The company dropped the broker channel just months after Frank Martell became CEO; now that Anthony Hsieh is running things again, LoanDepot brought it back.

More mortgage professionals told National Mortgage News they expect their companies to hire, or stand pat, rather than fire workers this year.

More than half of respondents in a National Mortgage News survey predict AI-backed underwriting will fundamentally change mortgage processes in 2026.

The announcement drove a large increase in Better's stock price, but UWM, Rocket and Pennymac all saw any gains earlier in the day more than dissipate.

While correspondent is still the bulk of Planet Financial's production, growth of its servicing portfolio helped the company increase retention volume.

This year 40 companies had what it takes to land on the Best Mortgage Companies to Work For list.

The top employers in home lending value business partners with a large market share and reach but they also need to differentiate themselves.

-

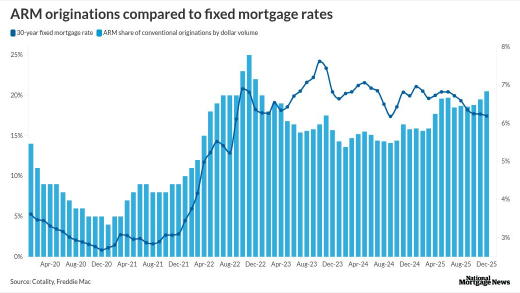

In the highest-priced housing markets, some buyers see adjustable-rate mortgages as the only loan they may initially qualify for, Cotality found.

-

San Francisco-based Anthropic is challenging a decision by the department and other federal agencies like the Federal Housing Finance Agency to shift their AI work to other providers.

-

President Trump's criticism of large institutional investors prompted inclusion of a sales timeline for build-to-rent properties in the ROAD Act, which in turn pushed NAHB to withdraw its support.

-

The Bureau of Labor Statistics reported that the economy lost 92,000 jobs in February while unemployment held steady at 4.4%, a development that could spur the Federal Reserve to question whether interest rates are truly in balance.

-

Many homeowners and first-time buyers are surprised by rising property taxes and insurance, which can sharply increase monthly mortgage costs beyond principal and interest.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

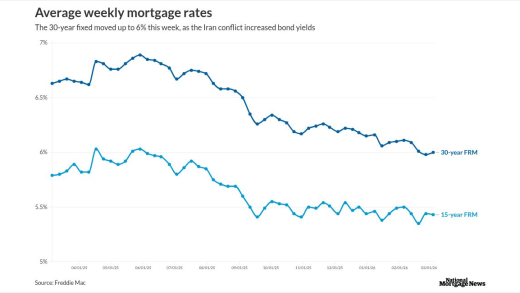

Treasury yields swung wildly after a soft jobs report as oil's surge added a new complication for the Fed, raising concerns about the rate path ahead, according to the head of correspondent business development at AD Mortgage.

-

Proposed housing legislation aimed at curbing institutional homebuying could also block investment platforms that let everyday Americans own shares in rental homes, according to the CEO of Arrived.

-

War headlines failed to lift Treasuries; rates sold off, resistance held, and hedging beat rate bets, according to the Head of Correspondent Business Development at AD Mortgage.

- UPCOMING LIVESTREAMThursday, March 19, 20261:00 p.m. / 10:00 a.m.

Sean Snaith, Director of the Institute for Economic Forecasting at the University of Central Florida, will provide insight into the FOMC meeting.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- Partner Insights from Hyland

- Partner Insights from Plaid

-

-