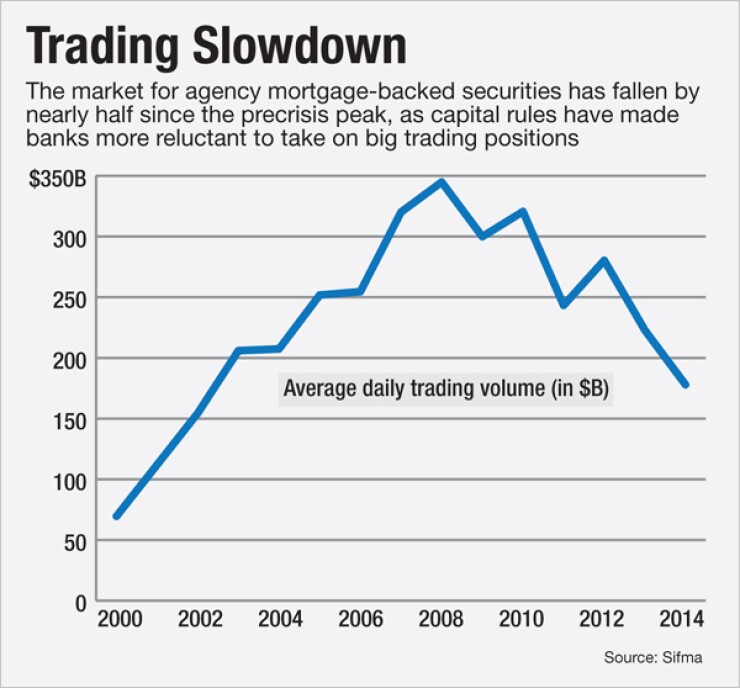

The recent lull in the market for securities backed by agency mortgages could be a hint of danger for the bond market, and may ultimately reduce the liquidity for banks to lend to homeowners.

The trading volume for mortgage-backed securities guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae sharply slowed in the first quarter. Meanwhile, issuance has risen, and the amount of outstanding securities is steadily increasing — a combination that is making the market slack, and which could affect the underlying market for mortgages.

Large banks that serve as broker-dealers for these securities have pulled back because of higher capital burdens that they have to bear, said Ron D'Vari, co-founder of the consulting firm NewOak Capital.

"As we're getting close to the implementation of Dodd-Frank and the Basel III framework, you are seeing capital get more restricted," he said. "Some banks have gotten out of that trading zone, and the ones that are staying are much more careful about allocating their capital."

The average daily trading volume for agency MBS has fallen 43% since 2008, its busiest year, to $188 billion last month, according to the Securities Industry and Financial Markets Association. Trading volume has slid the last three months after jumping in January to its highest rate in nearly two years.

This pullback could mean there will be fewer players with the bandwidth to keep the market liquid in a period of stress, D'Vari said. The four largest U.S. banks handle the great majority of the agency MBS broker-dealer business, and they have become more reluctant to take on the large trading positions that keep the market flowing — particularly when the market gets choppy.

Moreover, the reduced trading of agency MBS could lower market profitability, ultimately making less liquidity available for banks of all sizes to make mortgages.

"The reason we had such a good mortgage finance business in the U.S. is that it was backed by the most liquid of markets," that is, agency MBS, D'Vari said. Now, however, "even the most liquid parts of the market have started to show signs of illiquidity."

The trading slowdown also coincides with reduced appetite for agency MBS from large entities whose demand has kept the market going in recent years.

The Federal Reserve's holdings of mortgage-backed bonds

Large U.S. commercial banks, meanwhile, have

Expectations of a rate hike have also dampened MBS trading. With the Fed's long-awaited rate hike expected later this year, companies are reluctant to take big positions on long-term securities.

"This pending hike forces people to be very hedged; they shut down their activities and don't stray away from their benchmarks," D'Vari said.

Meanwhile, Fannie and Freddie have been issuing new MBS at a faster rate this year than last. The GSEs issued $130.5 billion in MBS last month, compared with an average of $82 billion a month last year. The total amount of agency MBS outstanding has increased every quarter since 2011 and reached more than $6 trillion at the end of March, according to SIFMA.

The slowdown in trading, combined with the increase in new issuance, is likely because of concerns about capital and interest rates, rather than the underlying performance of the securities, analysts say. The Bloomberg MBS Bond index, which tracks agency securities,has returned 5.19% over the past year, more than Bloomberg's indexes that track U.S. Treasury bonds and corporate bonds.

The underwriting of agency mortgages has gotten much stronger since the crisis, and consequently the credit performance of more recent agency loans has been "great," said Grant Bailey, head of U.S. residential mortgage-backed securities for Fitch Ratings.

"The credit attributes of the recent vintage loans has been quite a bit stronger than precrisis, and the performance has been a lot stronger," he said.

The pullback by major players could even make agency MBS a buying opportunity for investors, relative to other bonds. Fund managers at DoubleLine, a mutual-fund family, recommended buying agency MBS last month, writing in a research note that the securities should be "part of a solution" for investors looking to diversify away from corporate and U.S. Treasury bonds.

The market for nonagency MBS, meanwhile, has been stable. Last month, an average of $4.4 billion on nonagency MBS was traded every day, the same as in 2011, the first year SIFMA tracked daily trading volume for the securities.

Nonagency RMBS issuances dried up nearly completely during the financial crisis, dropping from $507 billion in 2007 to zero in 2009. It has since restarted modestly, and in the first quarter $1.2 billion of nonagency RMBS was issued.