-

The mortgage technology unit at Intercontinental Exchange posted a profit for the third straight quarter, even as lower minimums among renewals capped growth.

February 5 -

Fraudsters and modestly dishonest employees can use generative AI to quickly create convincing fake utility bills, pay stubs, passports and other documents banks rely on.

February 5 -

Bed Bath & Beyond purchased Tokens.com, a blockchain platform utilizing services from Figure, tZERO and ShyftLabs.

February 3 -

Mortgage subsidiary Newrez expects to begin moving borrowers onto the platform by 2027, with the deal marking its second major tech investment this year.

February 2 -

A California consumer who applied for a refinance in November says he was unaware his data, including financial details, was shared with advertisers.

January 28 -

On Jan. 26, use of the new Uniform Residential Appraisal Report shifts from limited production to the optional phase, giving lenders 10 months to get ready.

January 26 -

Pfotenhauer held many positions in the mortgage and title industries in his long career, including being the chair of Merscorp, MORPAC and MISMO.

January 22 -

The real estate data firm said the merger will support efforts to scale and plans to ramp up development of enterprise technology products.

January 20 -

AI can accelerate onboarding by providing recruits with real-time feedback, support compliance by flagging documentation issues, and close the confidence gap by offering reliable answers on the spot writes the CEO of Friday Harbor

January 14 Friday Harbor

Friday Harbor -

Titl hopes to standardize and connect property records through a centralized, digitized U.S. registry, which would lead to reduced closing times and costs.

January 14 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

Defendants argued the vendor doesn't operate a pricing algorithm, and said some of the implicated home loan players never used the software.

January 8 -

Loanlogics rolled out the LoanBeam NQM income analyzer in October and has four users for the non-qualified mortgage underwriting technology, including Pennymac.

January 7 -

A shared client base helped lead to introduction of the new integration, with implementation scheduled to come later this year, the companies said.

January 7 -

The deal comes as technology experts see likely 2026 artificial intelligence breakthroughs in mortgage to come through improved underwriting.

January 7 -

Marshall is tasked with bringing Sagent's Dara servicing platform implementation up to scale, replacing Geno Paluso, who is vice chairman during the transition.

January 6 -

AI's capabilities far exceed how the technology is being used in mortgage, but an all-in strategy will quickly put companies ahead of the pack, leaders say.

December 31 -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

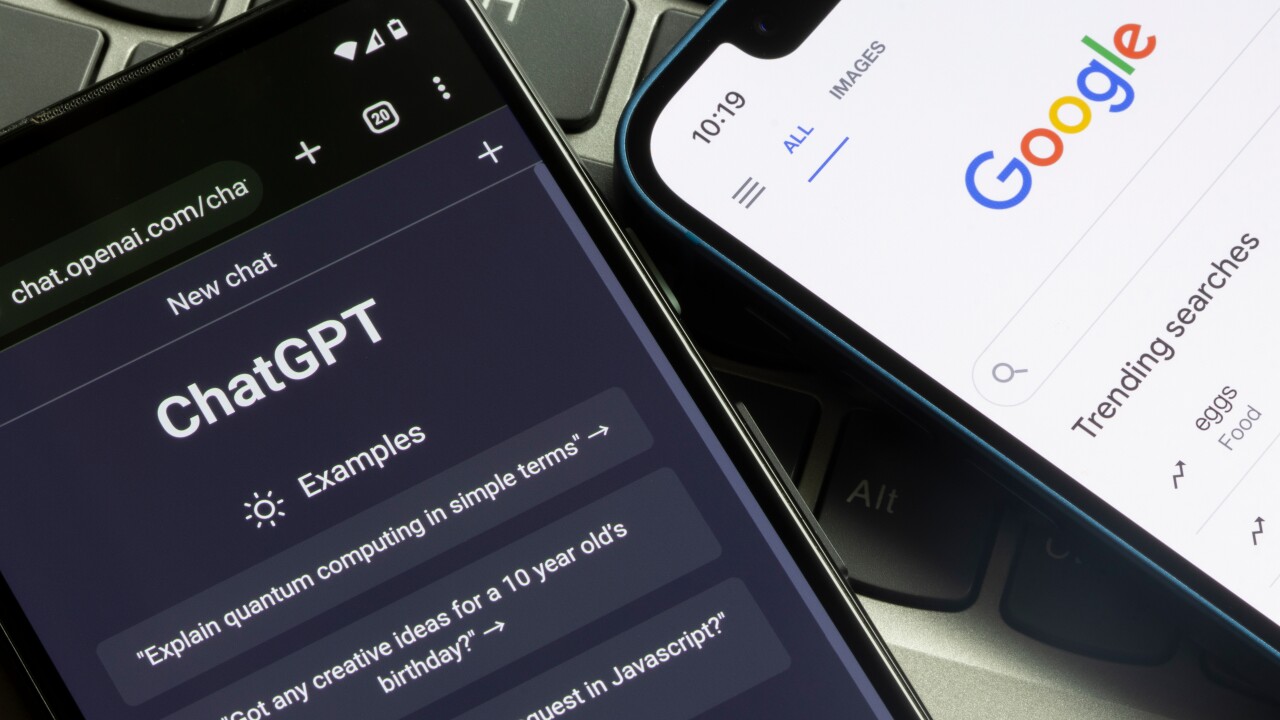

AI tools like ChatGPT are reshaping mortgage marketing, forcing lenders to rethink SEO, brand authority and how they show up as consumers turn to generative search for answers.

December 23