Staying in compliance with the Secure and Fair Enforcement for Mortgage Licensing Act has been a difficult task for lenders while employees work from home for months on end.

-

The company is finding it challenging to ramp originations back up after spending most of the second quarter on the sidelines.

November 5 -

Staying in compliance with the Secure and Fair Enforcement for Mortgage Licensing Act has been a difficult task for lenders while employees work from home for months on end.

November 3 Mphasis Digital Risk

Mphasis Digital Risk -

Getting ahead of the next wave of mortgage fraud calls for rock-solid systems with several protective tools deployed at once. But that only goes so far without the proper employee preparation.

November 3 -

The forbearance rate improved to the a level not seen since early April, but getting back to pre-COVID levels will require employment gains or additional government stimulus measures, according to the Mortgage Bankers Association.

November 2 -

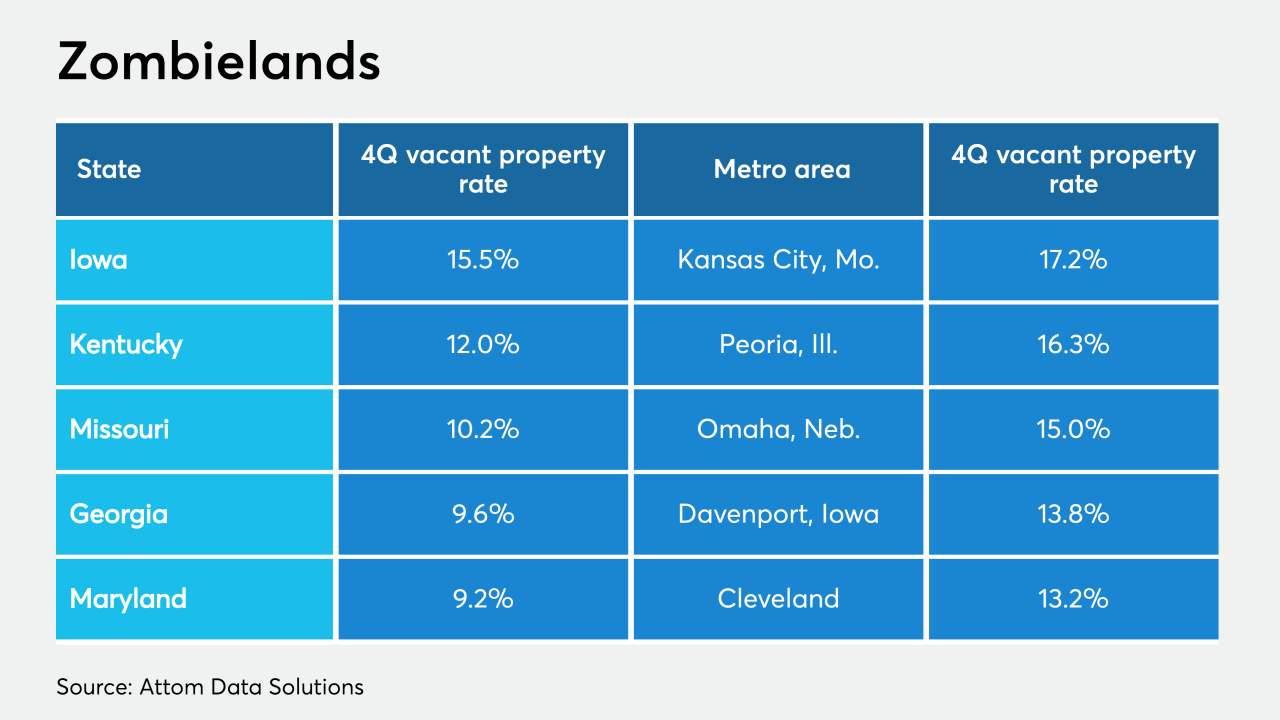

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

How we resolve millions of delinquent mortgages due to COVID is the only question that matters.

October 30 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgage rates remained relatively flat this week, helping housing to stay as one of the bright spots in the U.S. economy during the current uncertainty, according to Freddie Mac.

October 29 -

The lease/purchase home operator is securitizing a loan with higher debt-service coverage that most prior MBS issues from its trust. It also is providing a geographically diverse mix of homes that make the deal less vulnerable to isolated outbreak hotspots.

October 29 -

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

October 26 -

When both origination and forbearance demand spiked in the early weeks of COVID-19, quick thinking lenders were able to leverage their expertise and tech stacks to respond quickly.

October 22