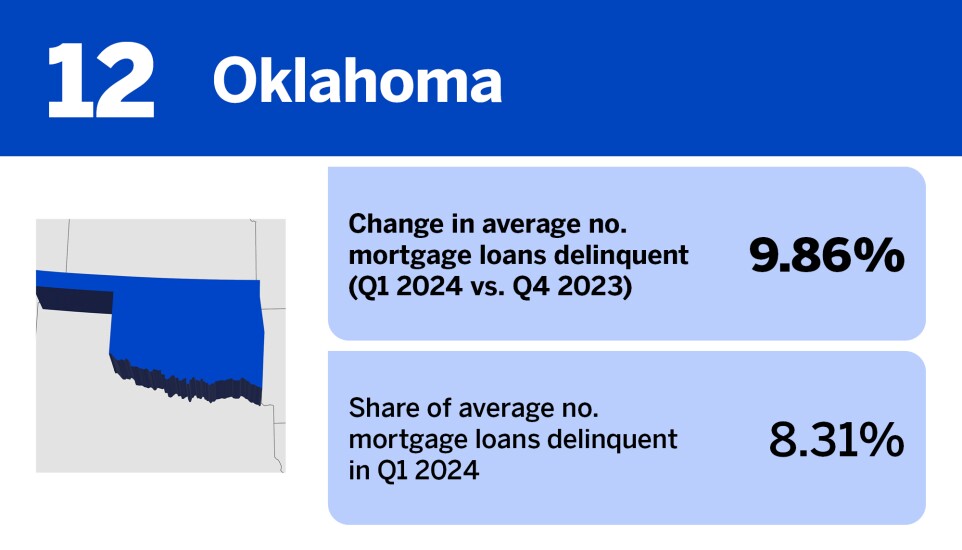

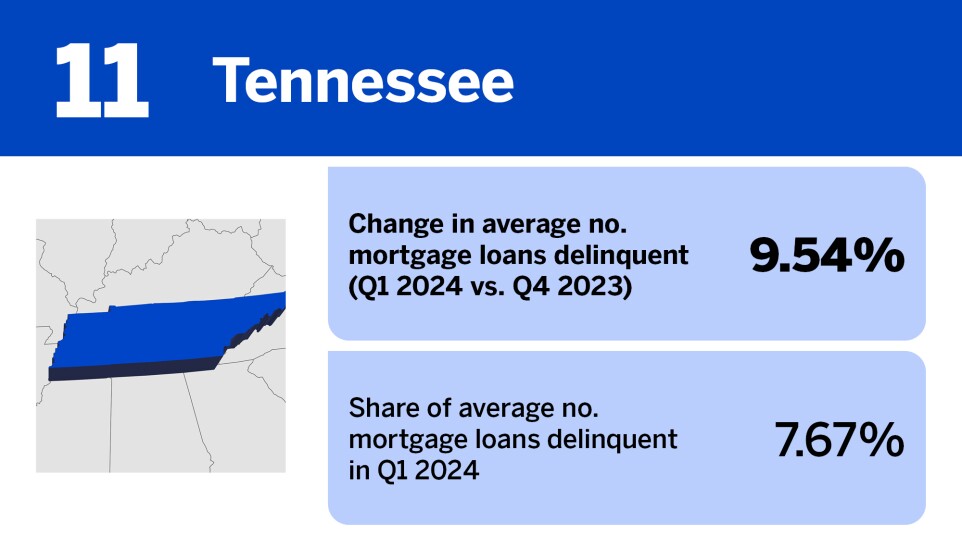

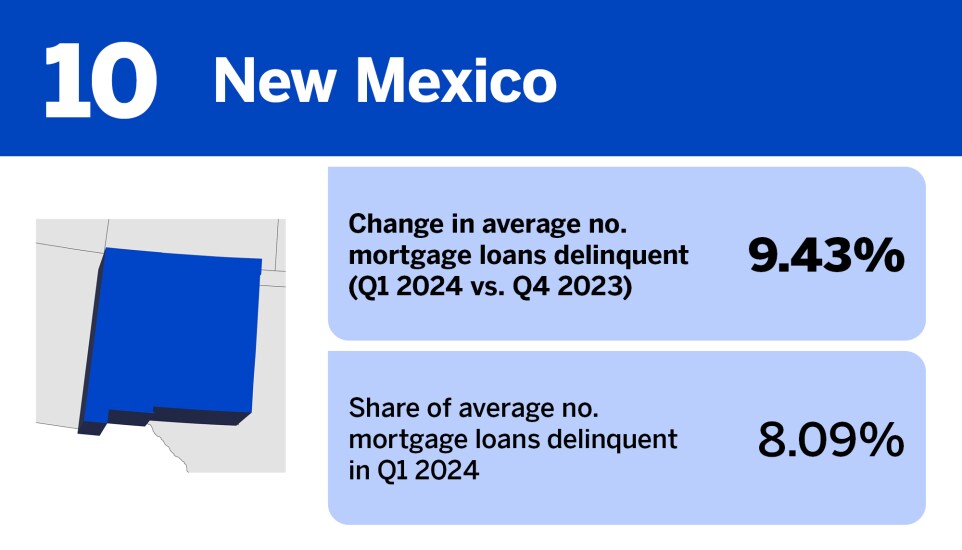

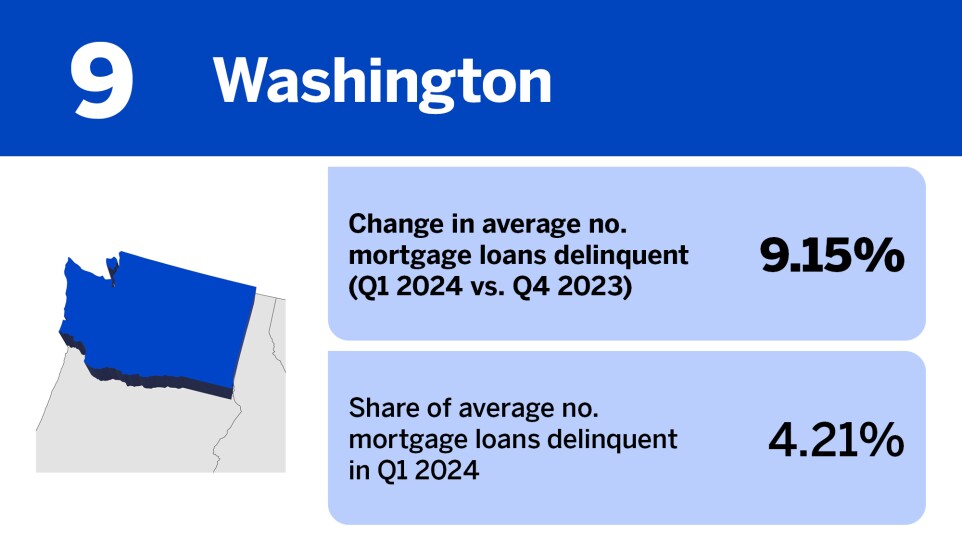

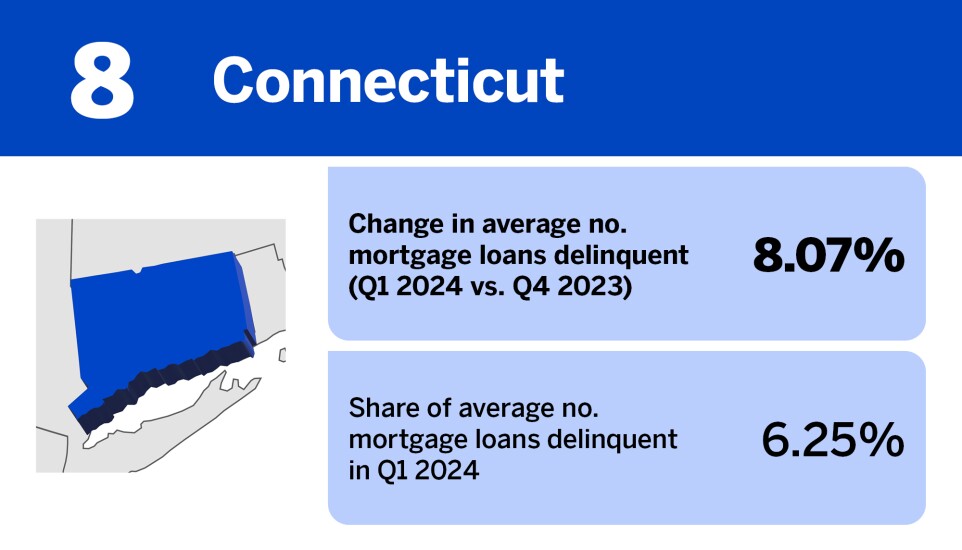

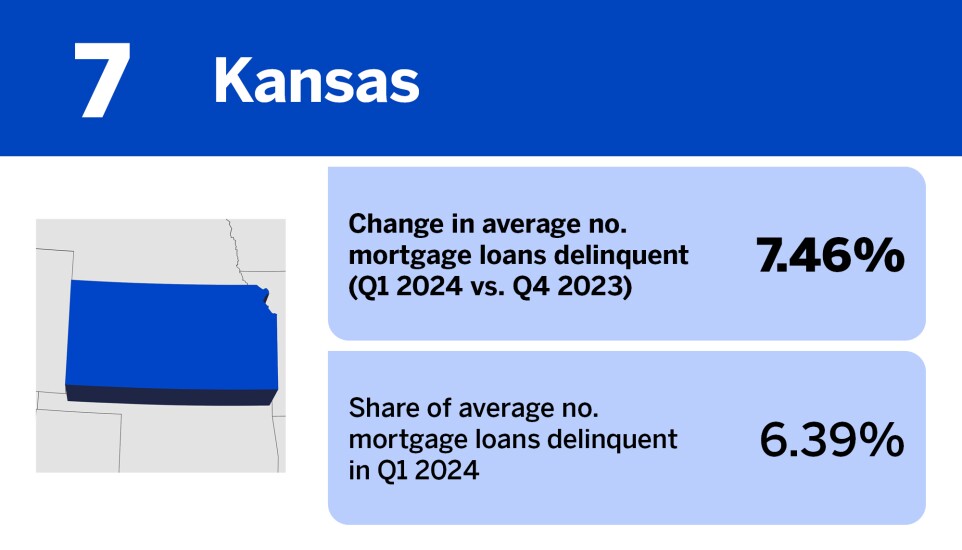

