While high appreciation hurts

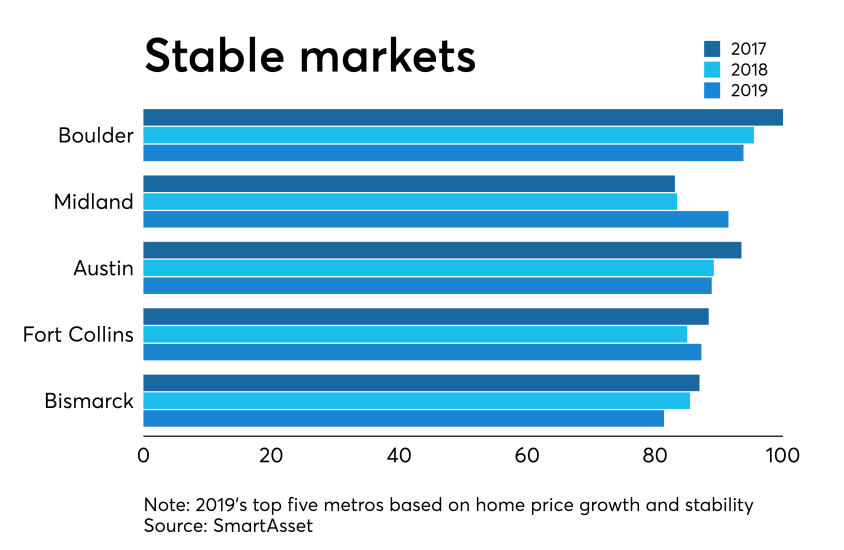

"We have performed our study on the best housing markets for growth and stability for the past five years now, and Colorado metro areas have consistently performed well," Ross Urken, a Senior Editor at SmartAsset, said in a statement. "Boulder, Denver and Fort Collins have cracked the top 10 housing markets with the most stable growth for the past four years and Boulder has claimed the number-one spot in our rankings every year. In Boulder, homeowners have consistently experienced no chance of suffering a significant price decline in the decade following their home purchase."

From Big Sky Country to the peaks of Colorado, here's a look at the 12 metro areas offering owners the most stability and appreciation in home prices over the past 25 years.

The analysis, based on Federal Housing Administration data, evaluates 358 housing markets from 1994 through 2018. Each market was given a score on a 100-point scale in both stability — the probability homeowners experienced a price decline of 5% or more at any point in the 10 years after purchasing a home — and overall price growth in the time period. The scores were then averaged to create the index value, giving a rank to each metro area.

No. 12 Billings, Mont.

Odds of 5% loss in home price within 10 years of purchase: 0%

Home price growth 1994-2018: 164%

No. 11 Odessa, Texas

Odds of 5% loss in home price within 10 years of purchase: 8%

Home price growth 1994-2018: 212%

No. 10 Cheyenne, Wyo.

Odds of 5% loss in home price within 10 years of purchase: 0%

Home price growth 1994-2018: 170%

No. 9 Houston-The Woodlands-Sugar Land, Texas

Odds of 5% loss in home price within 10 years of purchase: 0%

Home price growth 1994-2018: 174%

No. 8 Denver-Aurora-Lakewood, Colo.

Odds of 5% loss in home price within 10 years of purchase: 17%

Home price growth 1994-2018: 279%

No. 7 San Jose-Sunnyvale-Santa Clara, Calif.

Odds of 5% loss in home price within 10 years of purchase: 19%

Home price growth 1994-2018: 357%

No. 6 San Francisco-San Mateo-Redwood City, Calif.

Odds of 5% loss in home price within 10 years of purchase: 19%

Home price growth 1994-2018: 375%

No. 5 Bismarck, N.D.

Odds of 5% loss in home price within 10 years of purchase: 0%

Home price growth 1994-2018: 204%

No. 4 Fort Collins, Colo.

Odds of 5% loss in home price within 10 years of purchase: 2%

Home price growth 1994-2018: 245%

No. 3 Austin-Round Rock-Georgetown, Texas

Odds of 5% loss in home price within 10 years of purchase: 0%

Home price growth 1994-2018: 242%

No. 2 Midland, Texas

Odds of 5% loss in home price within 10 years of purchase: 0%

Home price growth 1994-2018: 256%

No. 1 Boulder, Colo.

Odds of 5% loss in home price within 10 years of purchase: 0%

Home price growth 1994-2018: 268%