For an

During the run-up to his surprise victory against House Majority Leader Eric Cantor in the Virginia Republican primary, Brat repeatedly blamed the 2008 crisis on Fannie Mae and Freddie Mac. That's a well-known, if hotly debated, interpretation of history.

But Brat exaggerates the already-disputed data of the American Enterprise Institute purporting to show the government-sponsored enterprises' culpability for the collapse. He also appears to miss the distinction between lenders that originate mortgages and secondary market participants like Fannie and Freddie.

Brat has claimed many times on the campaign trail that the GSEs were responsible for the overwhelming majority of subprime originations during the housing bubble. He typically makes this assertion using generic terms like "made" or "went through" to describe the GSEs' role in mortgage lending.

"Fannie and Freddie made two-thirds of all subprime mortgages. That is not a free market institution," he said in a Fox News interview the evening of the primary election. "That entity, along with the Fed printing too much money back in '03 and '04, caused the housing collapse."

In a campaign speech, Brat suggested that the GSEs had completely disintermediated the banking industry by granting loans directly to borrowers (which would mean that every lender's nightmare from the late 1990s had come true).

"The recent financial crisis, where did it start? In the housing market. We all know basically, probably the primary cause is located in Fannie and Freddie," he said. "American Enterprise Institute estimates 70% of all subprime loans went through Fannie and Freddie. Instead of who? Instead of through your banker. So we're putting bankers out of business. Bankers aren't doing banking. In the past, bankers actually had to check your credit if you wanted a mortgage. Today, they don't and Fannie and Freddie, they just say 'here, here's a mortgage.'"

Obviously, bankers still check applicants' credit, even when they plan to sell the mortgage to Fannie or Freddie, which do not originate loans and must acquire them from banks and other lenders.

Brat's campaign did not respond to requests for comment. But at a March campaign appearance, Brat also discounted banks' role in the origination process.

"Seventy percent of all subprime loans didn't go through bankers," he said. "Bankers, their job is to do risk. Fannie and Freddie, is their job to do risk? Or to put the risk on your back?"

Brat is by no means the first political candidate to misconstrue Fannie and Freddie's role in the mortgage industry. However, the murky wording of his remarks contrasts with Brat's claims that he was driven to run for office because of the government's handling of the financial crisis.

"What motivated the race for me was after the financial crisis, right, we had Fannie and Freddie collapse, the housing market, then the financial sector tanks," he has said. "And I thought surely our political leaders now — you know, we're on our knees economically. We'll learn some lessons and get it right, and they didn't. We're still in roughly the same mess."

The 70% figure Brat cites is also a stretch from what his sources, such as Peter Wallison, an AEI fellow and one of 10 members that served on the Financial Crisis Inquiry Commission, have said.

"By June 2008, before the financial crisis began in earnest, there were more than thirty-two million subprime and otherwise weak mortgages in the U.S. financial system, about 58 percent of the fifty-five million American mortgages then outstanding,"

Wallison made similar assertions in his

This analysis, which

Because by "government agencies," the AEI pundits mean the GSEs and the Federal Housing Administration and financial institutions subject to the Community Reinvestment Act. They are all "agencies" in the sense that they took on exposure to risky loans to meet fair lending regulations and government policies to increase homeownership, contend Wallison and Pinto.

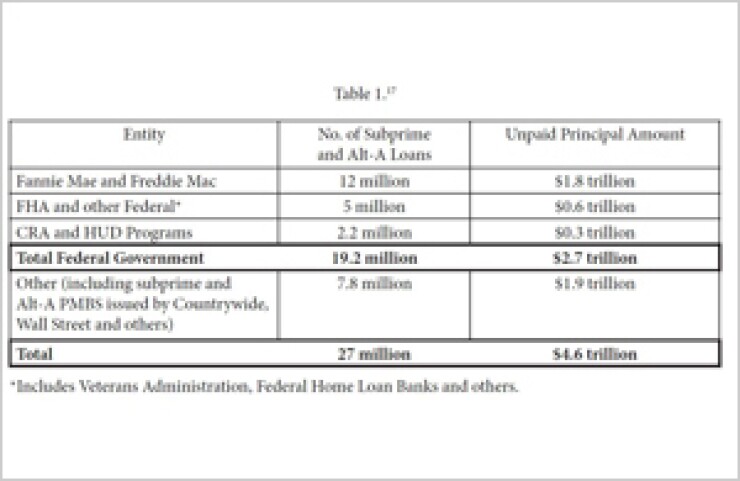

The above table, published in Wallison's FCIC dissenting statement, shows the breakdown of Pinto's data on subprime and Alt-A mortgages. (Click to enlarge.)

