Want unlimited access to top ideas and insights?

Mortgage rates have risen quickly in the past year, putting many mortgage-ready potential homebuyers on hold. As rates rise, according to recent Freddie Mac analysis, the pool of homebuyers who would qualify for the current average loan decreases notably — by around 15 million.

Mortgage rates have increased at the fastest rate since the early 1980s. According to Freddie Mac's

This high-rate environment has pushed market confidence down. According to Freddie Mac's latest

But at what point do higher rates become too high for consumers? A recent Freddie Mac analysis sought to answer that question.

Finding Mortgage-Ready Homebuyers

Using anonymized credit bureau data, Freddie Mac analysts created estimates enumerating the number of

"Mortgage rates have doubled in the last year and as a result, the population of mortgage-ready potential borrowers has fallen significantly," said Ralph DeFranco, macro housing economics senior director at Freddie Mac.

Mortgage-ready potential homebuyers are defined as those who:

- Do not have a mortgage.

- Have a credit score of 661 or above.

- Have no foreclosures or bankruptcies in the past 84 months and have no severe delinquencies in the past 12 months.

- Are 45 years-old or younger and have an estimated backend debt-to-income ratio less than 25%.

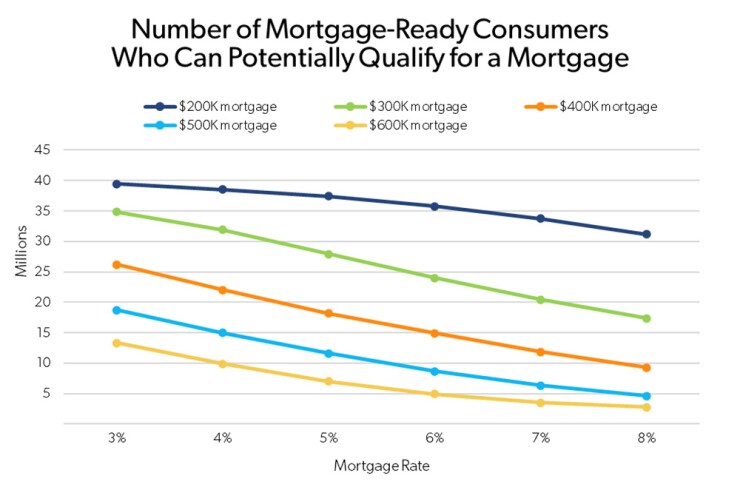

Our researchers determined the total number of mortgage-ready potential homebuyers who had the capacity to afford mortgages ranging from $200,000 to $600,000, with interest rates ranging from 3% to 8%. Mortgage capacity is defined as the maximum house price a mortgage-ready consumer can afford, given his or her income and debt, assuming a 3% down payment, a 30-year fixed-rate mortgage and a debt-to-income rate of 43%.

For example, the pool of mortgage-ready potential homebuyers that our analysts estimate would qualify for a $400,000 30-year fixed-rate mortgage at a 3% interest rate was approximately 26 million people.

How Interest Rate Changes Affect Mortgage-Ready Borrowers

As interest rates increase, the population of mortgage-ready potential borrowers falls.

The following chart illustrates how mortgage capacity decreases as interest rates rise.

Source: Freddie Mac

For instance, the pool of mortgage-ready potential homebuyers who have the capacity to afford a $400,000 loan declines significantly based on the available interest rate. This is important, as the nationwide median home sale price for existing homes was $384,500 in September; for new homes, it was $470,600.

While 26 million mortgage-ready potential homebuyers had the capacity to afford a $400,000 mortgage at a 3% interest rate, the total falls by 3 to 4 million with each percentage gain.

- 4%: 22 million homebuyers.

- 5%: 18 million homebuyers.

- 6%: 15 million homebuyers.

- 7%: 12 million homebuyers.

- 8%: 9 million homebuyers.

Based on the recent high mortgage rate, near 7%, and median home prices, approximately $400,000, only 12 million mortgage-ready potential homebuyers have the capacity to afford mortgages, compared to 26 million when rates were 3%. This means over the past year, around 15 million potential homebuyers may have been priced out.

For more insights from Freddie Mac's research team, visit

Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac's economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Mac's business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an "as is" basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution. Alteration of this document or its content is strictly prohibited. ©2022 by Freddie Mac.