Deutsche Bank is planning a return to the U.S. mortgage business by again financing home lenders, and it will do so by focusing on a product that most say they are unwilling to sell, American Banker has learned.

A New York unit at Germany's largest bank has received the green light to target lenders making mortgages falling outside of new regulatory guidelines, two officials with direct knowledge said.

"Deutsche sees enormous potential in nonqualified mortgages, period," one of the officials said. "Deutsche cannot stand by as competitors who stayed in residential lending begin to reap the benefits."

The decision to finance makers of non-QM loans is significant for Deutsche Bank, one of the many large banks trying to recover from the subprime mortgage crisis. It is also meaningful to the broader housing market, which seeks reassurances that the new mortgage rules, which took effect in January, will not cut off production for all but ultrasafe home loans. The market has the potential to become a $600 billion a year industry for originations, Deutsche Bank researchers said in a recent report.

Many traditional lenders are still hesitant, if not afraid, to offer non-QM mortgages. They argue the Consumer Financial Protection Bureau's Qualified Mortgage and Ability-to-Repay rules are overly restrictive in their intent to prevent banks from making loans to borrowers who cannot afford them. Loans that fail to meet that standard will be denied protection from borrower claims and suits, and that is a major deterrent.

Paul Nikodem, head strategist at Nomura Securities International, said the path towards non-QM lending is slowly gathering momentum. In April, one-third of commercial bankers polled said new lending guidelines would be prohibitive. That attitude may now be slowly changing, as investors communicate a greater willingness to take on lenders' litigation risks.

Sprinkles of nonqualified mortgages have begun to

Kyle Gunderlock, managing director of Citadel Servicing in Irvine, Calif., said that Citadel is originating non-QM in droves and they are seeing intense investor demand for their product.

"We are selling smaller-sized pools, a couple of them three times a month, and sold at premium," he said. "It's like making a great cheeseburger. Everybody wants one."

Citadel is looking to hire 100 more staffers in coming months, he said.

Deutsche Bank is pursuing specialty lenders similar to Citadel. Their goal is to take advantage of investors' appetite for riskier, higher-yielding assets and act as both a warehouse lender and a gateway to securitization markets, where Deutsche Bank would place the deals. A standard warehouse line of credit — similar to what Deutsche offers clients in single-family-rental and nonperforming loan markets — would be larger than $100 million, and would facilitate the production of nonqualified mortgages, the two officials said. Securitizations around $500 million could be ready for issuance in the first half of next year, one of the officials said.

While securitization is the ultimate exit strategy, it is not the only one. Impac Mortgage in Irvine, Calif., announced last month a partnership to sell all of its non-QM collateral to the New York-based capital markets arm of Australian bank Macquarie Group.

Steven Ujvary, managing director in Macquarie's fixed income, currencies and commodities division, saidthat Macquarie will for now hold the mortgages as investments.

"We expect that liquidity in the non-QM space will continue to develop, including both a more active whole-loan market, similar to the jumbo mortgage space, as well as the securitization market," he said.

Other firms, including Fenway Summer, are aggressively originating agency-eligible non-QM loans, but they are not involved in correspondent relationships. Their goal is to securitize and retain the most subordinate notes. Chris Haspel, head of Fenway's capital markets arm,

Most observers believe such a timeline is unrealistic. "I don't anticipate seeing a large concentration on non-QM, or even an entirely non-QM pool, until sometime in 2015," said Michele Patterson, a managing director at Kroll Bond Rating Agency. Constructing appropriate legal reserves has been a thorny issue for rating agencies, analysts agree. It would be possible to privately place an offering without credit ratings.

That could be one way to privately test investors' risk tolerance, which may largely determine other banks' willingness to commence lending operations or to build them out.

Large U.S. banks may also finance the nonconforming market, but their roles would be more complicated than Deutsche Bank's. Wells Fargo and others, for example, have previously

Deutsche Bank, by contrast, will not underwrite the underlying or individual loans, and it will not act as a trustee in any securitization, a decision made to limit any possible litigation exposure, one of the officials emphasized.

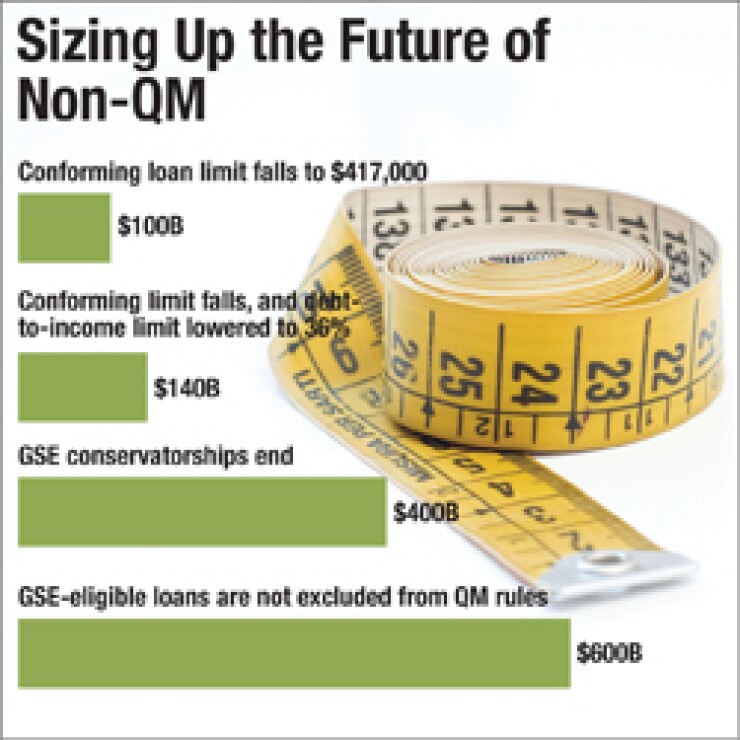

The market for non-QM collateral could one day reach $600 billion in loans per year, Deutsche Bank researchers Ying Shen and Richard Mele said in a July estimate. Current market conditions are producing what would amount to $50 billion a year. The ultimate figure will depend on the size of the institutions entering the business, and perhaps most significantly, the future of Fannie Mae and Freddie Mac. A complete wind-down of the agencies would result in a non-QM market of $400 billion. A smaller step, such as a reduction of the conforming loan limits down to $417,000, would double current production to $100 billion per year, they wrote.