Regional bankers provided strong indications on Tuesday that the industry's optimism may need to be toned down when it comes to loan demand.

The bucket of cold water came in the form of anecdotal and statistical evidence at the Credit Suisse Financial Services Forum in Miami Beach, Fla. Executives said their business clients are not yet ready to pull the trigger on major loan applications. And the latest data from the Federal Reserve, which was discussed at the conference, shows that demand for commercial and consumer loans contracted after the November election.

Good times may be on the way, but the spoils will not appear in banks' quarterly results for a while, warned Aleem Gillani, the chief financial officer of SunTrust Banks in Atlanta.

"All of that takes some time to deliver," Gillani said. "It takes time to draw up some architectural plans, to find contractors to start work. All of that takes time."

The remarks by Gillani and other regional bankers reinforced a message delivered by the largest banks in January. For example, JPMorgan Chase's fourth-quarter profits in the consumer and community banking division slipped 2% to $2.3 billion, but Chairman and CEO Jamie Dimon said expected improvement in consumer confidence and spending to spur growth for banks later in the year.

Bankers who spoke at the start of the two-day Credit Suisse conference indicated they expect lending to pick up later this year, too. That outlook jibed with the results of the Fed's quarterly Senior Loan Officer Opinion Survey released on Monday.

But the Fed's survey also provided evidence things are not yet where bankers want them to be. For the period of Dec. 27 to Jan. 9, demand weakened for land-based construction and development loans; multifamily lending; and most consumer loan categories, including auto, credit card and residential mortgage, Barclays analyst Jason Goldberg wrote in a Feb. 6 research note.

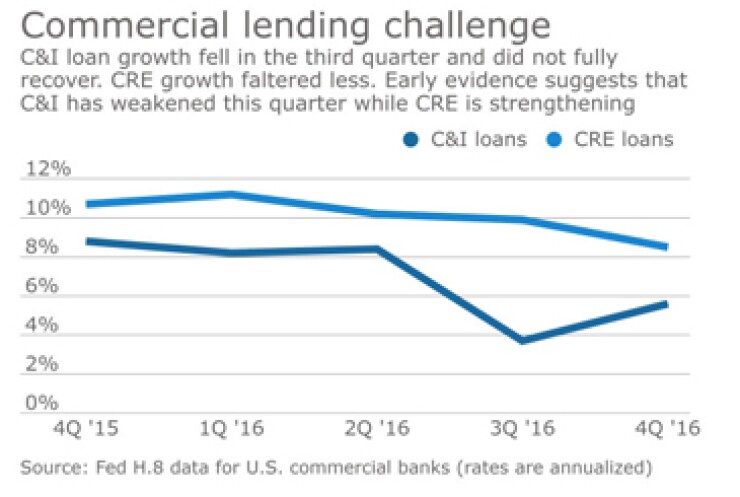

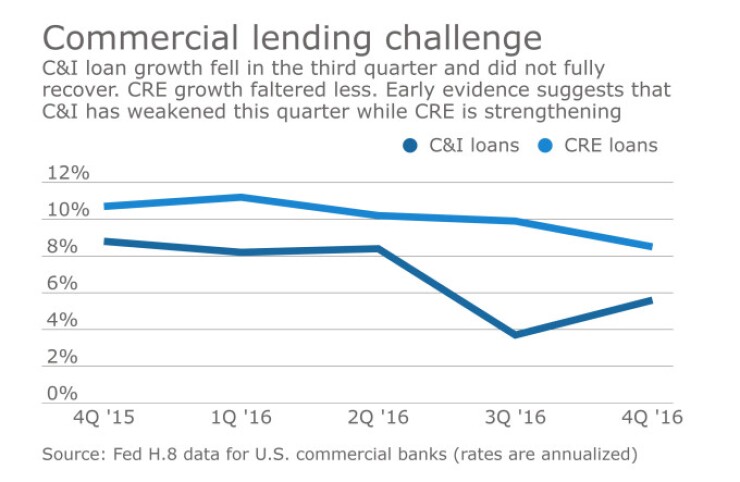

Moreover, the Fed's weekly H.8 report, released on Feb. 3, pointed to a slowdown in commercial lending in the second half of 2016 at U.S. banks.

Commercial and industrial loans rose at a 5.6% annual rate in the fourth quarter to $2.1 trillion, the report said. That was down from a nearly 9% pace a year earlier but better than 3.7% in the third quarter. The fourth-quarter 2016 performance included a negative 3% in December.

Meanwhile, growth in commercial real estate loan lagged in the second half, too, but outdid C&I loans. Fourth-quarter CRE loans increased at an 8.5% annual pace to nearly $2 trillion, slightly off the 10% to 11% marks in the previous five quarters, the H.8 report said.

Some of the numbers for early 2017 look worse. Core C&I loans were running at a negative 9.7% rate through Jan. 25 and consumer loans were at a negative 19.4% pace, according to a recent KBW report review of weekly H.8 data. However, CRE had strengthened, rising at a 9% annual rate, KBW said.

SunTrust's Gillani said he remains optimistic that anticipated changes from the Republican-controlled Congress and White House will be good for the $205 billion-asset company. Once that happens, it will "turn into incremental business for SunTrust in both loan growth and capital markets," he said.

President Trump has proposed cutting the corporate tax rate to as low as 15% and spending up to $1 trillion on upgrades to infrastructure like roads and airports. Further rate hikes this year could be in the offing from the Fed, too.

Commercial customers at the $446 billion-asset U.S. Bancorp have provided "a lot of very positive" energy about potential federal policy changes, Chief Financial Officer Terry Dolan said at the conference. But few are ready to make a big splash quite yet, he said.

Those customers have told U.S. Bancorp that they "have to actually see something actually take root from a policy perspective — whether that's tax policy, or whether that's actual infrastructure spend[ing]," Dolan said. "A lot of that positive energy is also in a little bit of a wait-and-see mode."

Notably, the cautious sentiments that Dolan referenced came from a wide sampling of U.S. Bancorp's commercial client base — middle-market, small-business and large corporate borrowers.

The $126 billion-asset Regions Financial in Birmingham, Ala., has been especially cautious about CRE lending. Chief Financial Officer David Turner noted during the conference that Regions has pulled back significantly on construction lending in Atlanta, Houston, Nashville, Tenn., and the Carolinas.

"We thought those areas were getting too hot," Turner said. "We're not going to go back and live the dream that we just escaped from."

Indeed, many small banks seem to be seizing the opportunity to grab some commercial real estate business as larger lenders like Regions and U.S. Bancorp pull back. U.S. Bancorp Chairman and CEO Richard Davis on Jan. 18 told analysts that "a lot of smaller banks…are doing some things that you guys aren't even writing about, because you don't follow the small banks. But we're in the middle of that, and we're not going to play."

Discover Financial Services offered a counterpoint on Tuesday, as Chief Financial Officer Mark Graf said the Riverwoods, Ill., company's personal lending business has thrived. One reason has been the difficulties that online lenders such as Lending Club and Prosper Marketplace have faced, Graf said. But Discover has also made changes to boost the business.

"I think really it was redesigning the website — the client-acquisition experience — and making some enhancements to the product itself that drove the incremental growth," Graf said at the conference.