Add Amalgamated Bank to the list of financial institutions looking to gain an edge in marketing to millennials.

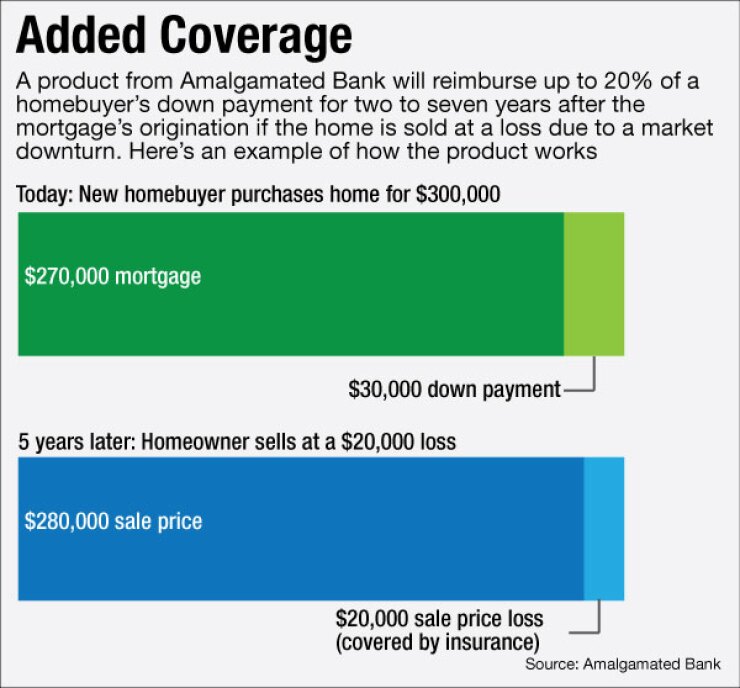

The New York bank has started offering down payment insurance for homebuyers. The product — offered through a third party — covers a percentage of a borrower's down payment if they have to sell their home at a loss.

Amalgamated's goal is to differentiate itself in a highly commoditized market. The coverage is designed for homebuyers, especially millennials, who are concerned about putting their life savings into a house, particularly in light of the last housing crash.

"Millennials and renters are afraid that if they buy a home today they may not get that down payment back if they sell in the future," said Joe Melendez, chief executive of ValueInsured, the company that created the offering. "This product gives confidence and empowerment when you take that risk off the table."

The product, which ValueInsured hopes to offer through more banks, provides homebuyers with insurance that covers up to 20% of a home's purchase price or the actual equity lost,

Amalgamated decided to pioneer the insurance because it is "committed to putting roofs over people's heads," President and CEO Keith Mestrich said.

The product should be appealing to first-time homebuyers, particularly those who might be concerned about recouping their investment if they are transferred in their jobs in a depressed housing market, Mestrich said. "This way they can take that risk and at least get back their hard-earned dollars," he said.

The $3.8 billion-asset Amalgamated, and other banks looking to introduce new consumer products, must carefully vet their partners to avoid issues with regulators such as the Consumer Financial Protection Bureau, industry experts said.

"There will be a wide array of laws and regulations that apply to any consumer financial product," said Elizabeth Khalil, a member in the government policy practice group and regulated industries department at Dykema. "It's important to think from the prospect of the consumer … and how they're likely to perceive what is being disclosed."

Banks also need to determine whether a new product "could be perceived as harmful to the consumer," Khalil said. "That helps you get out in front of any consumer protection issues."

There are other risks associated with being the first bank to introduce a product. Amalgamated, for instance, had no way to evaluate methods to reduce risk or gauge customer acceptance.

To address those concerns, ValueInsured vetted the product with banking and insurance regulators, including the CFPB, Melendez said. The CFPB's mission of protection and transparency "fits with our objectives," he said.

The CFPB declined to comment for this story.

Banks thinking about offering down payment insurance should seek feedback from regulators, said Lynn David, chief executive of Community Bank Consulting Services. Bankers should show regulators materials such as written agreements with third-party provider and any sales literature they might give to a customer.

Insurance products are tricky to get right, Khalil said. Clear disclosures are extremely important, and the value of the insurance must be fair to the consumer. Third-party relationships have also been drawing close scrutiny from regulators. Any shortfall in service could open a bank up to reputational risk.

"You have to make sure you analyze the third party's stability," among other things, David said. "You need to make sure there won't be any negative implications to the bank."

Amalgamated spent six months vetting ValueInsured in a process that included research into the potential for consumer data being exposed and a full review of the vendor's operational and technical systems, a bank spokesman said.

Amalgamated has taken steps to make sure its customer service agents and mortgage staff are aware of the insurance and the need for proper documentation, Mestrich said. The product has also been built into the bank's existing automated systems.

In-house training by the bank is critical for success, Khalil said.

"Banks get into trouble by allowing the third party to drive the bus," Khalil said. "They aren't aware of the training going on, the scripts being used and what customers are being told."