The mortgage technology unit at Intercontinental Exchange posted a profit for the third straight quarter, even as lower minimums among renewals capped growth.

Looking to build on last year's live sing-along, Lady Gaga will be performing the theme to Mister Rogers Neighborhood in a campaign from Rocket and Redfin.

The high court, without comment, refused Emigrant Mortgage's appeal of a verdict holding it liable for no income, no asset verification loans to minorities.

Traci Parks has been a copy editor at American Banker since 2023. She's worked at Scholastic National Partnerships and many fashion magazines, including V Magazine where she was also a contributing writer. As a playwright, her work has been produced in New York, Seattle and Los Angeles.

-

-

Leverage is moderate in Saluda Grade's pool, yet the junior liens carry slightly more LTV and DTI risk, on a weighted average (WA) basis.

-

Federal Reserve Gov. Lisa Cook said in a speech Wednesday night that the central bank's credibility depends on its ability to bring inflation back to its 2% target.

-

Home equity investment platforms continue to attract dollars from the venture capital community but also face a proposed de facto ban in one state.

-

In a contentious House Financial Services Committee oversight hearing, Treasury Secretary Scott Bessent sidestepped questions on the Trump family crypto conflicts of interest and inflation with pugnacious responses to Democratic lawmakers' questions.

-

After four years, the senior note classes will either pay a 100 basis-point increase to the fixed coupon or the net weighted average coupon (WAC) rate, whichever is lower.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Treasury yields are stuck, but gold and the dollar are flashing unusual signals that could push rates after the FOMC, according to the CEO of IF Securities.

-

Treasury yields are diverging, charts are breaking down and trading looks two-sided into the FOMC, according to the CEO of IF Securities.

-

Treasury moves look less about data or auctions and more about gaps and channels, with PMI next to decide direction, according to the CEO of IF Securities.

More mortgage professionals told National Mortgage News they expect their companies to hire, or stand pat, rather than fire workers this year.

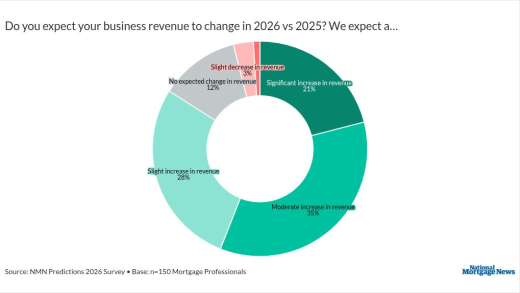

Pulte says a GSE stock offering remains likely in 2026, but other policy paths are in play. NMN survey data shows the industry expects broader changes first.

- ON-DEMAND VIDEOMatt Dowd, VP of Product Management at ICE Mortgage Technology joins the National Mortgage News Leaders channel

- ON-DEMAND VIDEORecapture strategies from a subservicer perspective

- ON-DEMAND VIDEO

KC Mathews, executive vice president and chief market strategist at Commerce Trust breaks down the FOMC meeting.