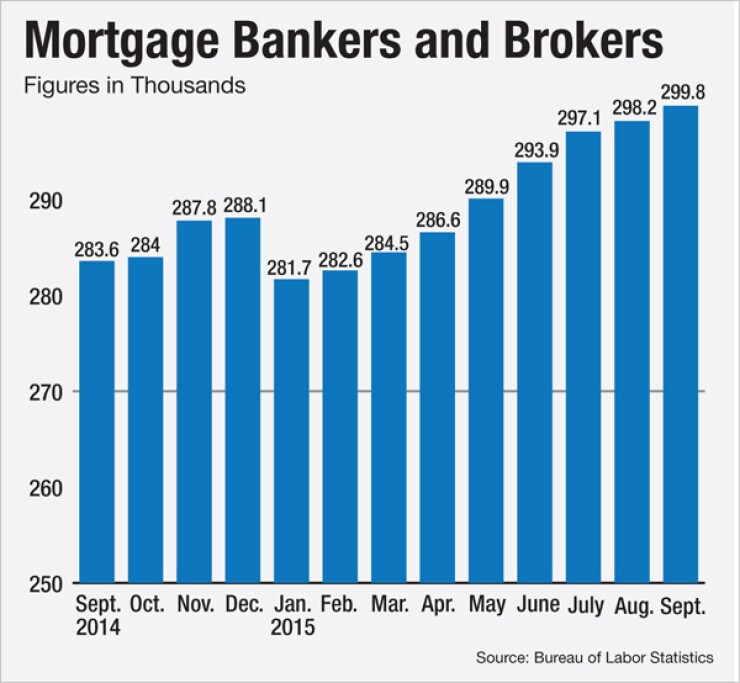

Nonbank mortgage lenders added 1,600 employees to their payrolls in September, while

Industry employment rose to 299,800 in September, up 5.7% from a year ago. Together with the new August figures, the nonbank sector of the mortgage industry has added jobs for eight straight months, going back to January 2015.

The September estimate marks the highest level of mortgage industry employment since August 2013, when employment was an estimated 300,400 workers. Meanwhile, the overall U.S. economy created 271,000 new jobs in October. (The BLS industry-specific estimates lag national reporting figures by one month.)

This unexpectedly strong report is likely to lead to higher interest rates, according to Scott Anderson, chief economist at the Bank of the West.

"This will likely trigger an initial interest rate hike from the Federal Reserve in December and acceleration in U.S. dollar appreciation and interest rate increases," Anderson said in a statement.

JPMorgan Chase economists expect to see a "gradual increase in mortgage rates over the coming year" that could lead to a "typical late-cycle housing slowdown," according to a recent report.

However, most of the slowdown will likely be on the multifamily side, as the "shift toward renting finally may be letting up," according to the Oct. 30 JPMorgan U.S. Weekly Prospects report. "The single-family share of housing starts has stopped declining and leveled off." At the same time, "homeownership rates for those under 35 are up two quarters in a row."

In reporting the October jobs numbers, BLS also revised the September jobs number to 153,000, up 17,000 from its previous report.

The national unemployment rate edged down to 5% in October, from 5.1% in September.