Mortgage momentum might be the lone bright spot for many small banks reporting quarterly earnings.

Community banks have faced difficulties boosting revenue, especially noninterest income, in recent years, given heightened regulatory scrutiny, competition and changing consumer demands. But mortgages, and specifically fees from selling originations, have been a mainstay for smaller institutions.

Cyclicality is always a concern. While the second quarter is typically a strong period for originations, due to the spring home purchases, low rates seem to be providing a lift to refinancing activity. Though bad for other loan categories, it could provide some relief to banks that have sizeable mortgage operations.

The research team at Keefe, Bruyette & Woods forecast in a recent note that second-quarter profit at the community banks it covers should, on average, increase by 5% from a year earlier, which should nominally improve returns. Mortgage banking activity played a big role in the team's predictions.

A key consideration for investors should be bankers' projections for mortgage-related revenue in coming quarters, though some industry observers believe that low rates could provide an ongoing lift through the rest of this year.

"We expect to see a bounce in mortgage[s] in second quarter and maybe even thereafter," Kevin Fitzsimmons, co-head of equity research at Hovde Group, said.

"That may be the one positive byproduct of the lower rate environment," Fitzsimmons added. "We'd expect to see more juice from refinancing activity that months ago everyone thought was in a long, steady decline."

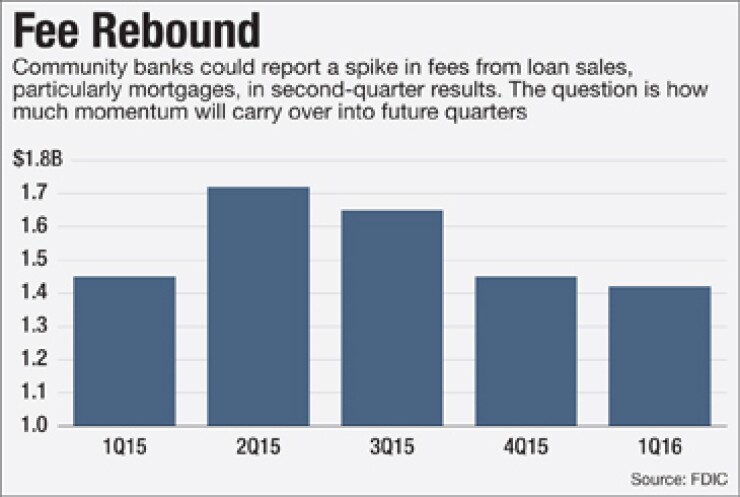

Fees from loan sales, including mortgages, had been tepid. Such fees for community banks fell 2% in the first quarter from a year earlier, to $1.4 billion, based on data from the Federal Deposit Insurance Corp.

That trend could be changing. The 10-year Treasury, which has a strong correlation to mortgage rates, is down nearly 29% this year, ending Friday at 1.6%. And refinancing volume in early July increased nearly 65% from a year earlier, reaching its highest level of activity in three years, according to the Mortgage Bankers Association.

Other factors could also influence banks' mortgage results. Refinancing activity has historically been rate driven and, by extension, hyper competitive. The competitive landscape also changes on a regular basis as banks ramp up or scale back in that business.

BankUnited in Miami Lakes, Fla., disclosed in January that it had

"Banks that are heavily concentrated in mortgage lending will probably see a good boost this quarter" due to "low interest rates and a healthy economy," said Joe Gladue, director of research at Merion Capital Group. "There are a lot of people employed. We're getting close to full employment and that, coupled with low interest rates, should be a good omen for mortgages."

At the same time, low rates do not automatically translate into bigger returns.

Wells Fargo, which has the industry's leading mortgage business, last week reported that its mortgage fee income fell 17% from a year earlier, to $1.4 billion. The $1.9 trillion-asset company said it is losing mortgage-servicing customers as other companies refinance them into new loans.

A good, but not great, economy should still help broader results at smaller institutions. Higher oil prices should improve the tone of calls hosted by energy lenders, and banks of all sizes are originating more loans. KBW, for instance, expects that the community banks its analysts cover will report 9% year-over-year loan growth in the second quarter.

"I think earnings for the group will be fairly decent this quarter," Chris McGratty, a KBW analyst, said in discussing the outlook for smaller banks. "The key is what the outlook [will be] because of what's happened with rates in the last month. I think the message will be loan growth's still pretty good, credit costs are still pretty benign."