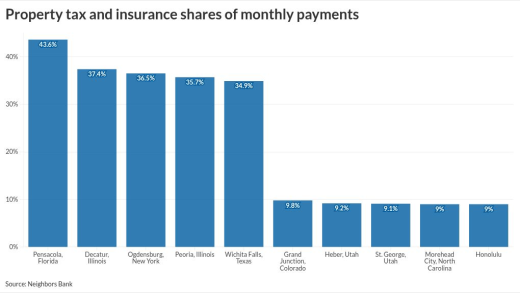

Many homeowners and first-time buyers are surprised by rising property taxes and insurance, which can sharply increase monthly mortgage costs beyond principal and interest.

American Banker's 2026 Predictions report finds that nonbank entities and check fraud are major threats to local banks in the coming months.

Respondents to an exclusive NMN survey lay odds on lower rates boosting housing despite stagflation and recession risks. Here's how the Fed's view compares.

Chicago-based mortgage lender Rate is partnering with Westlake Financial to offer in-app auto loans, advancing its push into product diversification and broader household financial services.

In their decision to send the case to a lower court, appellate court judges said the servicer's handling of borrowers' mortgage payments was still unclear.

This year 40 companies had what it takes to land on the Best Mortgage Companies to Work For list.

The top employers in home lending value business partners with a large market share and reach but they also need to differentiate themselves.

-

-

Chicago-based mortgage lender Rate is partnering with Westlake Financial to offer in-app auto loans, advancing its push into product diversification and broader household financial services.

-

The deal benefits from three accounts–a Funding, Expense Reserve and Interest Reserve. The Funding Account will fund draws and purchase additional loans.

-

The government-sponsored enterprises' oversight chief severed ties with the AI firm following President Trump's dispute with it over boundaries on military use.

-

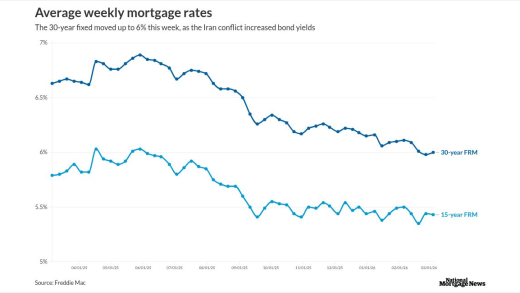

In the initial aftermath of the conflict, the 10-year Treasury rose by 10 basis points over a two-day period, pushing mortgage rates back above the 6% level.

-

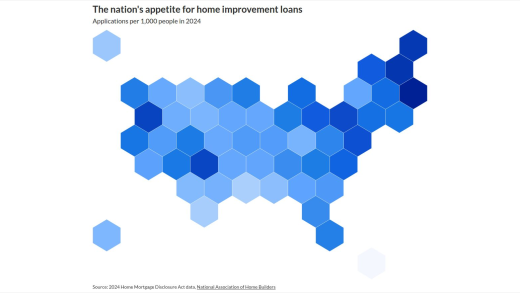

Applications for renovation financing in 2024 were more abundant in some of the nation's smaller counties and states, than in the largest housing markets.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

The 5-year yield swung sharply after conflicting BLS jobs and CPI data, with softer inflation boosting rate-cut hopes, according to the CEO of IF Securities.

-

Mortgage tech's speed is undermined by flawed credit data, causing costly fallout. Lenders must treat data accuracy as a pipeline risk, not a peripheral issue, according to the founder of Consumer Attorneys

-

The federal government should step in to prevent an emerging patchwork of state regulations from stifling the benefits of applying the tools of generative artificial intelligence to the mortgage market.

- ON-DEMAND VIDEO

How did Pennymac grow into a leading TPO player? Wholesale chief Kim Nichols describes the lender's rapid rise, and weighs in on the impact of trigger leads, LO

- ON-DEMAND VIDEOMatt Dowd, VP of Product Management at ICE Mortgage Technology joins the National Mortgage News Leaders channel

- ON-DEMAND VIDEORecapture strategies from a subservicer perspective