Customers suffered when they were placed in mortgage relief plans without their consent, the Massachusetts senator says. She urged the Federal Reserve to take the blunder into account as it weighs when to lift other sanctions against the bank.

-

With the onset of COVID and the reaction by the Federal Reserve Board and other agencies, market pressures have reduced credit availability significantly.

October 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

October 1 -

Customers suffered when they were placed in mortgage relief plans without their consent, the Massachusetts senator says. She urged the Federal Reserve to take the blunder into account as it weighs when to lift other sanctions against the bank.

October 1 -

China Oceanwide said it was not able to meet with Hony Capital to finalize the terms and conditions because of the pandemic.

October 1 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

Gov. Andrew M. Cuomo on Monday announced he will extend the eviction moratorium — set to expire Oct. 1 — to next year, continuing protections for tenants as well as homeowners who have been unable to pay rent and mortgage during the public health crisis.

September 29 -

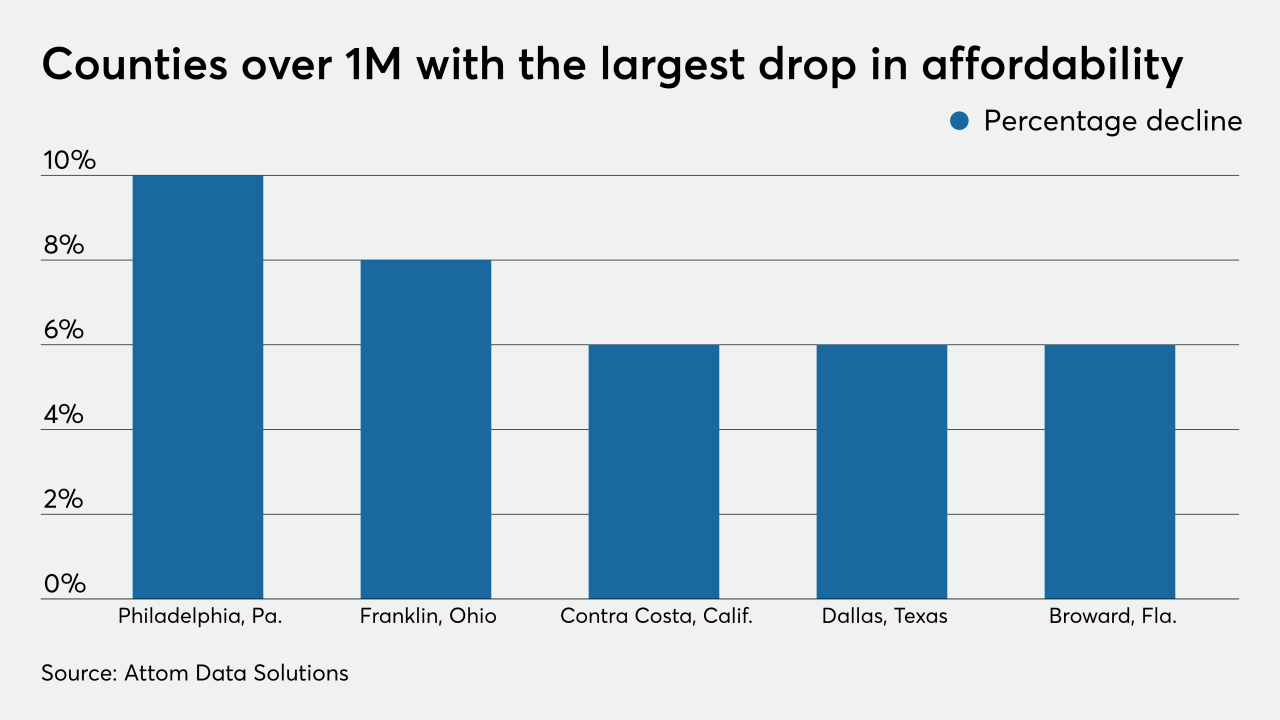

More counties have median home prices above their historic averages for typical wage earners, the company found.

September 24 -

The agency reported signs of stress on the credit quality in residential loans serviced by seven large banks as a result of the COVID-19 pandemic.

September 23 -

Commercial real estate loans are vulnerable as financial assistance for tenants winds down and might not be fully renewed. Late rent payments could rise, leading lenders to press landlords to pay up.

September 23