Some banks can't get out of their Federal Deposit Insurance Corp. loss-share agreements fast enough. Others, however, may have to stay partners with the FDIC for a while longer.

The banks that have been rushing to terminate their agreements want to exit before the FDIC's protection expires and they have to shoulder the full cost of nonperforming loans obtained in failed-bank deals. Exiting early can provide some financial advantages if the loans have started performing again.

"Instead of it being a two-way street, now it's a one-way street" if banks are not proactive, said Brennan Ryan, an attorney at Nelson Mullins Riley & Scarborough who advises banks on acquisitions and capital raises.

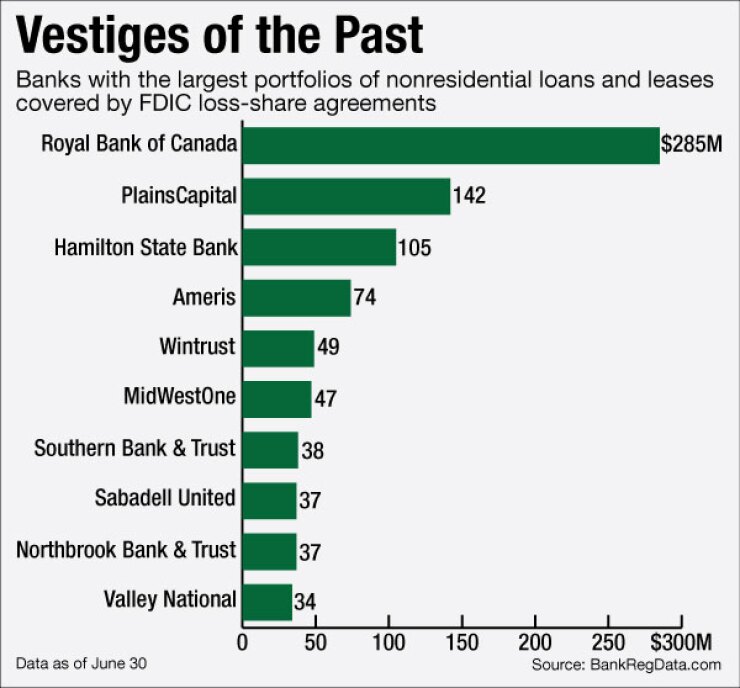

Yet dozens of banks, including Royal Bank of Canada and community banks such as Hamilton State Bank and Ameris Bancorp, have not yet ended their loss-share deals, according to FDIC records. Their reasons are uncertain.

After the financial meltdown the FDIC typically agreed to share 80% of the losses from the assets of failed banks in order to facilitate their resolutions, although the FDIC's share varied by deal. The coverage on nonresidential loans expires after five years, and on residential mortgages after 10 years. Banks own the loans regardless of whether the FDIC is sharing in the losses, so most banks have preferred to terminate the loss-share agreements before their expiration so they do not have to continue paying loss-share-related expenses.

RBC had the largest portfolio of nonresidential covered loans at June 30 with $285 million, which it inherited through its November acquisition of City National Bank in Los Angeles. City National purchased deposits and assets of four failed banks from 2009 to 2011, including $3.2 billion of assets covered by loss-share agreements, according to FDIC press releases about the deals.

RBC, Hamilton and Ameris did not return calls seeking comment for this story.

The $9 billion-asset PlainsCapital Bank in Dallas had the second-largest nonresidential total at $142 million loans. It is nearly three years into its loss-share agreement on loans acquired in September 2013 from First National Bank of Edinburg in Texas. PlainsCapital has not yet discussed whether to seek an early termination of the agreement, Jeremy Ford, chief executive of Hilltop Holdings, PlainsCapital's holding company, said in an email.

PlainsCapital acquired both nonresidential loans, for which loss-share expires in September 2018, and residential mortgages, which lose their loss-share coverage in September 2023. As of June 30, PlainsCapital had $181 million of covered residential mortgages in addition to the $142 million of covered nonresidential loans, according to its call report.

The largest remaining loss-share loan portfolios are made up of residential mortgages. CIT Bank's $4.8 billion balance of loans and other assets is the largest, followed by U.S. Bank's $3.3 billion portfolio.

It could be that some banks still in the loss-share program may have overestimated the loans' value when they were acquired from failed institutions, Ryan said.

"There could be situations where banks have not properly valued their loss-share assets," he said. "They may not want to terminate the loss-share coverage because it would require them taking a big charge that they would have to explain to the market. It would be an embarrassment."

Other remaining banks may want the insurance that loss-share plans provide. Many bankers have been worried about the performance of home equity lines of credit, as many homeowners are getting socked with higher monthly payments as balloon rates kick in, said Randy Dennis, president of DD&F Consulting Group in Little Rock, Ark. Some home equity lines may receive longer terms of FDIC loss-share coverage, as residential loans get 10-year protection periods from the FDIC, compared with the five years for all other loan categories.

"The one that scares most people are single-family second mortgages," Dennis said. "There are still areas out there where mortgages are still underwater."

Whatever the explanation for why some banks are still in the loss-share plan, it must be a good reason, Ryan said. Though loss-share program has been very well-managed by the FDIC, most banks are itching to get out of it.

"You're paying for the FDIC audits and for the increased staffing to deal with compliance," Ryan said. "It's a pain. You just want to be done with the FDIC."

Plus, banks that are able to secure early terminations can expect a quick financial boost. Loss-share deals can reduce a bank's noninterest income, largely because of the amortization of the FDIC indemnification asset tied to the agreements. Banks also must deal with high costs associated with collecting on the loans.

This year 25 banks have reached agreements on terminations. In the one of the most recent, the $3.2 billion-asset Park Sterling in Charlotte, N.C., on Monday agreed to an early termination on $15.5 million of loss-share assets.

Still a number of banks remain in the loss-share program, even if they have small portfolios subject to the insurance. The $151 million-asset Farmers State Bank in Hillsboro, Wis., had a remaining loss-share loan portfolio of $87,000 at June 30.

Banks provide limited details on their covered loans and when the FDIC's protections expire. The $1.8 billion-asset Hamilton State Bank in Hoschton, Ga., has not detailed when coverage will expire on its $105 million loss-share portfolio. Hamilton acquired four failed banks between 2011 and 2013, and it is likely that its agreement with the FDIC varied for all four banks. Hamilton's chief executive, Bob Oliver, did not return a call seeking comment for this story.