-

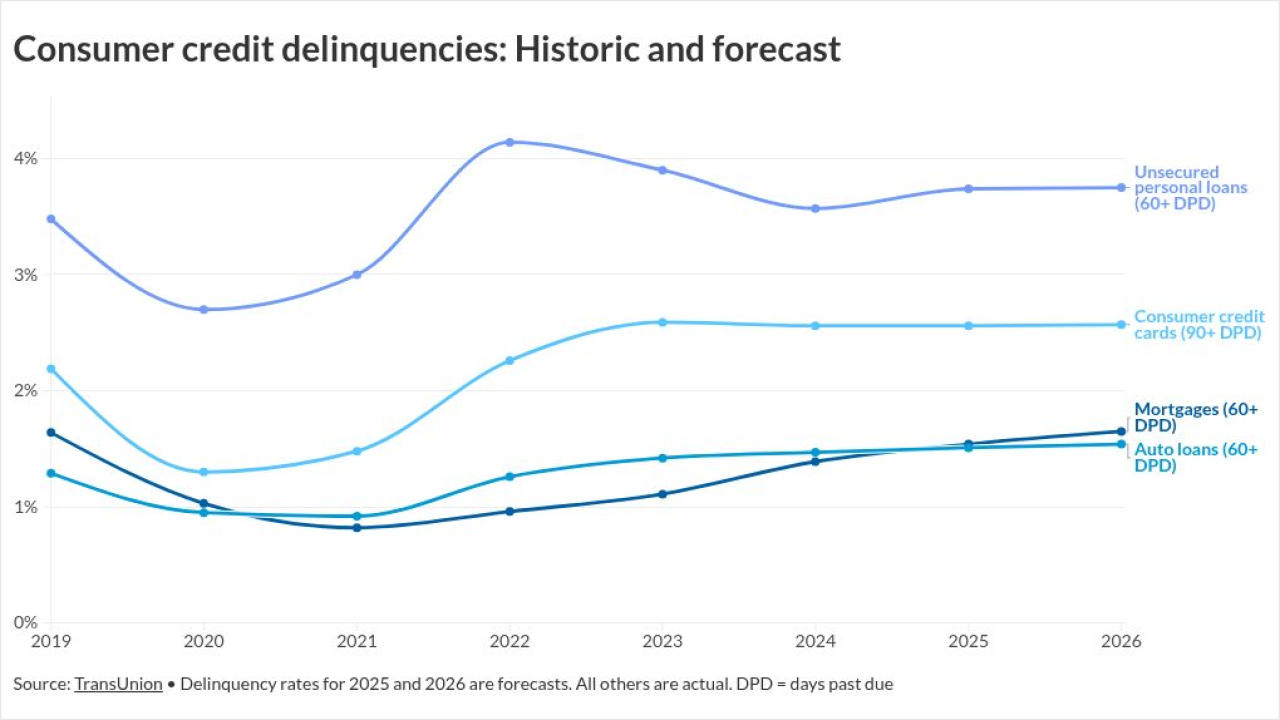

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10 -

Michael Burry, the money manager made famous in The Big Short, believes a re-listing of the US housing-finance giants is "nearly upon us."

December 9 -

Big players, Wall Street and tech firms stand to gain. Community lenders call for policymakers to protect g-fee parity and the cash window. Part 5 in a series.

December 5 -

In the New Jersey case, MV Realty and its principals agreed to pay $28 million in fines and restitution for these "Homeowner Benefit Agreements."

December 2 -

Big-picture plans for the government-sponsored enterprises get the spotlight, but other issues may affect the industry more directly. Part 1 of a series.

December 1 -

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

November 24 -

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

Thursday's wild selloffs, and further losses Friday, were a reminder that the fervor of retail traders — whipped up in part by Federal Housing Finance Agency head Pulte — can quickly turn sour.

November 23 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

The Consumer Financial Protection Bureau, building on an executive order by President Trump, wants to eliminate the legal framework of "disparate impact" from its implementation of the Equal Credit Opportunity Act.

November 12