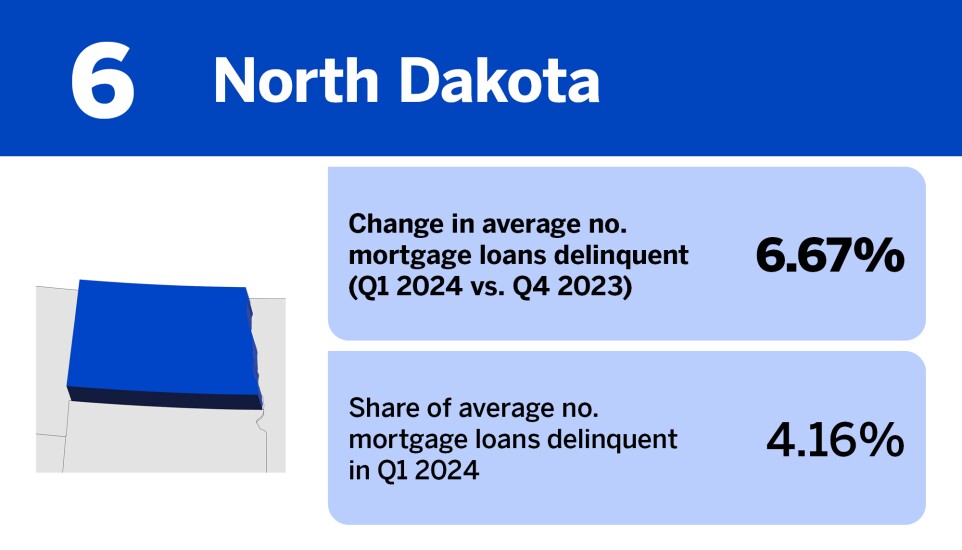

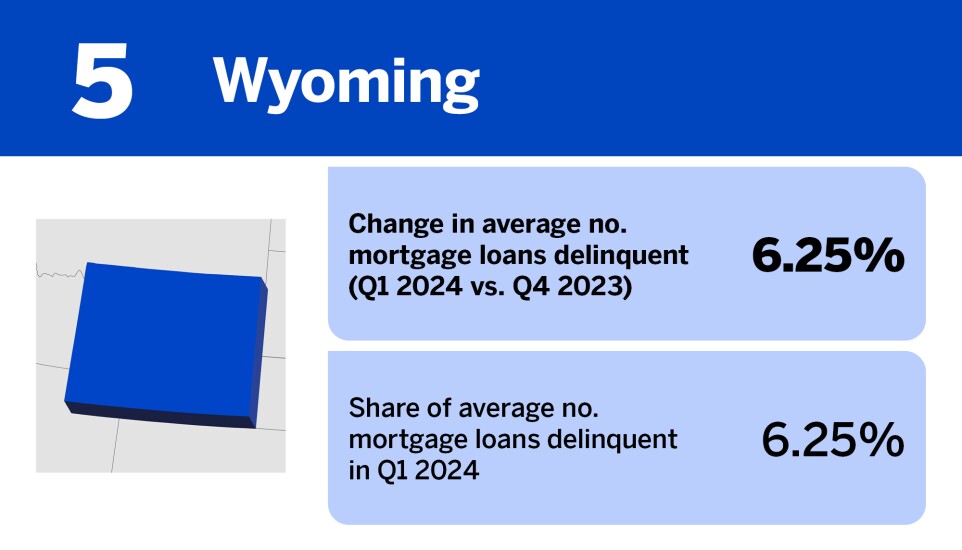

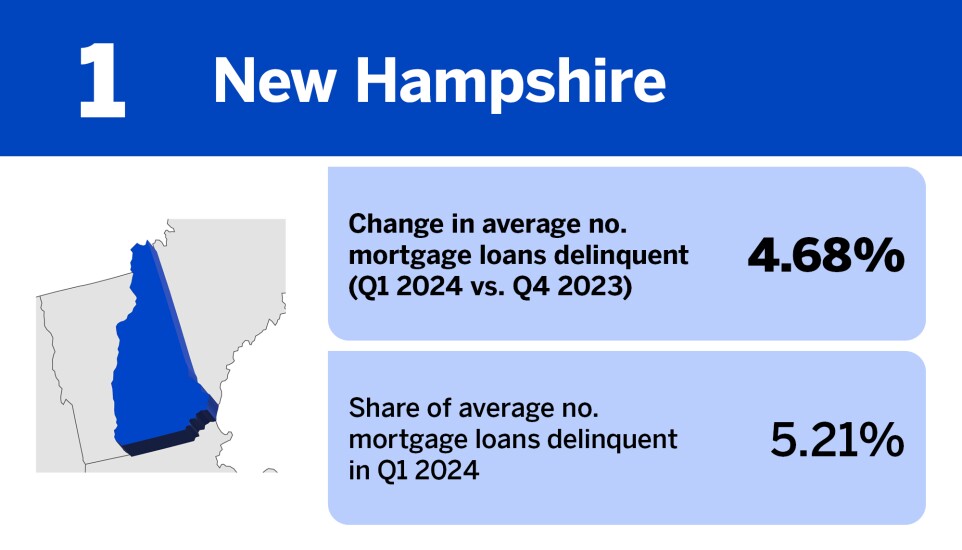

As mortgage rates and housing costs continue to be closely scrutinized, delinquency on some payments feels inevitable. But in certain states, homeowners are struggling less to meet their payments as other locales across the nation see sharp increases in delinquency.

"If you are experiencing financial difficulty that prevents you from paying, ask your lender if they will allow temporary forbearance until you get back on your feet, which may prevent you from being reported as delinquent," Cassandra Happe, WalletHub analyst, said in a release.

