Want unlimited access to top ideas and insights?

WASHINGTON — As President Trump heads to Capitol Hill Tuesday evening to make his first address to Congress, bankers are continuing to see him as a net positive for the financial services industry, according to a new poll from by SourceMedia Research.

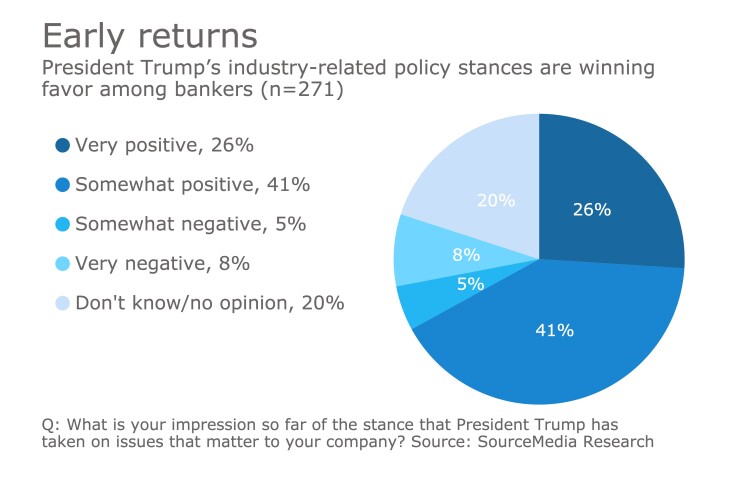

In a survey of more than 250 bankers taken in early February, roughly two-thirds of respondents said his actions to date have been either very or somewhat positive to the industry. Only 14% found his moves so far to be either somewhat or very negative, while 20% hadn’t formed an opinion yet.

The findings suggest support for Trump among bankers has only increased since the election. A SourceMedia poll taken in October found that 53% of 300 bankers polled said Trump would be better for their industry, compared with 20% for his rival Democrat Hillary Clinton.

In the February poll, 70% said they were very or somewhat confident that Trump’s policies would accelerate economic growth.

Another reason for bankers’ support is that they believe the Trump administration can deliver on promises of regulatory relief in the forms most sought after by the industry. Of those polled in February, 28% said they were “very confident” regulatory relief would be coming under Trump’s leadership, while an additional 51% were somewhat confident it was on its way. During Trump’s address on Tuesday evening, the president is likely to tout his efforts at deregulation, including a recent executive order targeting the Dodd-Frank Act.

As for what kind of regulatory relief would happen, bankers overwhelmingly — 81% — said reform of the Consumer Financial Protection Bureau would be part of any final effort, while 40% also predicted that a repeal of the Durbin amendment limiting debit interchange fees was in the offing. Almost half said that a simpler capital regime was likely to be part of any legislation.

Bankers’ predictions broadly tracked with what they want to see in any relief package. More than half — 53% — said reform of the CFPB was their top priority, while 82% selected it as one of their three top priorities. A quarter of bankers surveyed said simpler capital and liquidity requirements were their top priority, while 75% put it in the top three.

Relatively few — 11% — said that repealing the Durbin amendment was their first priority, but a sizable chunk, 54%, placed it in the top tier. Nearly 40% also listed reforming the Volcker Rule as among their top priorities, though that issue was primarily one for the bigger banks. More than 50% of those representing banks with more than $10 billion of assets said Volcker was a top-tier issue, compared with 35% for those from banks with between $100 million to $1 billion of assets.

Bankers’ priorities do not necessarily line up with everything Republicans are hoping to do. House Financial Services Committee Chairman Jeb Hensarling’s Financial Choice bill would target the CFPB, complex capital rules and the Durbin amendment — all areas in which bankers want change — but it includes other provisions that the surveyed executives do not consider a top priority.

For example, the legislation would repeal the Federal Deposit Insurance Corp.’s ability to use Dodd-Frank Act powers to seize and unwind a failing banking company, but only 15% of respondents listed that among their top three priorities when choosing from a list of options.

Similarly, raising the $50 billion systemic threshold, which subjects banks to extra rules including higher capital requirements, is only a large priority for larger institutions. Of the bankers surveyed that came from institutions with more than $10 billion of assets, 40% listed raising the threshold as a top-tier priority. Only 17% of bankers from institutions with between $1 billion to $10 billion of assets considered the issue of high importance relative to other issues.

The fate of nonbanks was similarly not top-of-mind. Only 16% listed limiting the Financial Stability Oversight Council’s power to designate nonbanks as systemically important as a top-tier priority.

Yet while bankers are mostly positive about Trump and his administration, they do have some concerns. Roughly 62% said they are worried Trump’s rhetoric and actions could trigger a damaging international trade war.

Somewhat paradoxically, however, more bankers than not said the Trump administration’s early moves regarding trade made them more optimistic about the economy. Roughly 43% said they were at least somewhat more optimistic, while 28% said they were somewhat or much more pessimistic.

But bankers’ responses clearly reflected some strongly held views on both sides. When asked to explain why they were optimistic or pessimistic, some lavishly praised Trump.

“We finally have a business mind in the White House, that also has the support of the House and Senate, so changes can be made,” wrote one respondent. “Trump will make a significant reduction if regulations that are over reaching and accomplish very little other than slowing down the process. Business owners now have confidence that we have a pro-business administration that understands the power of reduced regulatory oversight.”

Other optimists focused on the contrast with President Barack Obama’s policies.

“Trying to reverse 8 [years] of giveaways, fear, and uncertainty,” wrote one.

But for those who rated themselves as much more pessimistic, their view of Trump was far different.

One banker in the Pacific Northwest noted that trade was of “paramount importance” for agricultural and industrial products in the area.

“Trump has shown himself to be ignorant about the issues and not willing to become more knowledgeable before he undoes years of diplomacy, negotiation and trust-building,” the banker said.

Others cited Trump’s immigration policies as a cause for concern.

“Administration hostility toward trade presents significant challenges to cross-border business,” wrote one banker. “Additionally, immigration regulation threatens ability to attract and retain talent from the global talent pool.”