Bankers are still grappling with vendor software problems, longer processing times and delays in mortgage closings as a result of new disclosures that went into effect four months ago, according to a new survey by the American Bankers Association.

The survey, which was released Tuesday, found that banks are delaying closings by eight days on average, with some institutions reporting delays of up to 20 days.

"One of the more startling findings was the revelation of how many lenders are still waiting for updates on their" loan origination systems, said Robert Davis, a senior vice president of the ABA.

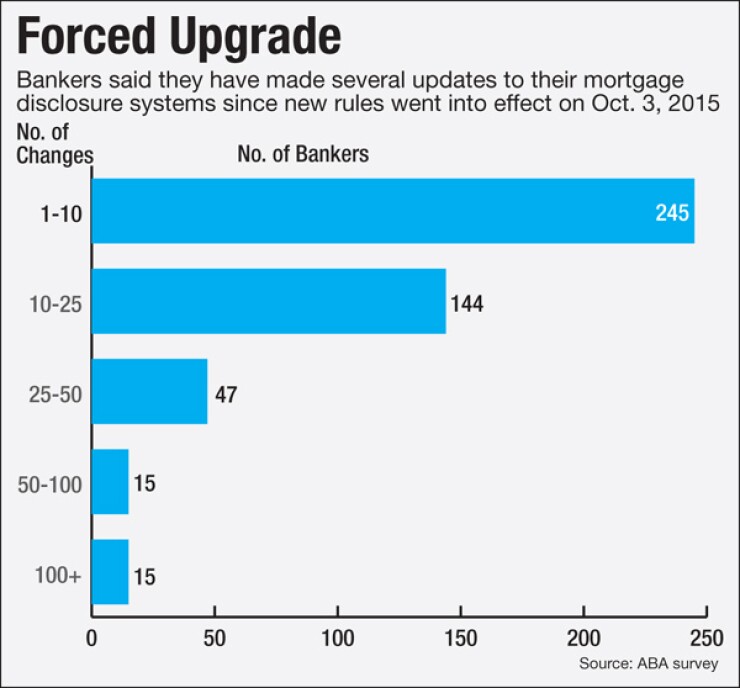

The survey of 548 banks found that most are having trouble because vendors are still updating their loan origination systems. Over three-fourths of survey respondents said they are still waiting for such updates and 83% claimed they are forced to use manual workarounds.

"As we anticipated, our bankers are struggling to comply in part because the systems being provided by vendors are incomplete or inaccurate," Davis said in a statement. "The causes of many of these systems problems are ambiguities in the TRID rule that require resolution."

Lenders had pressured the Consumer Financial Protection Bureau to delay the implementation of the Truth-in-Lending/Real Estate Settlement Procedures Act integrated disclosures (known as TRID) a second time, but the agency held fast to its Oct. 3 implementation date.

In an interview, Davis said there is an ongoing dialogue with CFPB about outstanding TRID issues with the aim of providing lenders with more certainty about the rules.

"But there needs to be a concerted dedicated effort by the CFPB to work with the industry to close open questions," Davis said. "That could resolve the LOS delivery problems."

The survey also highlights lenders' concerns about offering certain loan products. ABA found many banks have stopped making construction loans, adjustable-rate mortgages and home equity loans because the TRID "rule does not provide adequate compliance direction."

Meanwhile, 94% of the bankers surveyed want CFPB to keep the current TRID "good faith" grace period in place. This open-ended grace period is designed to shield lenders from enforcement actions and potential liability, if they are make a good effort to comply with the TRID rule.