The marketplace for nonperforming loans is full of heavyweight buyers like Bayview Asset Management and Lone Star Funds, private equity behemoths that can buy thousands of delinquent mortgages at a time.

So New Jersey Community Capital, a nonprofit community development financial institution managing only roughly $300 million in total capital, doesn't seem like a threat to the significant players in the nonperforming loan arena.

But New Jersey Community Capital and fellow nonprofit Hogar Hispano have become trailblazers as they have purchased more than 2,000 nonperforming loans from the Federal Housing Administration, government-sponsored enterprises and banks. In doing so, they've raised questions regarding nonprofits' capacity to buy these loans and how this could alter markets.

Over the past year, the Department of Housing and Urban Development and the government-sponsored enterprises have come to embrace nonprofits, working to make nonprofits an increasingly important part of the market for nonperforming loans.

In June, HUD

Last year, Fannie Mae rolled out its first "community impact" pool of nonperforming loans designed to appeal to nonprofits, small investors and minority- and women-owned businesses. Fannie Mae went on to select New Jersey Community Capital, a nonprofit community development institution, as the winner in

Similarly, Freddie Mac completed its first nonperforming loan sale to a nonprofit last December and then followed with another sale to a nonprofit in July, selling 292 nonperforming loans altogether between the two offerings. New Jersey Community Capital won both pools.

New Jersey Community Capital and Hogar Hispano dominate the conversation surrounding nonprofit investment in nonperforming loans. Another nonprofit, the Mortgage Resolution Fund, has participated in the space, but has not bought any of these loans since 2013, according to a report from the Urban Institute.

New Jersey Community Capital was formed in 1987 and originally focused on issues surrounding affordable housing. In the wake of the foreclosure crisis and the devastating effects of Hurricane Sandy on its home state, the nonprofit began to look for ways to intervene in the crisis, particularly in Newark.

"We needed to do something on a more meaningful scale to put a dent in the tide of foreclosures that were coming," Peter Grof, deputy to the president at New Jersey Community Capital, said.

The group would eventually look into tapping into nonperforming loans, but had trouble acquiring them directly from banks and had to get OMB approval for its first direct sale from HUD. They later went on to bid on pools beyond New Jersey, specifically in Florida, at the urging of HUD and housing groups in the Sunshine State. Today, New Jersey Community Capital has successfully bid or negotiated the purchase of more than 1,700 loans in New Jersey and Florida, Grof said.

Hogar Hispano was formed in 2004 as the community development arm of the National Council of La Raza, the largest Latino advocacy organization in the U.S. One of Hogar Hispano's first major projects was acquiring and renovating a building in Washington, D.C., that now serves as the NCLR's headquarters.

Like New Jersey Community Capital, Hogar Hispano began approaching nonperforming loan sales as a way to address the effects of the housing crisis and initially faced difficulty tapping into the market.

"We had opportunity, but we couldn’t get loans," Marcos Morales, executive director of Hogar Hispano, said. "We were looking for targeted markets, but everything was being sold in bulk."

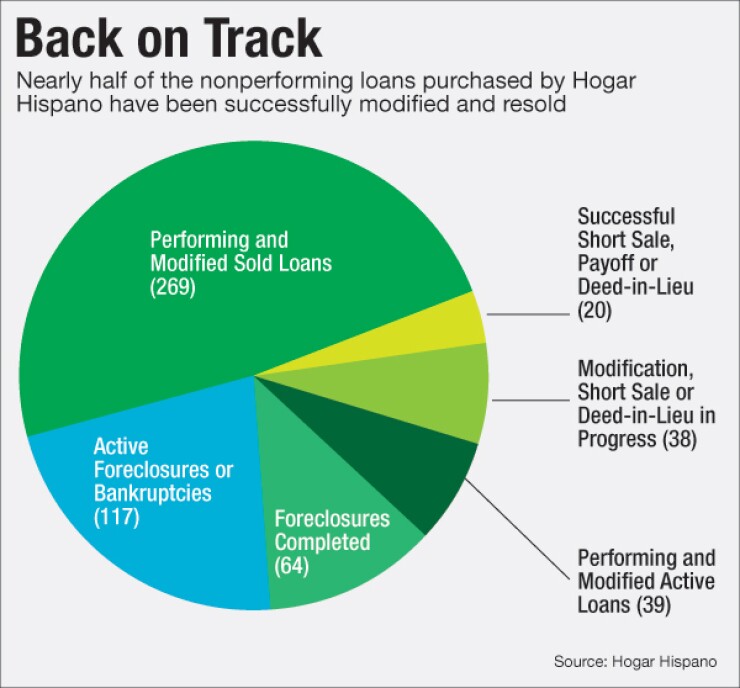

Morales would later get invited to meet with CitiMortgage in New York about how the lender could work with nonprofits. That meeting would eventually lead to Hogar Hispano buying more than 450 loans. Hogar Hispano has gone on to purchase more than 560 loans altogether and has consulted HUD on how to increase nonprofits' involvement in this space.

