Regional banks and nonbank servicers are likely to find themselves in the crosshairs of the Consumer Financial Protection Bureau in the coming year as the agency continues its crackdown on mortgage servicers.

The CFPB wants to protect defaulted borrowers who received promises of relief from their servicer only to have that relief denied when a new servicer buys their loan. The agency has repeatedly warned servicers of problems with loan transfers, the integrity of consumer data and loss mitigation activities. It is said to have at least six active investigations into mortgage servicers, according to industry lawyers.

"Regulators are taking a more rigorous look at servicing transfers, particularly on loss mitigation and loan modifications," said Lori Pinto, a senior vice president of business development at loan servicer Cenlar, based in Ewing, N.J.

Nonbank or regional servicers have acquired massive amounts of defaulted loans in the last few years, mostly from large banks. Often there are missing documents or data errors in the transfer process, and loan modifications that simply do not get tracked.

The CFPB's new mortgage servicing rules that went into effect in January were meant to ensure that companies transferring servicing rights keep accurate records on borrowers and that transfers do not result in interruptions for consumers awaiting modifications.

"We're seeing the bureau look at new servicers that may not have robust on-boarding of transferred loans," said Jeffrey Naimon, a partner at the Washington law firm BuckleySandler.

Regional banks may simply be the next in line, after large banks and nonbanks, to get hit with enforcement actions.

In September,

To this day, mortgage servicers are

But the CFPB is not the only regulator focused on mortgage servicers. The New York State Department of Financial Services' investigation of Ocwen Financial resulted in

And the settlement with New York regulators doesn't mean Ocwen's troubles are over, as the firm faces

In addition, the Federal Housing Finance Agency, which oversees Fannie Mae and Freddie Mac,

But there is some good news for large banks.

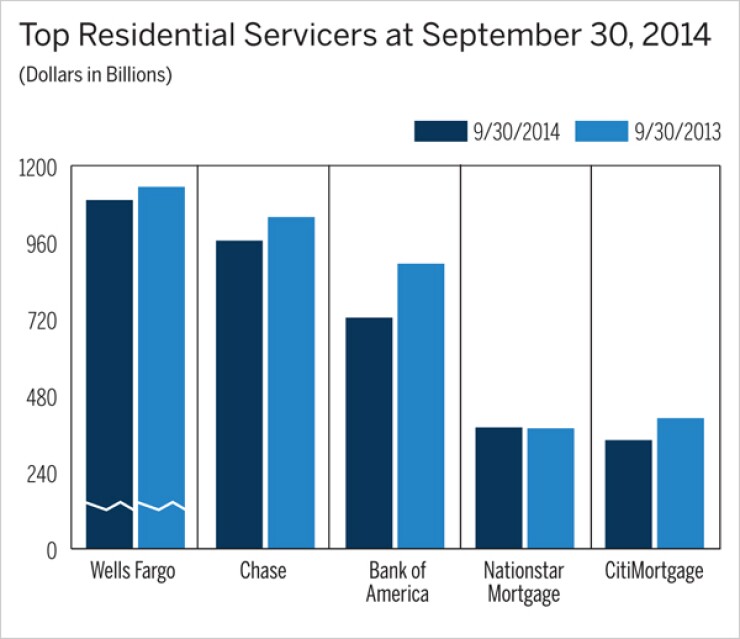

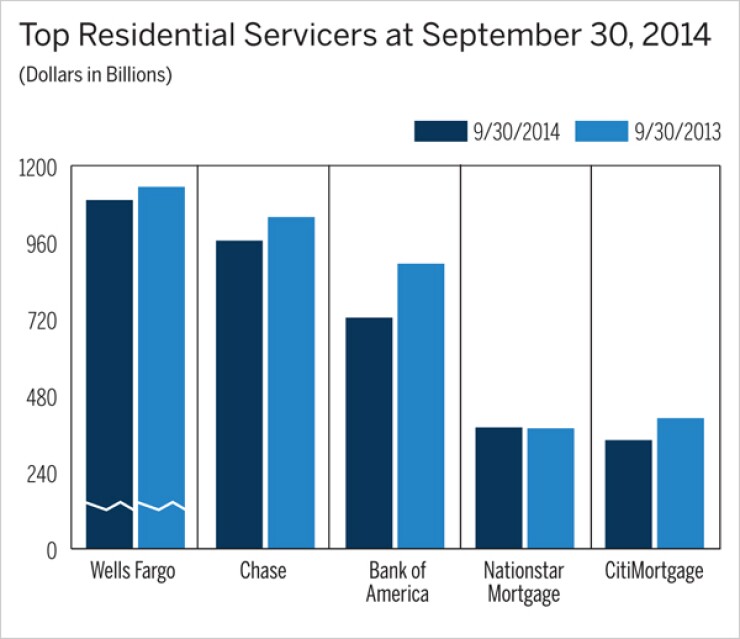

Bank of America, Citigroup, JPMorgan Chase and Wells Fargo, which were subject to the $25 billion national mortgage settlement, have improved their servicing operations after years of turmoil.

In the second quarter, none of the top banks failed any of the servicing tests conducted by Joseph A. Smith, the monitor of the national mortgage settlement. In the first quarter, B of A failed two tests and Citi failed just one.

Roelof Slump, a managing director at Fitch Ratings, wrote in a recent report that large bank servicers "lack the integration challenges faced by nonbank servicers and have more meaningful regulatory compliance resources."