To be sure: Should Brat win the general election to represent Virginia's 7th district, he wouldn't have anywhere near as much influence on housing finance policy as Cantor, who will step down as majority leader on Aug. 1 after 13 years in Congress.

Still, his views on the housing market are of interest, since it's likely that efforts to reform the mortgage finance system will continue well into the 114th Congressional term.

Brat's campaign rhetoric helped differentiate him from Cantor, who's been regarded as an

Indeed, Brat singled out the GSEs in his criticism of Cantor's tenure in Congress.

"The No. 1 issue if I went to Congress, and the No. 1 thing I hold against Eric Cantor is how he's been there while Fannie and Freddie just went along and did their thing forever."

In another speech, Brat criticized

"He voted for the flood insurance program. Who does that go to? A lot of the money goes to gazillionaires on both coasts who have homes in nice real estate locations."

To a lesser extent, the free-market economist has criticized private-sector actors, directing some of his scathing populist rebuke for the financial crisis at Wall Street.

"The one asset that had been safe for the American history, the American family home, we had not messed that market up. The geniuses on Wall Street figured out how to mess that up. So we're upside down. That spread into the financial markets and the financial system, and we're still reeling from that."

Prior to entering the political arena, Brat shared his views on the causes of the housing crisis in a

"Essentially, Countrywide collapsed because the mortgage market continued to collapse and people could not pay on their mortgages. No one would buy mortgages anymore and there was no money available to make new mortgages, causing major losses," the paper summarizes.

"The harsh reality that banks are being hit with a double whammy — a stock market that is in bear territory and mortgage-backed securities whose value keeps plummeting — is making the hunt for new capital that much tougher. In other words, the financial sector continues to struggle, and credit remains tight," it adds.

More recently, Brat has bolstered his criticism of the GSEs by claiming they not only violate free-market principles, but also violate the 10th Amendment to the Constitution, which limits federal powers.

"What led to the last financial crisis? Fannie and Freddie. Where are they housed? At the federal government level. Should they be? Should anyone who follows the Constitution have allowed that to happen?" Brat says.

"So, number one, you should not allow them to exist on free market principles, if you followed any of those principles. Number two, you shouldn't allow them to exist on Constitutional principles. And number three, on just common sense principles, they're gonna fail. You know they have to fail. Every planned economy has failed in the history of the nation," he says.

Brat faces Jack Trammell, a fellow Randolph-Macon College professor and political unknown running as a Democrat in the general election. A Democrat hasn't represented Virginia's 7th Congressional district since 1971.

Austin Kilgore is the managing editor of National Mortgage News. The views expressed are his own.

ENDNOTES

* For example, loans with a FICO score less than 660 are "subprime by characteristic," even if the lender originating them used some other term to describe them (like "nonprime" or "credit challenged"). Loans that everyone agrees are subprime are "self-denominated subprime." Both the by-characteristic and self-denominated categories are lumped together when counting the total for "subprime." Alternative-A gets similar treatment a loan for more than 90% of the home's values is alt-A "by characteristic," a loan that the lender called alt-A is "self-denominated," and both get counted toward the total.

** David Min, who served as CAP's associate director for financial markets policy and led its Mortgage Finance Working Group from 2009 to 2012, responded to Wallison's FCIC dissent with

"[T]he unique categories of 'high-risk' loans used by Wallison and Pinto contain large numbers of mortgages that are not actually high risk (and which could not be legitimately understood to have caused the mortgage crisis), as reflected by their relative delinquency rates,"

"Did Fannie and Freddie buy high-risk mortgage-backed securities? Yes. But they did not buy enough of them to be blamed for the mortgage crisis," Min writes. "Highly respected analysts who have looked at these data in much greater detail than Wallison, Pinto, or myself, including the

*** Cantor's wife has held executive positions at financial institutions including Alternative Investment Management, New York Private Bank & Trust and Goldman Sachs, while Cantor has previously held an ownership stake in TrustMor Mortgage, a Virginia mortgage bank founded by the Cantor family and led by his Eric's brother. (