Nonprofits like New Jersey Community Capital and Hogar Hispano have attracted support from affordable housing advocates who argue that these nonprofits are better equipped in many ways to keep homeowners in their homes.

"The private investors in this space are not neighborhood real estate professionals," Julia Gordon, executive vice president of the National Community Stabilization Trust, said. "They're capital markets professionals, and there's a difference."

Both Hogar Hispano and New Jersey Community Capital had experience working on real estate related issues before they began to buy nonperforming loans. And both have a wide network of other advocacy organizations and nonprofits that can and will lend support to through housing counselors to the borrowers that fall into the organizations' laps. They also bring a boots-on-the-ground mentality.

"We survey every property that's in a pool and don't just make determinations from an appraisal and numbers off a spreadsheet," Grof said.

Furthermore, because the two organizations don't have to be as profit-minded as their private equity peers, they can operate in a manner that's arguably more to the homeowners' benefit than theirs.

"We're not having folks modify to an investor bottom-line requirement," Morales said. "We try to mod to the needs of the borrower. We don't want to mod somebody and have them still be underwater."

Thus far, it appears the two nonprofits have created as many, if not more, favorable outcomes for their borrowers as the rest of the industry.

"The early returns suggest that…their results contacting borrowers and providing loan modifications have been extremely impressive, multiple times the success rate of the private buyers," Gordon said.

HUD reported this January that 28% of the loans sold through DASP had outcomes that avoided foreclosure, which equates to 43% of loans after accounting for loans that are not yet resolved.

New Jersey Community Capital, meanwhile, says that 40% of the nonperforming loans it bought have seen nonforeclosure outcomes. And 66% of resolved loans that Hogar Hispano bought were resolved to favorable outcomes, including reperforming and modified loans, payoffs, short sales and deeds-in-lieu.

While those figures are quite promising, observers are quick to note that these figures are subject to change given how new these nonprofits still are to buying nonperforming loans.

"There's so few that have been purchased," Laurie Goodman, co-director of the Housing Finance Policy Center at the Urban Institute, said. "Everyone's quoting the success rate, but that's off of a very small number of loans."

Others, meanwhile, contend that the reporting is spotty when it comes to loan performance in these sales across the board, making these comparisons harder.

"We don't have enough reporting," Sarah Edelman, director of housing policy at the Center for American Progress, said, noting problems with how in the past the FHA shared information by action.

"In any given auction, there can be 10 different buyers," Edelman said. "It can be hard to do an apples-to-apples comparison."

But the bigger question about the nonprofits is not regarding their success rate; most agree that given the delinquency of these pools just trying to avoid foreclosure can be a job well done. Rather, observers debate whether nonprofits in general really have the capacity to take on these loans, especially in light of HUD proposing to set aside up to 10% of its sales to nonprofits only.

"I do not expect a massive tsunami of nonprofits," Gordon said. "The process of getting qualified as a participant in these auctions is extremely complex. It's almost laughable to think that a mom-and-pop nonprofit is going to show up at HUD's door and start bidding on these things."

For starters, nonprofits face an uphill battle securing capital from private investors — New Jersey Community Capital has relationships with MetLife and Prudential, while Hogar Hispano works with smaller investors. Nonprofits may also face challenges developing working relationships with servicers for the loans, since they can't pay top-dollar prices like their private equity counterparts.

But both of the nonprofits have invested time and effort into building capacity and applaud HUD and GSE efforts to spur increased participation. Hogar Hispano and Morales in particular have devoted time to training sessions with nonprofits to help them learn how to access capital and participate in these sales.

Morales also believe that HUD can go a step further, arguing that up to 50% of HUD's nonperforming loan sales should go to nonprofits

"I know it's ridiculous because I'm creating my own competition," he said. "But if we don't then we won't have a proven track record in this space and there's no need for HUD or Fannie to do this the next time around."