Read more:

The state where

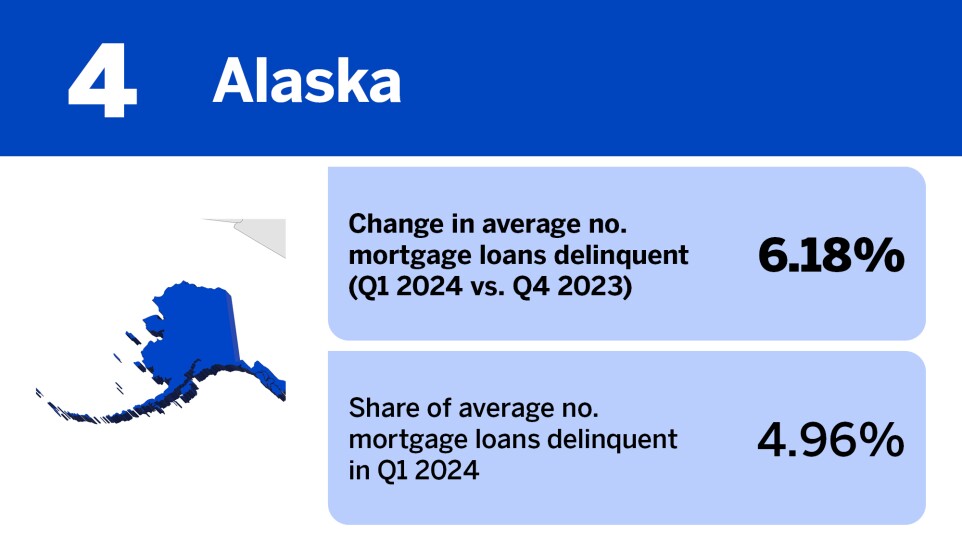

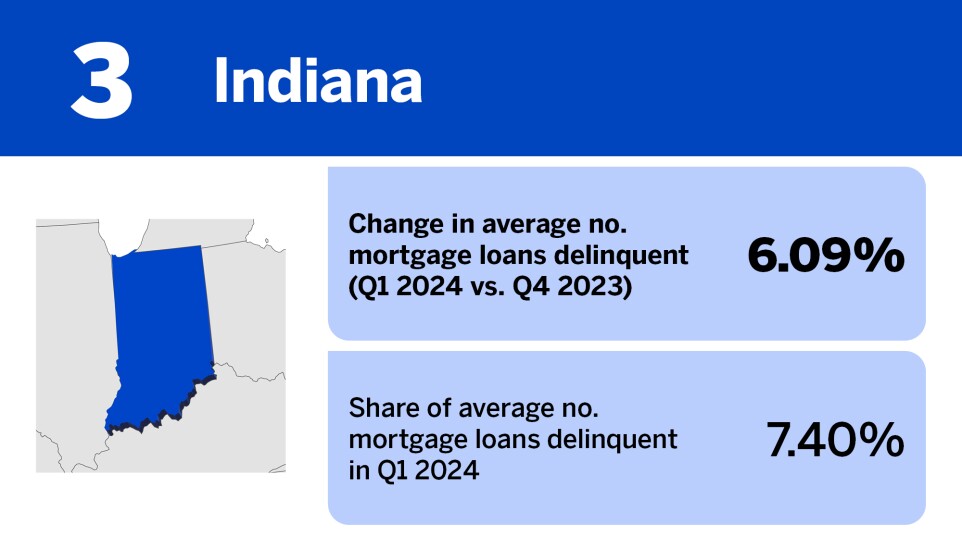

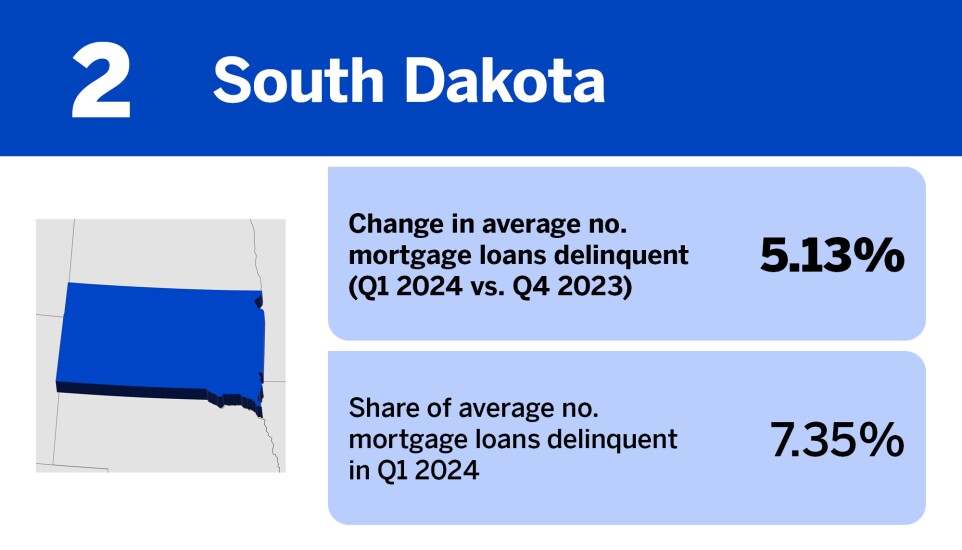

Other states at the top of the list include South Dakota and Indiana. South Dakota saw a 5.13% change in average number of mortgage loans delinquent between Q1 2024 and Q4 2023 and Indiana saw a 6.09% change.

The state where mortgage debt

Read more:

