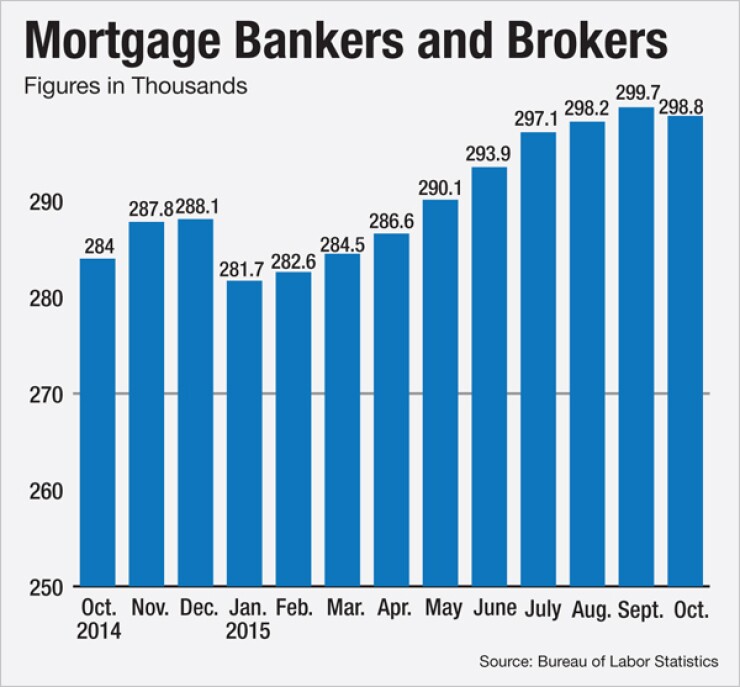

Hiring by nonbank mortgage lenders stalled in October after adding new employees to their payrolls for eight straight months.

Nonbank mortgage lenders and brokers reduced their payrolls by 600 full-time employees in October after hiring 1,500 a month earlier, when total jobs in the sector hit a two year high, according to a report released Friday by the Bureau of Labor Statistics.

The hiring slowdown appears partially due to expected interest rate hikes soon by the Federal Reserve Board.

Overall, the U.S. economy created 211,000 new jobs in November and the October jobs report was revised upward to 298,000 from 271,000. The unemployment rate remained unchanged at 5%. (The BLS industry-specific estimates lag national reporting figures by one month.)

The BLS report "showed another strong month for jobs gains, along with upward revisions to prior months," said Curt Long, chief economist at the National Association of Credit Unions. "This should put to bed any doubts about whether the Fed will announce a rate increase later this month."

CoreLogic chief economist Frank Nothaft was looking for a higher jobs number of 270,000 to force the Fed's hand at its meeting next week. If the Fed does approve a fed funds rate increase, it is expected to be a 25-basis-point hike.

"If the economy grows at 2% to 3% rate in 2016, the Fed will probably follow through on its targets and raise the fed funds rate by one percentage point," Nothaft said in an interview Thursday. That could push up mortgage rates by 50 basis points from the current rate which is close to 4%.

"By the end of 2016, we could see 30-year fixed mortgages at 4.5%," Nothaft said.

Economists at the Mortgage Bankers Association are forecasting a 13% drop in mortgage originations in 2016. Originations are expected to drop to $293 billion in the first quarter of 2016 from the $360 billion in the current quarter.

BLS also reported Friday that jobs in the construction trades rose by 46,000 including 26,000 hires by residential contractors, which is a good sign for purchase mortgage activity.

The implication for housing is "encouraging, as construction payrolls posted the best back-to-back gains since January. Today's report reinforces our view that underlying domestic demand appears to be solid enough for the Fed to finally depart from its zero interest rate policy this month," said Doug Duncan, chief economist for Fannie Mae.