Ginnie Mae is mulling whether to guarantee a new type of securitized-loan pool.

It plans to conduct a test run made up entirely of modified and reperforming loans that at the outset would come from its balance sheet.

"We're doing this as an experiment," Ginnie President Ted Tozer said. "We have quite a few of these loans that we've bought out from pools over the years, mainly from the

Ginnie would sell the new pool type outside of the main "to-be-announced" market as a specified pool. RPLs and mods otherwise will continue to be pooled along with recent production in multi-issuer Ginnie II securities.

The government agency plans to issue pools made up of Ginnie-owned loans using the new pool type by this summer, John Getchis, senior vice president of capital markets at Ginnie, wrote in an email.

"We will share our price discovery with the industry," he said.

Specified pools are more common at the agencies than Ginnie, according to a 2015 JPMorgan Chase report. For example, Freddie Mac has three pool types for mods or RPLs, Freddie spokeswoman Lisa Gagnon wrote in an email. All contain loans that were performing for 12 months at securitization.

Ginnie is testing a specified pool of this type that has a large number of mods to pool because its previous sub-servicer of the Taylor, Bean portfolio was unable to pool those loans as they became current, Tozer said in an email.

Tozer did not immediately reply to questions seeking the names of the subservicing companies that formerly handled or currently run the Taylor, Bean portfolio, or why the reperforming loans had not previously been pooled.

The volume of newer FHA RPLs and mods that issuers could contribute to the potential new pool type has dwindled in line with 90-day delinquencies since the downturn when Taylor, Bean defaulted.

However, there have been significant concentrations of mods and RPLs in some types of contemporary Ginnie securitizations. Mods and loans that appear to be RPLs based on their weighted average loan age were more than 25% of recently originated Ginnie IIs at one point in 2015, according to the JPMorgan report.

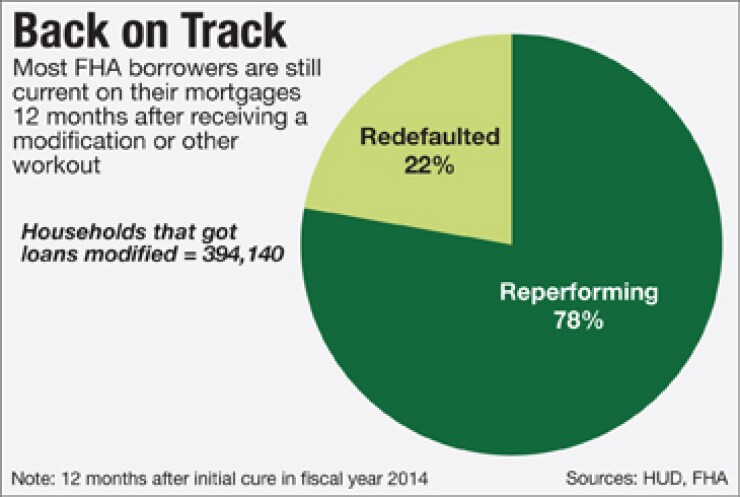

There were 394,140 households that had trouble paying their Federal Housing Administration loans between Oct. 1, 2013, and Sept. 30, 2014, and received a modification or other type of cure for the first time during that fiscal year.

Seventy-eight percent of these remained reperforming after 12 months, and while 22% redefaulted within a year after the first cure, some in that category received multiple cures and may have reperformed later. In total there were 480,436 cures applied to FHA loans during fiscal year 2014.

Modifications are complicated for Ginnie issuers that service loans, or

When loans have been delinquent for more than 90 days, Ginnie servicers have to buy the mortgages out of pools or cover the payments, and then mitigate losses as specified by FHA rules. If borrowers start paying regularly after modification, the loans that have been removed can be reinstated in pools.

How Ginnie will define RPLs in its test pool remains to be seen, but it could require timely payments of somewhere between three and 12 months after the loss mitigation is applied.

What price investors are willing to pay for any new type of security or loan pool is typically uncertain because the new investment lacks a specific track record that buyers can use to size up its value.

"The market would receive any new [pool type] with interest, but they would want a lot of data on the performance characteristics on [Ginnie's or] FHA's own pool before they started to put numbers on the bonds," said Walter Schmidt, a senior vice president in FTN Financial Group's Chicago office.

FHA/Ginnie reperforming rates can vary widely depending on seasoning, modification type, vintage and coupon, according to JPMorgan research and separate FHA data. So how investors may react could depend on the test pool's composition.

Investors pricing the bonds will look particularly closely at how mods and RPLs have prepaid due to refinancing or redefaults.

Historically, the prepayment profile of mods and RPLs has been "mixed," Tozer said.

During the housing downturn, the rate of 90-day delinquencies that occurred within three months of a modification or other type of loss-mitigation measure was 9.76%.

In more recent fiscal years, the equivalent FHA redefault rate three months after cure has been about 3%, and the redefault rate 12 months after cure has been closer to 22%.

Although there is considerable performance variation within the universe of FHA mods and RPLs, the two categories of mortgages still might have a better prepayment profile than recent production.

"Given the relatively high levels of voluntary refinancing in the market, the prepayment advantage provided by the low rate sensitivity of [Ginnie] mods and reinstateds outweighs the cost of high redefaults," JPMorgan researcher Matt Jozoff said in a report on 2015 securitizations.

Overall home loan refinancing rates have trended downward over time, but refis still constitute more than 50% of home loan applications, according to recent weekly

Given such current market conditions, former Ginnie Chairman Joe Murin thinks it may be worth it for Ginnie to test out the new pool type.

"An alternative liquidity instrument makes sense. They just don't know how that's going to work yet and whether there would be an appetite for it in the marketplace," said Murin, who is currently chairman of the investment advisory firm JJAM Financial LLC in Pittsburgh. "They'll see how it goes, and if it goes well they'll continue."