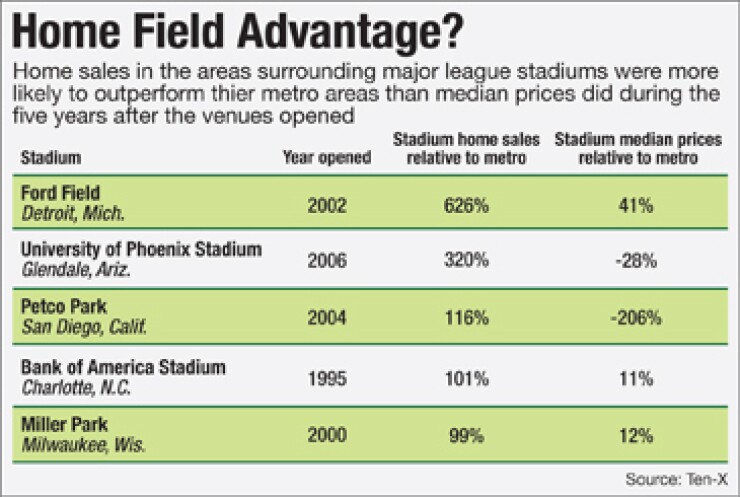

The jury is still out on whether new sports stadiums are economic engines for their communities. But when it comes to housing alone, new stadiums are a boon for local home sales, but don't always contribute to home price appreciation.

Sales of houses within close proximity — three to six miles — to 12 stadiums for professional sports teams that were announced in the 25-year span between 1990 and 2015 outpaced the overall metropolitan markets 80% of the time, according to real estate technology firm Ten-X, the

Once the stadiums were opened, sales in the immediate areas were 70% above that of the entire metro area. The results were strikingly more modest for price gains, but nearby population growth was significant.

The study is not an attempt to evaluate the merits of how stadiums are financed, which is the major bone of contention between proponents of public financing and those who are opposed to it.

"It's just a real estate study on the performance of housing markets," said Rick Sharga, Ten-X executive vice president.

The Irvine, Calif.-based company undertook the study when staffers during an internal meeting wondered what the impact of the new home planned for the Los Angeles Rams football team in nearby Inglewood would have on the local real estate market.

The stadium is being built a few miles from downtown Los Angeles on a 300-acre site. At $2.6 billion, it is expected to be the world's most expensive sports arena when it opens in 2019.

Only time will tell what will happen around the as-yet unnamed stadium. But Sharga expects the same big spike in sales that was found in other markets.

In half of the dozen stadiums covered in the report, prices in their immediate areas grew at a greater percentage than they did for the entire metro area, said Matthew Schreck, a quantitative strategist with Ten-X.

In the rest, values still grew but not at as great a rate as the overall market, Schreck explained.

At the same time, populations in the immediate vicinity of stadiums studied grew 26% above the broader metro area after they were opened.

It also helps when the teams occupying the stadiums are highly ranked. In those cases, the study found that nearby housing sales are likely to be stronger than if the teams are perennial losers.

Take, for example, Petco Park, the downtown home of the lowly San Diego Padres baseball team, an architectural gem which opened in 2004 and immediately became known as "America's Best Ballpark."

In the five-year period after the stadium was announced in 2000, the volume of homes sold within a three-mile radius was 295% greater than for the city as a whole. Even after the Petco opened, sales in the vicinity were 116% greater than for the entire city, Tex-X found.

The population around the ballpark also blossomed 31% between 2000 and 2010. Over the same period, the San Diego metro area's population grew by just 11%.

At the time of the stadium's announcement, the five-year average median home price was down 33% relative to the broader metro area. At the park's opening, the five-year average median home price was off 206% from the entire San Diego market.

Of course, local market conditions play a big role in the study's findings, said Sharga, who ventured that the glut of downtown San Diego condominiums during the study period probably had an impact on pricing.

The neighborhoods within a three-mile radius of Nissan Stadium in Nashville, the home of football Tennessee Titans, showed even more activity than those in San Diego. Sales were 412% greater in the stadium area in the five-year period after the stadium was announced in 1995 than the overall Nashville market.

Sales slowed considerably after Nissan Stadium opened in 1999, but they were still 12% greater than the larger market in the following five-year period. During that same period, prices and population around the stadium outpaced the entire market by 13% and 12%, respectively.