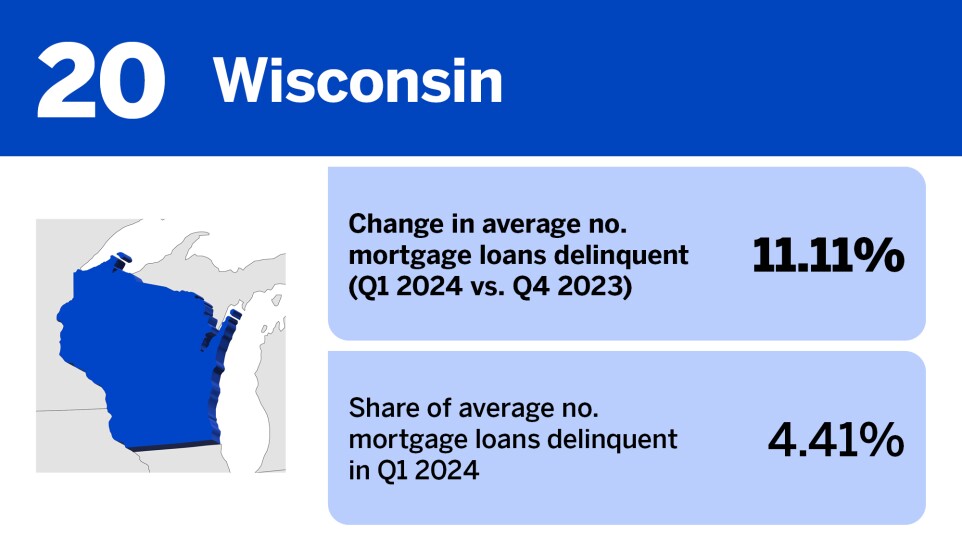

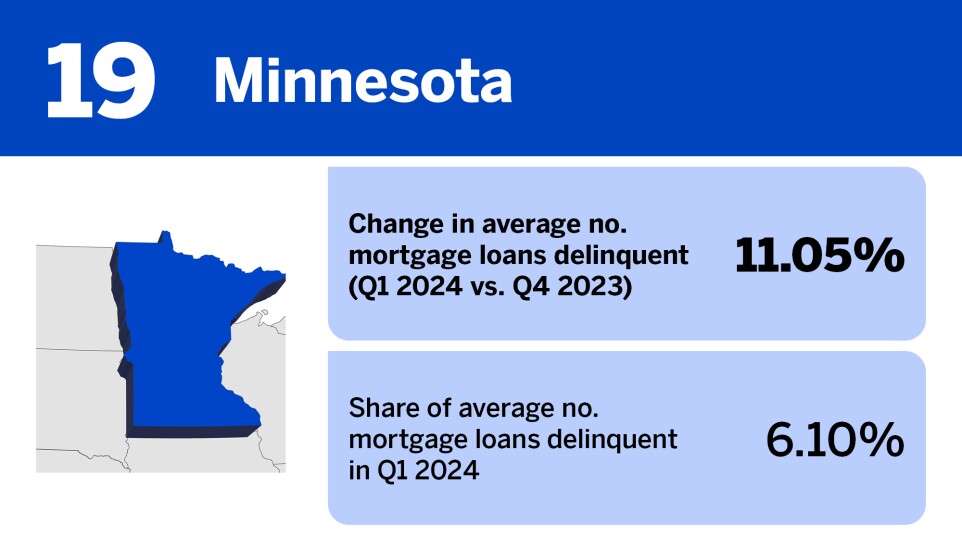

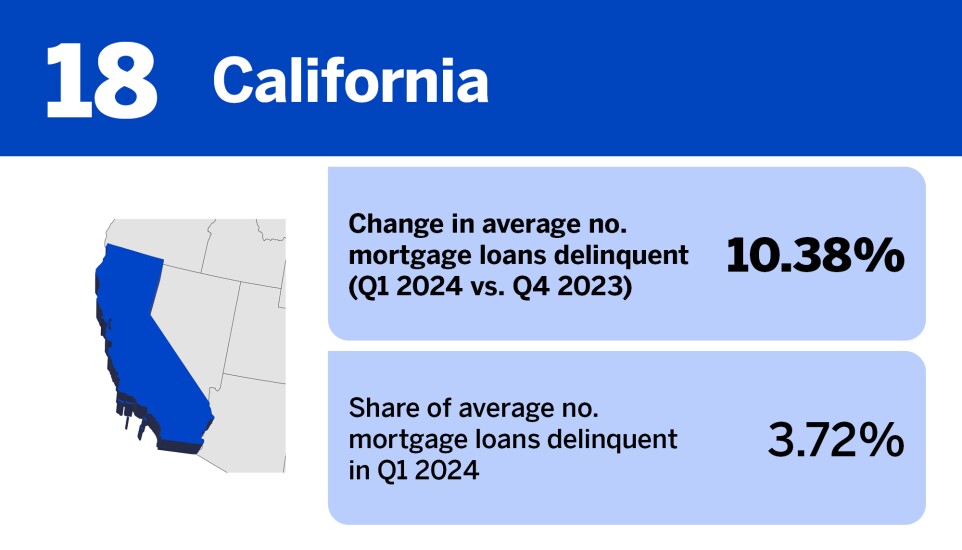

