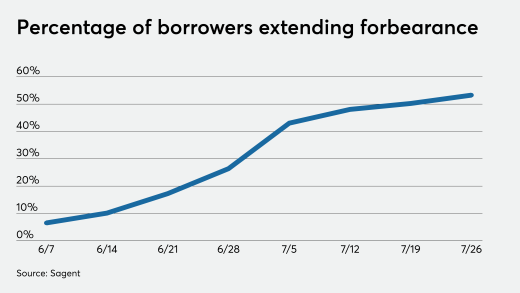

Though overall forbearance share is down, the number of extensions is rising as coronavirus hardship filings surpass the 90-day mark that delineates the end of traditional forbearance plans.

-

Despite a housing market that has remained solid during the COVID-19 outbreak, the hesitancy of potential sellers is contributing to one of the most acute shortages of available homes in decades.

August 11 -

The number of loans going into coronavirus-related forbearance was down for the eighth consecutive week, as the growth rate fell 23 basis points between July 27 and August 2, according to the Mortgage Bankers Association.

August 10 -

Earnings reports out this week beat pessimistic expectations, but strained coronavirus relief negotiations in Congress cloud the outlook for what's ahead.

August 7 -

Though overall forbearance share is down, the number of extensions is rising as coronavirus hardship filings surpass the 90-day mark that delineates the end of traditional forbearance plans.

August 7 -

Conditions have improved for the first time since November.

August 6 -

Insurance claims and claims expenses were 503% above 1Q and 1,075% over 2Q19.

August 6 -

Credit card balances declined most sharply as consumers cut back their spending due to the coronavirus pandemic and associated shutdown orders, the New York Fed said Thursday. But delinquencies also fell across all debt categories, thanks to government and lender relief efforts.

August 6 -

The agency said property owners can enter into new or modified forbearance plans if they have a hardship due to the coronavirus, but the landlords must agree not to kick out renters solely for nonpayment of rent.

August 6 -

The delinquent loan inventory more than doubled compared with the prior year.

August 5 -

The Federal Reserve Racial and Economic Equity Act would direct the Fed to consider racial inequality in employment, income and access to affordable credit when making monetary policy and in its regulation and supervision of banks.

August 5