Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

In a world assailed by extreme weather, homeowners and purchasers need to know their property's vulnerability to wildfire or flooding. Ratings like those Zillow took down are a big improvement on often outdated federal flood maps and state wildfire maps.

The high court, without comment, refused Emigrant Mortgage's appeal of a verdict holding it liable for no income, no asset verification loans to minorities.

-

Analysts estimate Pennymac, Rocket, UWM and Loandepot will post an improved earnings per share and total loan origination volume than the same time a year prior.

-

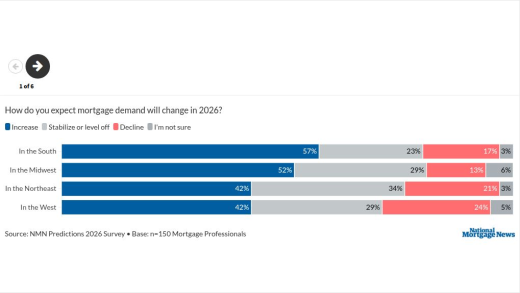

Overall, three-quarters of those in a National Mortgage News survey believe loan production will increase during 2026, but just 15% felt strongly about it.

-

Propy, a real estate technology company, tapped the private credit market for the first time, securing $100 million to support the startup's acquisition strategy.

-

Supply chain attacks have doubled since 2021, with professional services firms increasingly acting as "stepping stones" to access bank data.

-

A Massachusetts borrower sued the servicer last year after she was surprised with a $200,000 mortgage bill, after 16 years of not receiving statements.

-

The pending agreement would resolve claims over a 2021 hack which affected 5.8 million customers of Lakeview, Community, and Pingora Loan Servicing.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

One of the biggest culprits is the CFPB's qualified mortgage rule and the ever-expanding debt-to-income ratios allowed under it, writes a co-director of the AEI Housing Center.

-

Policy shifts and economic headwinds could reshape mortgage finance under Trump II says the Chairman of Whalen Global Advisors.

-

Rocket said the Redfin deal is part of a purchase mortgage strategy, but originating and retaining residential mortgages in portfolio is the real endgame writes the chairman of Whalen Global Advisors.

- ON-DEMAND VIDEO

The markets are looking for a Fed pivot, but central bankers continue to say more hikes are coming and rates will stay higher longer. OANDA's Ed Moya joins us after the meeting to give a comprehensive look at what the Fed signals for the future.

- ON-DEMAND VIDEO

The central bank has raised rates aggressively for nearly a year, but experts believe the hiking cycle is nearly over.

- ON-DEMAND VIDEO

Many believe the Federal Reserve will slow down rate increases beginning in December.. Steve Friedman, senior macroeconomist at MacKay Shields, will join us the day after the meeting to discuss what was done and what he expects in the future.