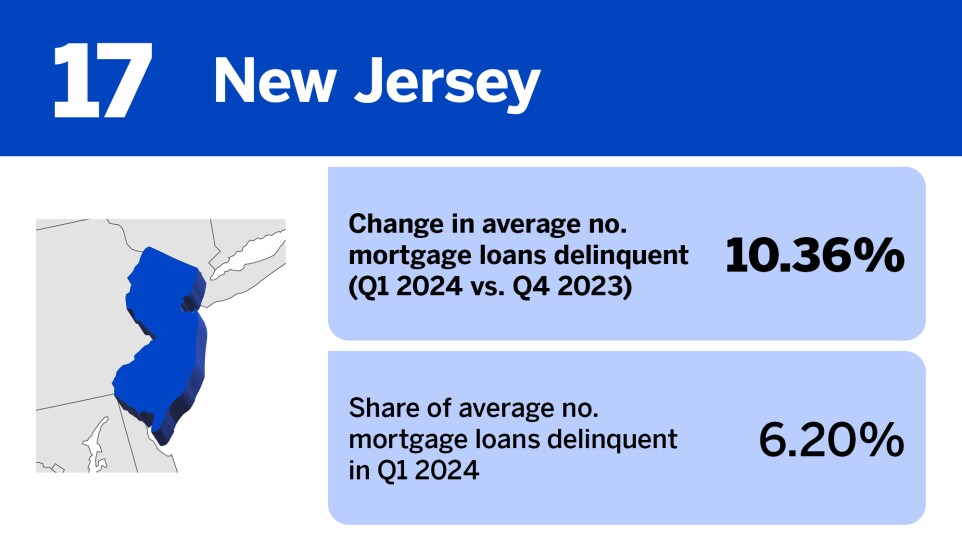

Read more about the 20 states where mortgage delinquency is increasing the least.