Fannie Mae and Freddie Mac's efforts to offer low down payment mortgages include multiple layers of protection against credit losses. But an analysis of these measures suggests the government-sponsored enterprises are actually overcharging the low-income borrowers and first-time homebuyers they're supposed to be helping.

The GSEs' federal charters require a minimum 20% credit enhancement on every mortgage Fannie and Freddie purchase. The simplest way to meet this Congressional requirement is for the borrower to have a 20% down payment. Alternatively, if the borrower's down payment is less than 20%, private mortgage insurance can be obtained for the loan.

As the discussion continues about what to do with Fannie and Freddie, one question continues to be a major obstacle to a sustainable solution: Will a new housing finance system be able to support well-qualified, low-to-moderate income families as well as the current system?

But to really answer this question, it's necessary to understand to what extent, if at all, the GSEs are cross-subsidizing their pricing. This analysis is based on the limited public information on GSE pricing, including loan-level price adjustments, observed from the GSE LLPA pricing charts since the GSE and FHFA pricing methodology is very opaque.

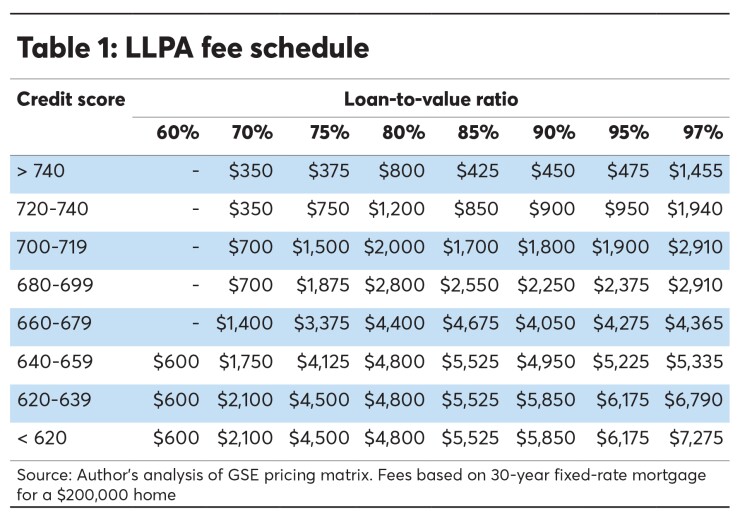

Analyzing and understanding the amount of credit risk Fannie and Freddie hold at various LTV ratios leads to the question of how they price credit risk. Let's consider a borrower with a 660 credit score and a 5% down payment who wants to buy a $200,000 house.

The loan has to be credit enhanced to the point that the GSE would only experience a credit loss if the overall losses on the home were in excess of $40,000. To do this, the borrower would need to pay an LLPA of $4,275 and buy a mortgage insurance policy to supplement the down payment, which gives the GSE $67,000 of credit loss protection — in essence, a 66.5% LTV loan.

To effectively

One would expect the LLPA charged for this loan to be equivalent to the LLPA charged on a 66.5% LTV loan, since the GSE loss severity exposure is the same. However, the fee charged for a 70% LTV loan is only $1,400. The 95% LTV borrower must pay an extra $2,875. What's more, an apparent high LTV penalty appears at all credit score levels.

Because of the lack of transparency by the GSEs and FHFA, there is speculation about the rationale for the apparent bias against high LTV loans. One reason could be the counterparty risk the GSEs have with the PMI companies.

During the housing crisis, three PMI companies were seized by state regulators. The state regulators slowed down the claims-paying process at these three companies to assure all claims would be paid eventually. The other five PMI companies paid their claims on time and in full.

All housing finance participants that survived the mortgage crisis have adjusted policies to strengthen the overall system. For example, the FHFA has minimized future risk to the GSEs from the use of MI by becoming an unofficial regulator of the PMI companies and setting capital standards that are double pre-crisis levels.

There was controversy around PMI companies rescinding coverage for fraud and poor underwriting during the crisis, similar to the buybacks the GSEs required. The MI rescissions were detrimental to the servicers and advantageous to the GSEs. The GSEs required servicers to buy back MI rescinded loans, which entirely eliminated the GSE credit risk. To become better partners with the lending community, the PMI companies have rewritten their master policies to limit and clarify the company's ability to rescind coverage.

Given these MI industry enhancements, it is hard to see how any lingering concerns about the PMI industry justify the incremental $2,875 being charged to the hypothetical borrower mentioned above.

Another possible reason for the increased fees on high LTV loans is the potential for greater losses to the GSEs, even after factoring MI claims being paid. Sticking with the example of a 660 credit score borrower buying a $200,000 home, Table 2 demonstrates the loss exposure to the GSEs at various LTV and default probability levels.

The GSEs do not charge LLPAs or require mortgage insurance on loans originated with 60% LTV ratios. Simply put, it's unlikely the GSEs would suffer a loss if a loan with that much equity defaults. So in this scenario, their limited risk exposure on the first $120,000 of the original purchase price is the same, regardless of the credit enhancements protecting the remaining $80,000.

While it's true that borrowers with smaller down payments present a greater default risk, the gap between the LLPAs charged on 70% LTV and 95% LTV loans is so great than increasing the loss frequency by a factor of 10 justifies less than half the $2,875 difference.

Based on this analysis, the cross subsidization appears to be overcharging high LTV borrowers and subsidizing low LTV borrowers by about $1,775. Put another way, 95% LTV mortgages would have to default at a rate of nearly 24 to 1 compared to 70% LTV loans to justify the difference in LLPA fees.

Requiring borrowers to pay a fee that disproportionately reflects the risk to the GSE is detrimental for low-income individuals and families, particularly first-time homebuyers and people of color. The GSE bias against high LTV lending has pushed borrowers to FHA who would normally be served through GSE products.

Housing reform advocates need to be conscious of and open-minded about how a new housing finance system affects and supports the underserved because the lack of transparency in the current system has pushed potential borrowers to the outskirts.