The top five companies in the ranking have a combined

The data in this ranking was sourced from National Mortgage News'

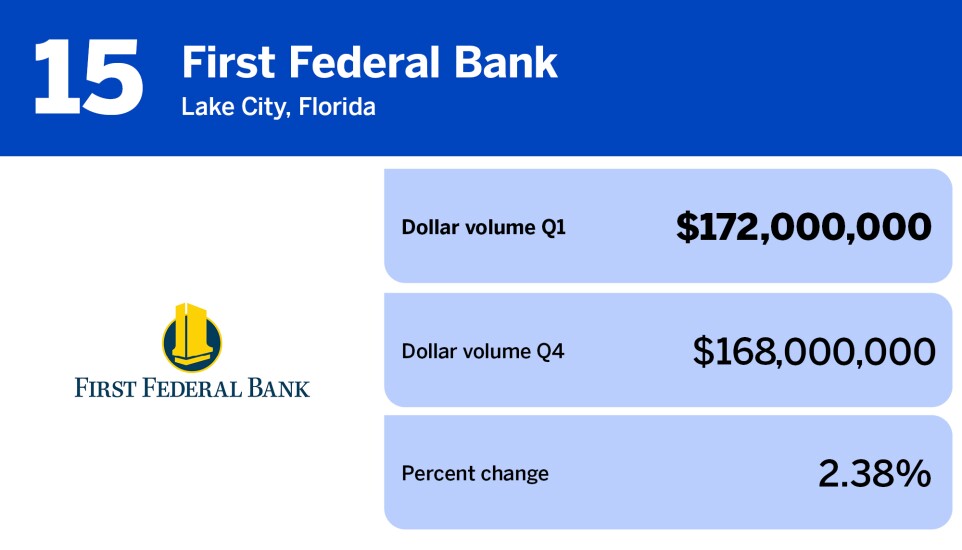

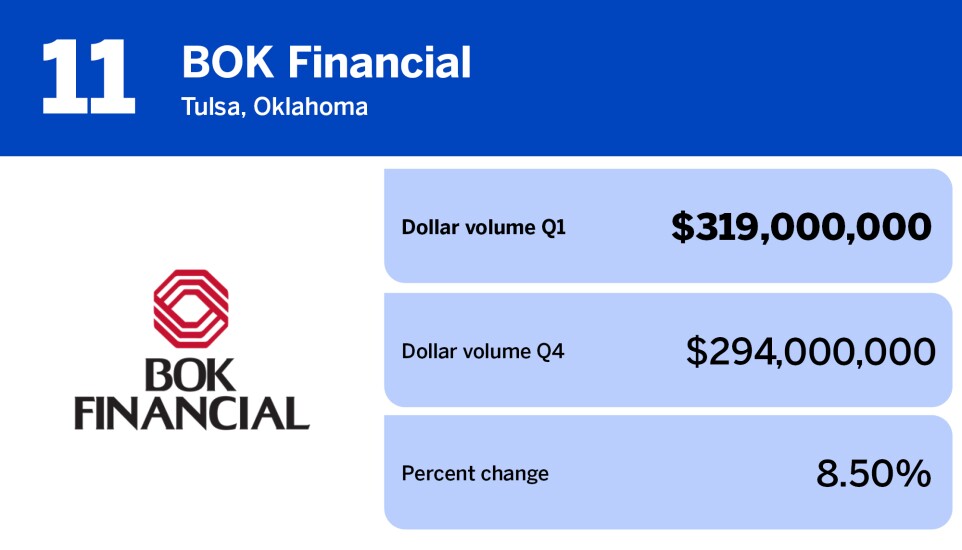

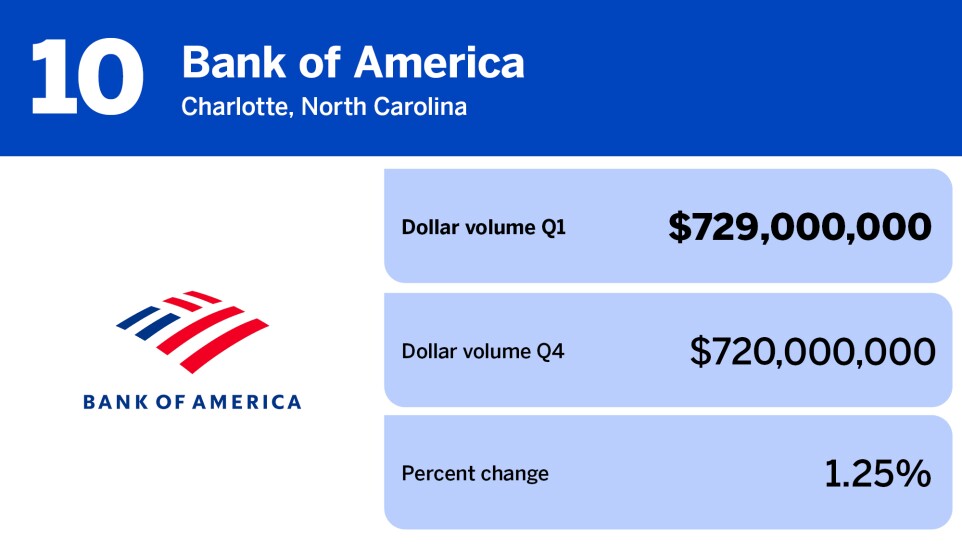

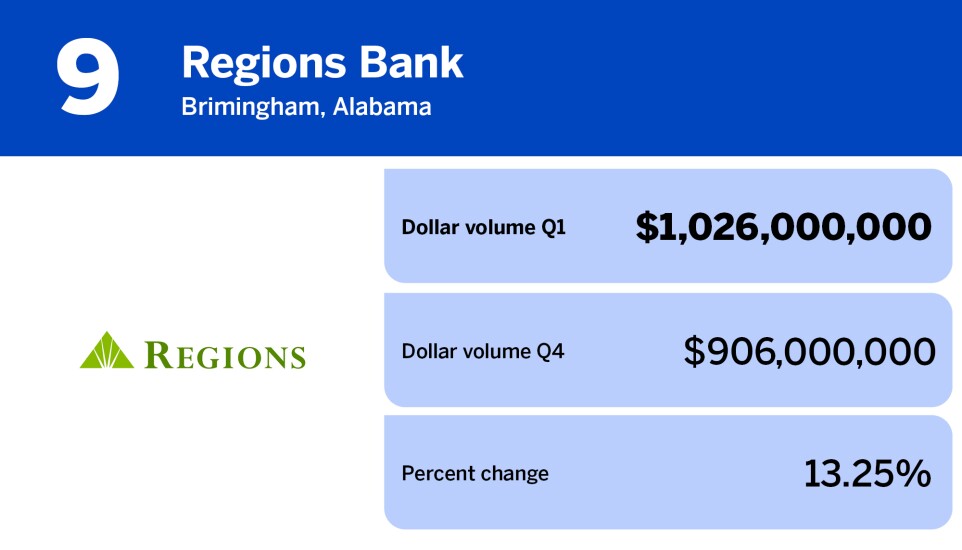

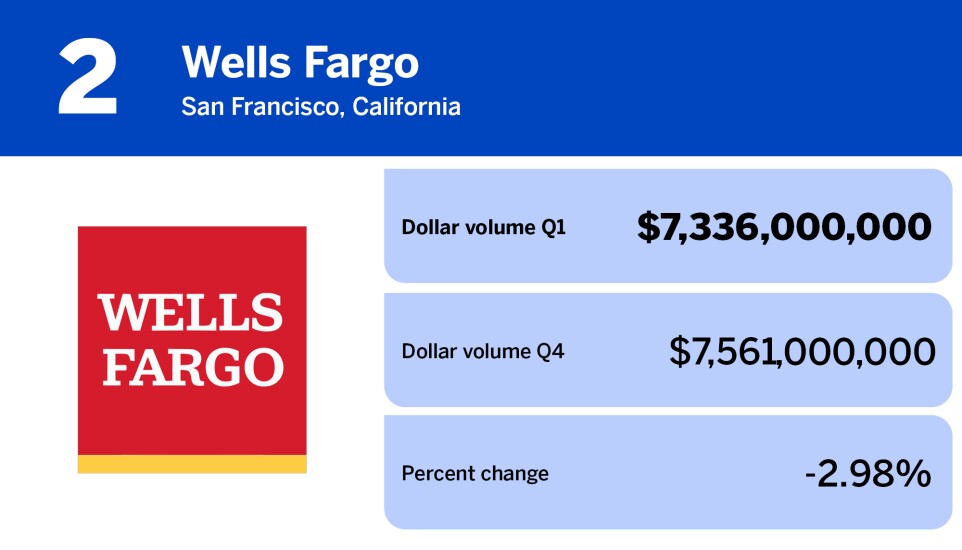

Scroll through to see which bank servicers are in the top 20 and how they fared through the end of March 2024.

The top five companies in the ranking have a combined

The data in this ranking was sourced from National Mortgage News'

Scroll through to see which bank servicers are in the top 20 and how they fared through the end of March 2024.

RoundPoint's corporate parent generated positive comprehensive income with the legal expense excluded and expanded its subservicing activity.

The influential nonbank mortgage company is calling for a "do no harm" approach to housing and finds comfort in officials' stated guardrails to that end.

The GSE accused four companies of trademark infringement, alleging they misrepresented to consumers that their products received its endorsement.

Fannie Mae revised its economic and housing outlook for 2025 and 2026, projecting mortgage rates to hit 6.3% and 5.9%, respectively.

Bill Pulte's X post has the industry excited that loan level price adjustments could change, but the impact would not be as beneficial as some think, KBW said.

A previous report on Waterstone Mortgage's Q3 earnings contained inaccurate information. We are correcting the record.